INP-WealthPk

Shams ul Nisa

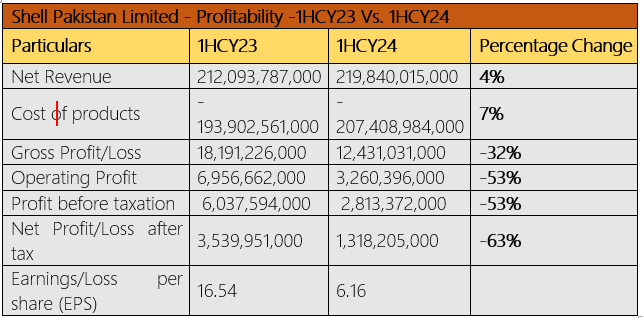

Shell Pakistan Limited’s net profit plummeted by 63% from Rs3.54 billion to Rs1.32 billion in the first half of the calendar year 2024, reports WealthPK.

However, the company’s net revenue increased by 4% to Rs219.84 billion in 1HCY24 despite a slowdown in the economy and decrease in the fuel demand due to the ongoing economic challenges and high energy prices in the region during the review period. Moreover, the cost of products rose by 7%, surpassing revenue growth and leading to a significant squeeze on the gross profit margins. Consequently, the company’s gross profit declined by 32% from Rs18.19 billion to Rs12.43 billion in 1HCY24, underscoring serious difficulties in managing the cost of goods relative to revenue generation. Additionally, the operating profit decreased by 53%, from Rs6.96 billion to Rs3.26 billion in 1HCY24, indicating that the company is having trouble converting sales into operational earnings effectively. The profit before taxation declined 53% from Rs6.04 billion to Rs2.81 billion. As a result, the earnings per share decreased to Rs6.16 in 1HCY24 from Rs16.54 in the same period last year.

Oil & Gas Marketing Sector

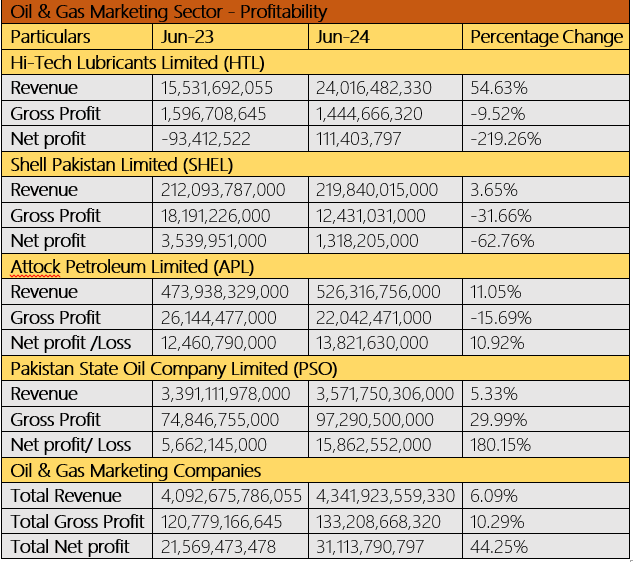

The sector analysis reveals a 6.09% increase in total revenue, which rose from Rs4.09 trillion in June 2023 to Rs4.34 trillion in June 2024, indicating a moderate growth across the oil and gas marketing (OGM) sector. The total gross profit grew by 10.29% to Rs133.2 billion in June 2024, reflecting improved profitability at a collective level. Additionally, the total net profit surged by 44.25% from Rs21.57 billion to Rs31.11 billion in June 2024, underscoring an overall improvement in profitability, despite challenges faced by major players like Shell Pakistan and Hi-Tech Lubricants Limited.

Hi-Tech Lubricants Limited saw a substantial revenue increase of 54.63%, reflecting a strong product demand and successful market strategies. However, the gross profit dropped by 9.52% to Rs1.44 billion, indicating that rising costs outpaced revenue growth. Despite these challenges, HTL achieved a net profit of Rs111.40 million, signaling improved operational efficiency. Shell Pakistan Limited posted a modest 3.65% increase in revenue, but its gross profit plunged by 31.66%, highlighting significant cost pressures. Attock Petroleum Limited recorded 11.05% increase in revenue, but its gross profit fell by 15.69%, suggesting that the rising costs impacted its ability to sustain profitability despite higher sales volumes. Pakistan State Oil Company Limited exhibited a strong performance, with the revenue growing by 5.33%, reinforcing its dominant market position. The company reported a 29.99% surge in gross profit and an impressive 180.15% jump in net profit during the period.

Future Outlook

The recent Finance Bill changed the sales tax regime on petroleum products from zero-rating to exemption, increasing the business costs for the company and the oil industry. The company plans to raise concerns over the regulatory reform and work with the other industry players. Despite these challenges, the management and the board of directors are committed to strengthening the company's financial position, maintaining a Goal-Zero safety performance, and ensuring responsible societal roles.

Company Profile

Shell Pakistan Limited, a Pakistani limited liability company, is a subsidiary of Shell Petroleum Company Limited, owned by Royal Dutch Shell Plc, which markets petroleum products, compressed natural gas, and various lubricating oils.

Credit: INP-WealthPk