INP-WealthPk

Shams ul Nisa

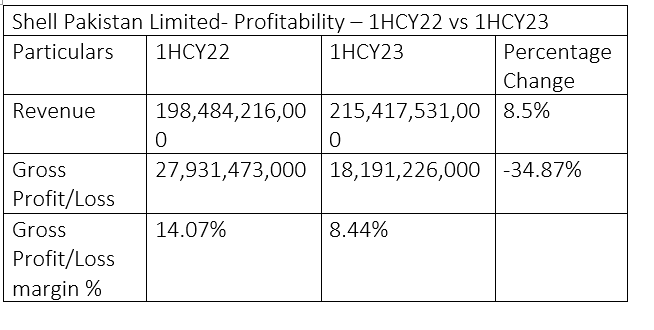

Shell Pakistan Limited reported a moderate increase in revenue but a substantial decline in profitability during the first half of the ongoing calendar year 2023 compared to the same period of 2022. During this period, the company’s revenue increased to Rs215.4 billion from Rs198.4 billion in 1HCY22, posting a growth of 8.5%. This growth is attributed to the increase in the company’s sales and prices of products. The gross profit dropped 34.87% to Rs18.1 billion in 1HCY23 from Rs27.9 billion in 1HCY22, resulting in a gross profit ratio of 8.44%. This fall in gross profit indicates the company is unable to finance the increase in cost of production.

Likewise, Shell Pakistan’s operating profit plunged by 43.62% to Rs6.9 billion in 1HCY23 from Rs12.3 billion last year, reflecting a decrease in the company’s capacity of generating profit through its core activities. During 1HCY23, the net profit plunged 52.9% to Rs3.5 billion from Rs7.5 billion in 1HCY22, showcasing the elevated expenses and taxes. Therefore, the earnings per share fell from Rs35.08 in 1HCY22 to Rs16.54 in 1HCY23. The decline in the net profit was because of rise in costs of core operations and increased taxes that made the company less effective in turning sales into net profit. The fall in the EPS was result of the decline in the profitability, making stocks less attractive to investors.

2QCY23 compared with 2QCY22

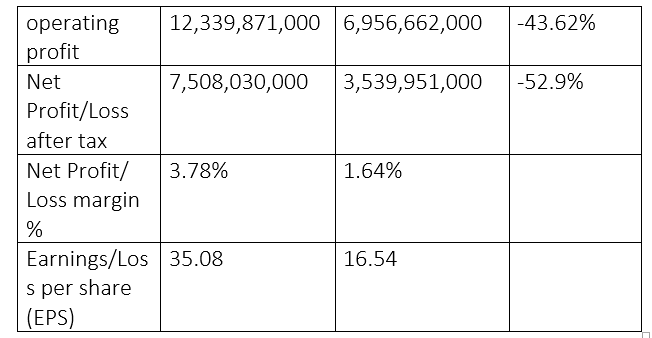

In 2QCY23, Shell Pakistan’s revenue dwindled by 6.5% to Rs106.8 billion from Rs114.2 billion in 2QCY22. The gross profit also plunged by 67.7% to Rs5.99 billion in 2QCY23 from Rs18.5 billion in 2QCY22.

The operating profit of the company in 2QCY23 stood at Rs10.4 billion compared to Rs9.2 billion in 2QCY22, registering a growth of 12.08%. Shell Pakistan posted a growth of 52.9% in its net profit, which soared to Rs8.3 billion in 2QCY23 from Rs5.4 billion in 2QCY22. The net profit margin also increased to 7.77% in 2QCY23 from 4.75% in 2QCY22. The EPS rose to Rs38.79 in 2QCY23 from Rs25.36 in 2QCY22. The financials at the end of second quarter indicated that the company was able to maintain profitability despite fall in sales.

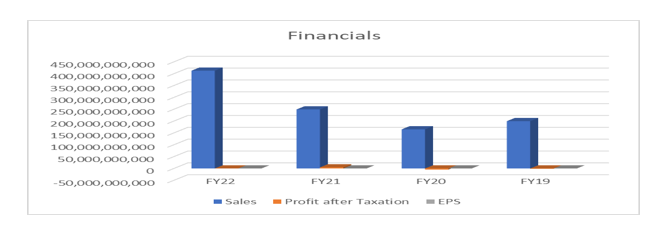

Analysis of financials in last four years

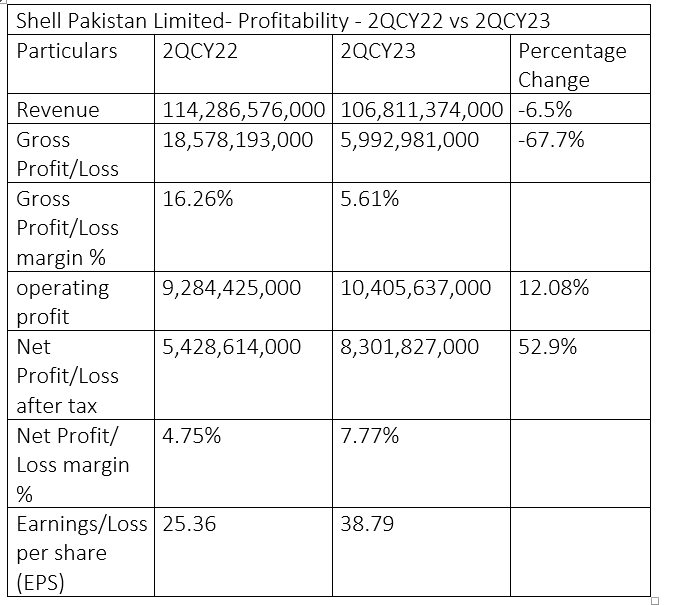

The company witnessed a gradual growth in sales between CY19 and CY22 except CY20, when revenue dipped slightly. The company had revenues of Rs199.7 billion in CY19, Rs165.1 billion in CY20, Rs249.2 billion in CY21 and Rs412.6 billion in CY22.

However, Shell Pakistan continued to suffer net losses during these years except the CY21, when it earned post-tax profit of Rs4.4 billion.

Similarly, the company continued to have negative EPS over these years except for the CY21, when its shareholders earned an EPS of Rs21.88.

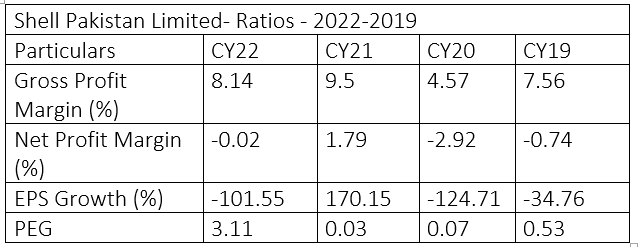

Analysis of ratios in last four years

Shell Pakistan’s gross profit margin was recorded the highest at 8.14% in CY22 and the lowest at 4.57% in CY20. It was 9.5% in CY21 and 7.56% in CY19. The company’s net profit ratio was positive in CY21 at 1.79%. However, it remained negative in CY22, CY20 and CY19 at 0.02%, 2.92% and 0.74%, respectively. EPS growth showed a similar pattern, as it was positive at 170.15% only in CY21. It remained negative at 101.55%, 124.71% and 34.76% in CY22, CY20 and CY19, respectively. The company’s price/earnings to growth ratio (PEG) was highest at 3.11% in CY22 followed by 0.03%, 0.07% and 0.53%, respectively, in CY21, CY20 and CY19.

Credit: INP-WealthPk