INP-WealthPk

Shams ul Nisa

Service Industries

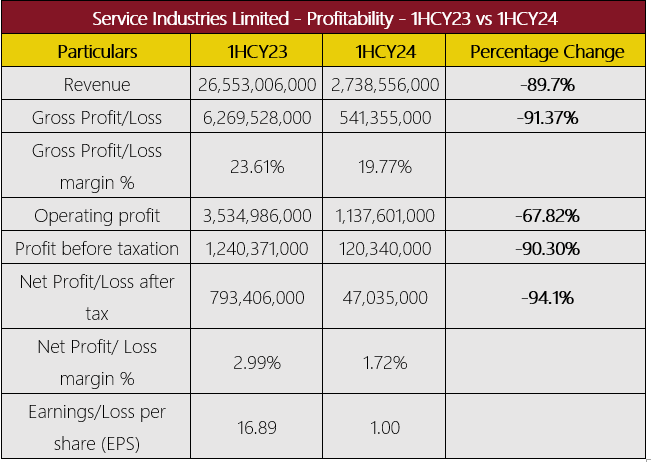

Limited experienced a massive 89.7% decrease in revenue, 91.37% in gross profit, and 94.1% in net profit in the first half of calendar year 2024, reports WealthPK. During the review period, the company posted a revenue of Rs2.74 billion, Rs541.3 million in gross profit and Rs47.03 million in net profit. The decline in revenue coupled with lower gross profit resulted in reduction in the gross profit margin from 23.61% in 1HCY23 to 19.77% in 1HCY24. This indicates that the company is facing challenges in maintaining profitability on sales, possibly due to the increased costs and market pricing pressures during the period.

Similarly, the operating profit decreased by 67.82%, and the profit before taxation contracted by 90.30% in 1HCY24. Thus, the net profit margin plummeted from 2.99% in 1HCY23 to 1.72% 1HCY24. At the end of the period, the earnings per share also slipped from Rs16.89 to Rs1.00, indicating a significant erosion of shareholder value.

Leather & Tanneries Sector

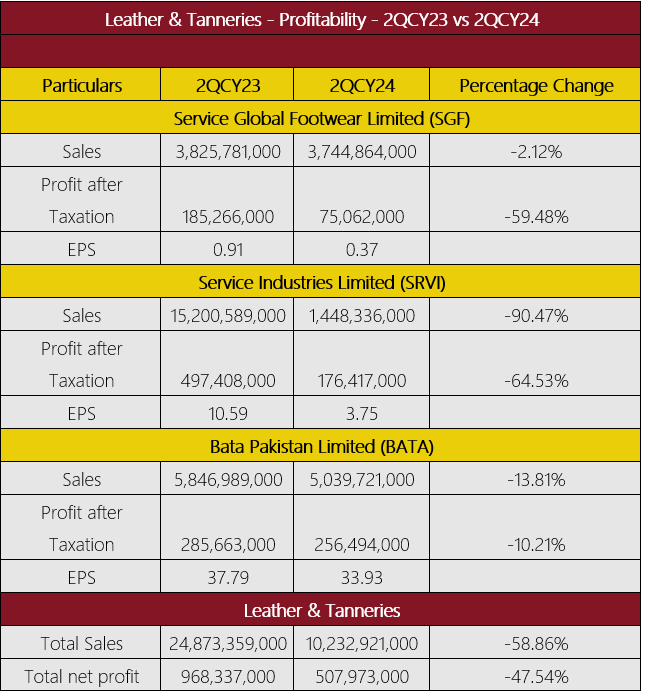

The Leather and Tanneries sector experienced an overall decline in sales, net profit and earnings per share in 2QCY24 compared to the same period last year.

The sector encountered a contraction of 58.86% in total sales from Rs24.87 billion in 2QCY23 to Rs10.23 billion in 2QCY24, indicating significant challenges in maintaining the market demand for products. Likewise, the sector faced difficulties in converting sales into profit, as it faces a reduction of 47.54% in total net profit to Rs507.9 million during the period. Among the companies in the sector, Bata Pakistan Limited emerged as the highest performer in the sector with a significantly higher ESP of Rs33.93 in 2QCY24 than its peers, indicating a stronger financial position compared to Rs37.79 in 2QCY23. However, the company registered a 13.81% decrease in sales and a 10.21% decline in profit after taxation, which is lower compared to other companies in the sector. Global Footwear Limited and Service Industries Limited both faced significant challenges during the review period. SGF's sales decreased by 2.12%, accompanied by a 59.48% drop in profit after tax. Similarly, SRVI suffered a decline of 90.47% in sales and the profit after tax plunged by 64.53% in 2QCY24.

Return to Shareholders Trend

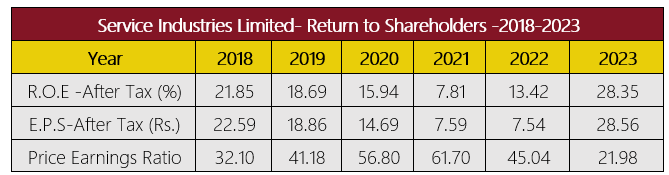

Service Industries Limited's return on equity (ROE) after tax increased significantly in 2023, reaching 28.35% from 21.85% in 2018, indicating a significant recovery in profitability relative to the shareholders' equity. This recovery is attributed to improved operational efficiency and effective management strategies.

The company's earnings per share rose from Rs7.54 in 2022 to Rs28.56 in 2023, indicating enhance profitability which resulted in greater value for shareholders. The price earnings ratio, peaked at 61.70 in 2021, indicates how the market values the company relative to its earnings. However, it has since decreased to 21.98 in 2023, indicating undervalue and waning investor confidence in the company’s stocks.

Future Outlook

Despite lower policy rates and reduced inflation, the company continues to encounter challenges in its operating environment. However, recent taxation measures, rising power costs, political instability, external account pressures, and international conflicts contribute to a pessimistic outlook. The management is adjusting business strategies to address these issues and remains confident that the newly demerged companies will perform more efficiently under dedicated teams, resulting in higher dividends and overall benefits.

Company profile

Service Industries Limited was established as a private limited company on March 20, 1957. The company’s main activities include the purchase, manufacture, and sale of footwear, tires and tubes, as well as technical rubber products.

Credit: INP-WealthPk