INP-WealthPk

Ayesha Mudassar

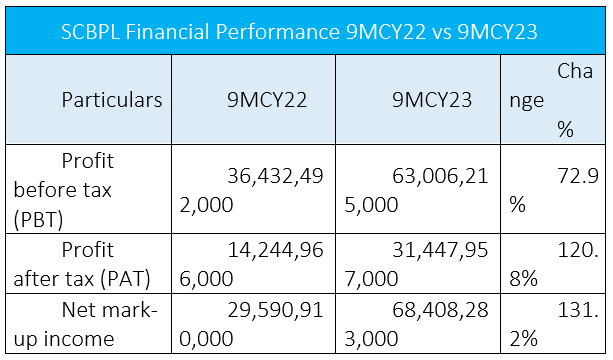

Standard Chartered Bank (Pak) Limited (SCBPL) announced a profit-before-tax (PBT) of Rs63 billion for the first three quarters of 2023, with an impressive growth of 72.9% over the corresponding period of last year, reports WealthPK. According to the financial results submitted to the Pakistan Stock Exchange (PSX), the bank also reported an impressive profit-after-tax (PAT) of Rs31.4 billion for 9MCY23 versus PAT of Rs14.2 billion in the same period last year. The inspiring performance reflected the bank's resilience, strong foundations, and enhanced headway toward achieving its strategic priorities. SCBPL announced an earnings per share (EPS) of Rs8.12 for the first nine months of 2023.

The net markup income jumped 131% to Rs68.4 billion, reflecting proactive balance sheet management, higher interest rates and pricing discipline. However, the non-markup interest income for the nine months of CY23 decreased 45% year-on-year. Furthermore, operating expenses increased 27% to Rs12 billion in line with inflation; and the bank's total revenue grew 70% to Rs46.6 billion, with positive contributions from all segments. The bank is continuously investing in its digital capabilities and infrastructure to enhance clients' banking experience through the introduction and implementation of innovative solutions. The management is also fully committed to achieving sustained growth through consistently focusing on clients’ needs.

Quarterly analysis

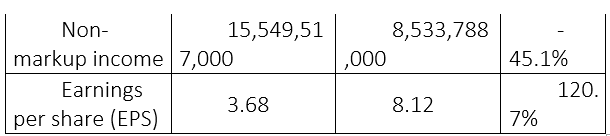

SCBPL witnessed an astounding profit growth of 106.4% for the third quarter of 2023, as it declared a profit-after-tax of Rs12.6 billion for 3QCY23 compared to Rs6.1 billion in the same quarter of the earlier calendar. The main factor that contributed to this record profit was a significant increase in net mark-up income during the quarter under review.

Moreover, SCBPL announced an EPS of Rs3.27 for the quarter, compared to Rs1.59 in the corresponding quarter of last year.

SCBPL- historical financials

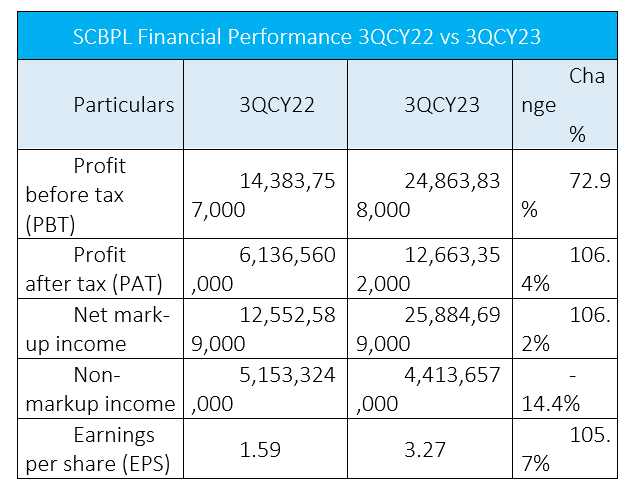

Historical analysis of SCBPL shows that in the last four years, the bank earned the highest mark-up in 2022. This indicates that the bank had a strong performance in terms of interest income, which is a significant revenue source. However, the bank has witnessed two dips regarding earned markup in 2020 and 2021. SCBPL earned a total income of Rs39.1 billion in 2019, Rs40.9 billion in 2020, Rs37.3 billion in 2021 and Rs62.6 billion in 2022. In terms of PAT, the bank hit the highest four-year figure in 2022 at Rs19.8 billion. The bank earned a net profit of Rs16.1 billion in 2019, Rs13.1 billion in 2020 and Rs13.7 billion in 2021.

The bank posted the highest four-year EPS of Rs5.13 in CY22. However, SCBPL experienced a decline in EPS in 2020.

Credit: INP-WealthPk