INP-WealthPk

Qudsia Bano

Shell Pakistan's announcement to exit Pakistan may not be just about an ‘economic slowdown’ and ‘financial losses’ as quoted by the company in its notice. Experts said the move could be linked with the company’s greater plans to realign its business model with the fast-changing global energy priorities.

According to the experts, a strategic shift from petroleum and compressed natural gas (CNG) to renewable energy (RE) has been witnessed in the energy sector across the globe, and Shell also plans to shift toward renewable energy as the company has recently announced a strategic review of energy and chemical assets in Singapore.

A senior official of government-owned Pakistan State Oil (PSO) told WealthPK that Shell aimed to align itself with the world's growing emphasis on renewable energy sources. “Consequently, the company has decided to sell 77% of its local shares, which also include a 26% stake in Pakistan Electric Power Company (Pepco). Additionally, Shell is planning to restructure its operations by transitioning to a model that grants ownership to the countries in which it conducts business,” the PSO official said.

He also admitted that the uncertain economic situation in Pakistan was definitely a reason for the company’s exit from the country. However, talking to WealthPK, a Shell Pakistan official denied these rumours and claimed that the only reason for the company’s exit was the slowing economy and disruption in the outflow of funds.

The official said SPCo also had plans to work on carbon emissions, and perform downstream gas marketing activities in Pakistan. “In order to meet this demand, it had sought to aggregate client demand and obtain a competitive international supply. The Oil and Gas Regulatory Authority (Ogra), the energy sector regulator, had also given permission to Shell Pakistan to offer petrol to potential customers after reviewing their credentials,” the official said.

However, the company faced a number of problems in working for these goals in Pakistan, including financial losses, unstable market situation, currency fluctuation, restrictions in the outflow of funds, and overdue receivables from its customers, he added.

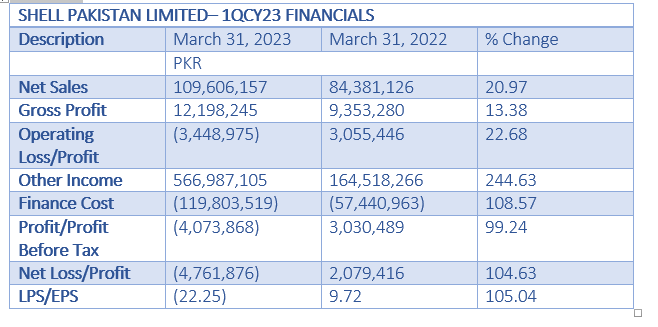

Financial Analysis

Shell Pakistan Limited's financial data for the first quarter of the calendar year 2023 reveals it suffered huge losses in operating and net profits during the period. The company’s net sales increased by 20.97% from Rs84.4 billion in 1QCY22 to Rs109.6 billion in 1QCY23, indicating improved revenue generation. Similarly, gross profit rose by 13.38% from Rs9.4 billion to Rs12.2 billion, reflecting better cost management. However, the company suffered an operating loss of Rs3.4 billion in 1QCY23 compared to an operating profit of Rs3.1 billion over the same period of the previous year, representing a significant decline in profitability. The substantial net loss of Rs4.8 billion in 1QCY23 compared to a net profit of Rs2.1 billion in 1QCY22, further highlights the financial challenges faced by the company. These losses are likely the primary reason for Shell’s parent company to exit the Pakistani market.

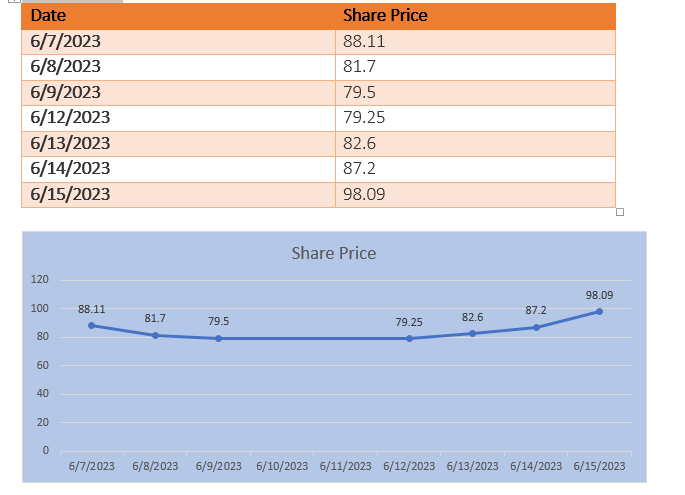

Share Price Movement

The announcement by SPCo to sell 77% of its shareholding in SPL had a notable impact on the company’s share price. Prior to the announcement, the share price experienced a downward trend, with prices declining from Rs88.11 on June 7, 2023 to Rs79.25 on June 12, 2023. However, on June 13, 2023, the share price increased to Rs82.6. The price further surged to Rs87.2 on June 14, the day when the exit decision was made. Afterwards, the share price further jumped to Rs98.09 on June 15.

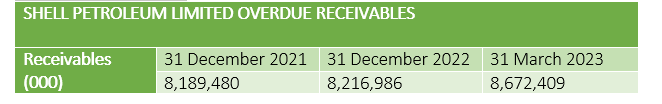

Overdue Receivables

Overdue receivables refer to outstanding payments that a company is yet to receive from its customers or clients within the agreed-upon timeframe. The overdue receivables likely played a significant role in SPCo’s decision to exit Pakistan.

As of December 31, 2021, the overdue receivables stood at Rs8.18 billion. Over the course of 2022, the figure remained relatively stable with a slight increase to Rs8.2 billion by December 31, 2022. However, a notable surge occurred by March 31, 2023, when receivables reached a staggering Rs8.67 billion.

The increasing trend in overdue receivables indicates potential challenges in Shell's ability to collect payments from its customers within the agreed-upon timeframe. Such a situation can have adverse effects on the company's cash flow, liquidity, and financial stability.

There could be several reasons contributing to the rise in overdue receivables. Economic factors, such as a financial crisis or economic slowdown in the country, have impacted customers' ability to make timely payments. Additionally, difficulties in the business environment, such as exchange rate fluctuations and the devaluation of the Pakistani rupee have added to the delay in payment collection.

The substantial increase in overdue receivables over the observed period likely placed additional strain on Shell's financial position. In the case of Shell Pakistan, the existence of overdue receivables has exacerbated the financial challenges the company was already facing. Combined with other factors like exchange rate fluctuations, the devaluation of rupee, and losses suffered in 2022, the presence of overdue receivables could have further strained the company's cash flow and overall financial performance.

While the departure of a foreign company may have short-term impact on the local economy, there are potential long-term benefits such as opportunities for local companies to fill the gap, technological knowledge transfer, and the development of domestic industries. It remains crucial for Pakistan to address economic challenges and create a favourable business environment to attract and retain foreign investments.

Credit : Independent News Pakistan-WealthPk