INP-WealthPk

Shams ul Nisa

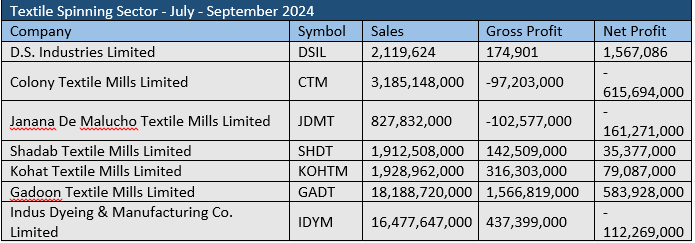

The textile spinning sector of Pakistan posted total sales of Rs48.12 billion and gross profit of Rs2.70 billion in the first quarter (July-Sept) of the ongoing fiscal year (1QFY25), reports WealthPK.

During the period, Pakistan's overall textile exports increased despite declining exports of raw materials like cotton yarn. The sector, however, suffered a net loss of Rs94.64 million, indicating challenges despite substantial sales during the 1QFY25.

![]()

Among the companies listed on the Pakistan Stock Exchange in the textile sector, Gadoon Textile Mills Limited (GADT) emerged as a leader in sales and profitability, reporting sales of Rs18.19 billion and a robust gross profit of Rs1.57 billion. Kohat Textile Mills Limited (KOHTM) also performed well, with sales of Rs1.93 billion and a gross profit of Rs316 million. However, Colony Textile Mills Limited (CTM), Janana De Malucho Textile Mills Limited (JDMT) and Indus Dyeing & Manufacturing Co. Limited faced significant losses, raising concerns about their operational efficiency, cost management practices and market competitiveness. Furthermore, smaller firms like DS Industries Limited (DSIL) and Elahi Cotton Mills Limited managed to maintain positive net profits of Rs1.57 billion and Rs10 million, respectively. The sector continues to face challenges, notably due to fluctuating cotton prices impacted by global supply chain disruptions and evolving apparel demand trends during the period under review.

Financial ratios

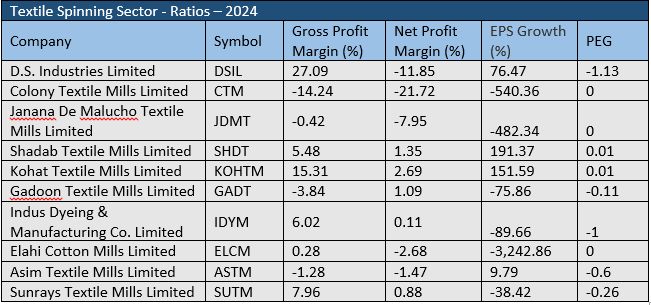

The spinning sector's financial ratios for the last fiscal year 2023-24 reveal significant disparities in performance across companies. DSIL had a commendable gross profit margin of 27.09%, indicating strong cost management and pricing power. However, the company registered a net loss margin of 11.85% in FY24. This implies that despite healthy gross profits, the company struggled with overhead costs and other expenses, which eroded its bottom line. The company’s earnings per share (EPS) growth of 76.47% was a positive indicator, reflecting strong earnings growth relative to its share price, although the negative price earnings growth (PEG) ratio raised concerns about valuation relative to growth expectations.

However, CTM, JDMT and Asim Textiles Mills Limited (ASTM) reported gross loss margins of 14.24%, 0.42% and 1.28%, respectively, in FY24. Additionally, these companies posted net loss margins of 21.72%, 7.95% and 1.47%, respectively, highlighting severe operational inefficiencies and potential market share loss. Furthermore, Shadab Textile Mills Limited (SHDT) and KOHTM posted more balanced performances, with gross profit margins of 5.48% and 15.31%, respectively, and positive net profit margins of 1.35% and 2.69%. However, GADT reported a gross loss margin of 3.84%, but a net profit margin of 1.09% in FY24. Companies like Indus Dyeing & Manufacturing Co. Limited and Sunrays Textile Mills Limited recorded gross profit margins of 6.02% and 7.96% in FY24, indicating they are operating in a tight margin environment where cost control is critical for survival.

Future prospects

Pakistan’s textile spinning sector is cautiously optimistic amid recent economic improvements, including easing inflation, reduced policy rates and a stable currency. These factors have slightly relieved financial pressures, but high production costs, particularly energy prices, continue to challenge the industry's competitiveness. The sector requires regionally competitive electricity and gas tariffs to better compete with countries like India, Bangladesh and Vietnam in export markets. Companies are increasingly investing in efficiency initiatives such as solar power and technology upgrades to reduce operational costs and improve profitability. Improved economic indicators, sustained government support, and policy shifts, including lower tariffs and favourable financing for renewable energy, are essential for the spinning sector’s growth. Demand-driven growth could especially be stimulated by further cutting the interest rate.

Credit: INP-WealthPk