INP-WealthPk

Hifsa Raja

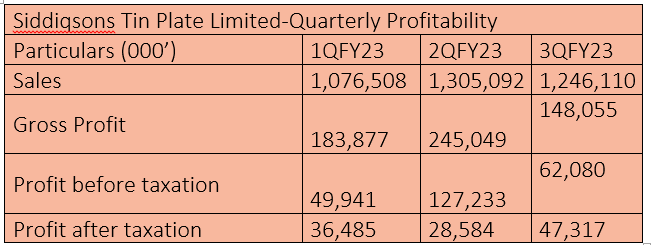

Siddiqsons Tin Plate Limited earned Rs1.07 billion, with a gross profit of Rs183 million and a net profit of Rs36 million, in the first quarter (July-September) of FY23, according to its recently released financial performance report for the first three quarters of the last fiscal year 2022-23.

The company’s income was Rs1.3 billion in the second quarter (October-December), with a gross profit of Rs245 million and a net profit of Rs28 million. In the first quarter (January-March), the income was Rs1.2 billion, the gross profit was Rs148 million and the net profit was Rs47 million. Though the business performed relatively well, the second quarter saw a dip in net profit. However, the firm posted better results the next quarter. The reason for better performance in the third quarter of FY23 was that international steel prices witnessed a downward trend.

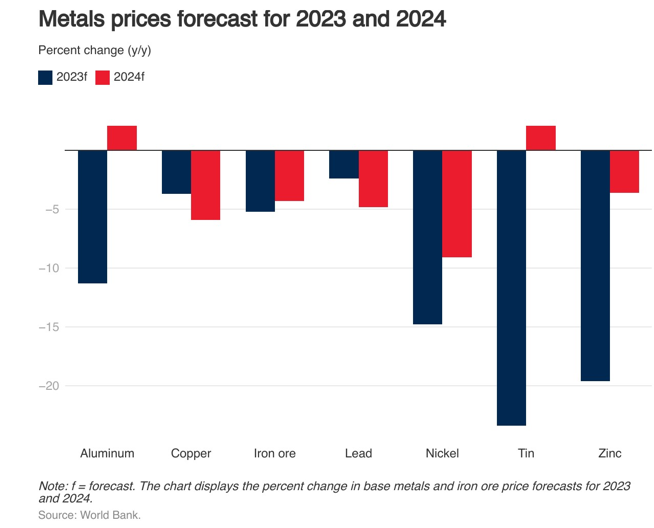

According to the World Bank, the prices of metals are predicted to decline by 8% in 2023 and another 3% in 2024. Tin and zinc are predicted to experience the highest price falls in 2023, with decreases of 23% and 20%, respectively. Copper, lead and nickel prices are predicted to drop by less than 5%, although aluminium and nickel prices are expected to fall by 11% and 15%, respectively. With price drops ranging from 3% for zinc to 9% for nickel, the majority of metal prices are predicted to continue to decline in 2024.

However, the persistent devaluation of Pakistani rupee is the main hindrance in passing the impact of declining prices to the domestic market. Moreover, the overall weakened demand in the economy is another alarming sign, which may impact the economic growth and restrict the industrial output. Along with this, a stronger-than-expected recovery of China’s real estate sector could boost prices for metals used in construction in near future.

Performance in FY22

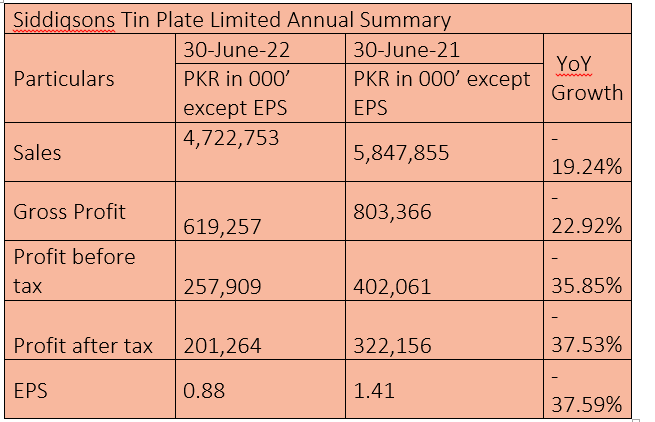

In the fiscal year 2021-22, the company’s sales decreased to Rs4.7 billion from Rs5.8 billion the previous year, indicating a negative growth of 19.24%. The gross profit also decreased to Rs619 million, down 22.92% from the previous year's figure of Rs803 million.

The company’s profit-before-tax decreased to Rs257 million in FY22 from the previous year's Rs402 million, recording negative growth of 35%. Moreover, the company’s net profit also slumped to Rs201 million in FY22 from previous year's profit of Rs322 million, reflecting a 37% negative growth. The business environment deteriorated in the third and fourth quarters of FY22, as the company faced challenges such as raw material shortages, international price fluctuations in flat steel products, and quality issues from local production.

The embedded economic imbalances started to have their effect and resulted in extraordinary increase in the policy rate and the Consumer Price Index inflation. The company tried its best in managing and transforming every untoward situation in its favour by effectively passing on the impact of increasing international prices and rupee devaluation and restricting credit sales.

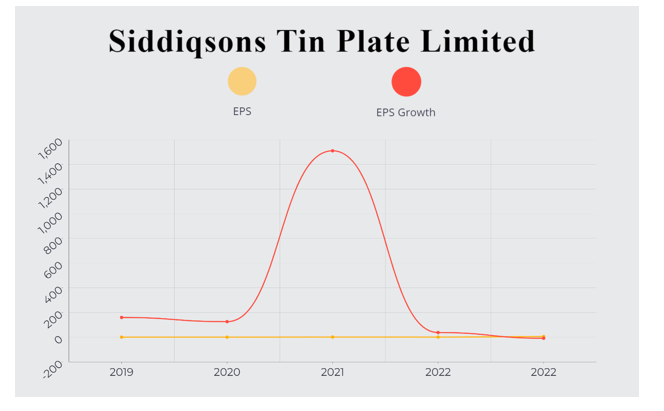

Earnings per share

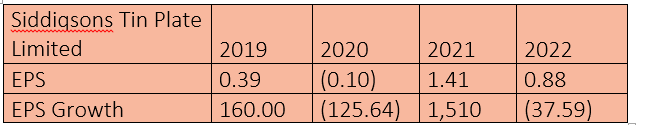

In 2019, the company’s EPS stood at Rs0.39, which became minus Rs0.10 in 2020. The EPS rose to Rs1.41 in 2021 with an exceptionally high growth rate. In 2022, due to price volatilities EPS dropped to Rs0.88, along with a negative EPS growth rate.

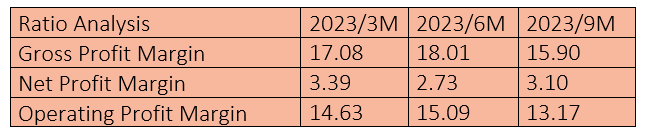

Ratio analysis

The company's profitability measures, including gross, net and operating profit margins, demonstrate its ability to generate healthy returns on its operations.

In the three-month period of 2023 (3QFY23), Siddiqsons Tin Plate Limited achieved a gross profit margin of 17.08% and a net profit margin of 3.39%, highlighting the firm’s ability to generate net income after considering all expenses, including taxes and interest payments. The firm registered an operating profit margin of 14.63% in this quarter. The gross profit margin in 6MFY23 stood at 18%, net profit margin at 2.73% and operating profit margin at 15.09%, respectively, showcasing the continued profitability of the company from its core operations. In 9MFY23, the gross profit margin decreased to 15.90%. However, the net profit margin increased to 3.10%.

The operating profit margin dropped to 13.17%. Overall, Siddiqsons Tin Plate Limited's ratio analysis indicates a stable financial performance during the first three quarters of FY23. The company has effectively managed its production costs and operating expenses, resulting in consistent gross and operating profit margins. While the net profit margin is relatively modest, it suggests that Siddiqsons Tin Plate has maintained profitability despite potential challenges in the market.

Industry comparison

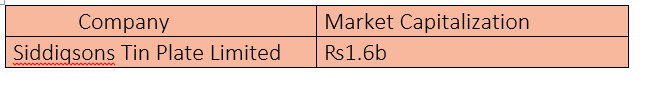

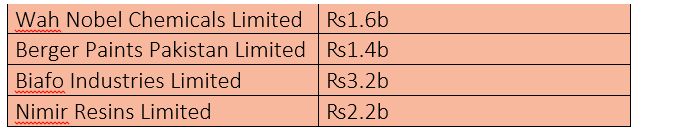

Siddiqsons Tin Plate Limited’s competitors include Wah Nobel Chemicals Limited, Berger Paints Pakistan Limited, Biafo Industries Limited, and Nimir Resins Limited.

Siddiqsons Tin Plate Limited has a market capitalisation of ₨1.6 billion. Biafo Industries Limited has the highest market value of ₨3.2 billion, and Berger Paints Pakistan has the lowest market cap of Rs1.4 billion.

Company profile

Siddiqsons Tin Plate Limited is engaged in the manufacturing and sale of tinplate and cans. The company's plant has a capacity of producing 120,000 tonnes per annum of tinplate, which is primarily used for making cans and containers for packaging of various items. The company’s tin plant is located at Winder Industrial Estate in the province of Balochistan.

Credit: INP-WealthPk