INP-WealthPk

Hifsa Raja

The Securities and Exchange Commission of Pakistan (SECP) has started issuing digital mortgage certificates and statutory returns. Muhammad Nabeel, manager of S.D. Mirza Securities, disclosed this to WealthPK during an interview, while quoting from a report issued by the companies’ regulator recently.

WealthPK: What are the new initiatives envisaged in the SECP report?

Muhammad Nabeel: "Digital mortgage certificates and statutory returns" are some of the new programmes and frameworks that the commission has been working on. According to the report, the SECP has begun issuing digital mortgage certificates as well as acknowledgments of annual and other returns, which are equivalent to physical certificates for all legal purposes.

WealthPK: Which industries did investors primarily buy from and sell to?

Muhammad Nabeel: The latest week on the PSX saw $2.06 million in foreign purchases, compared to $4.65 million in net sales the previous week. Oil marketing companies with $0.75 million, all other sectors ($0.47 million), and technology and communications ($0.45 million) saw significant buying in the most recent week.

WealthPK: How is the current political climate affecting investors’ confidence in stocks?

Muhammad Nabeel: Given the charged political atmosphere, stock investors should exercise caution during the coming weeks.

According to analysts of S.D Mirza Securities, due to players' increased vigilance amid the polarised political landscape, the market will stay range-bound in the coming weeks.

WealthPK: What potential key events are likely to happen in near future?

Muhammad Nabeel: The upcoming monetary policy meeting of the State Bank of Pakistan is likely to dictate the direction of the market. Markets are expecting no change in the interest rate by the central bank.

WealthPK: What is the outlook of the economy?

Muhammad Nabeel: With the policy rate likely to stay unchanged amid economic slowdown, it is hoped that the stock market will gain momentum in near future.

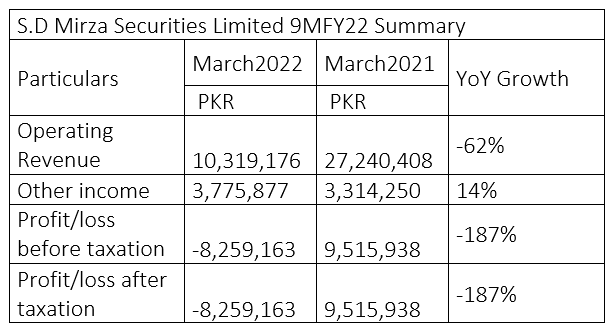

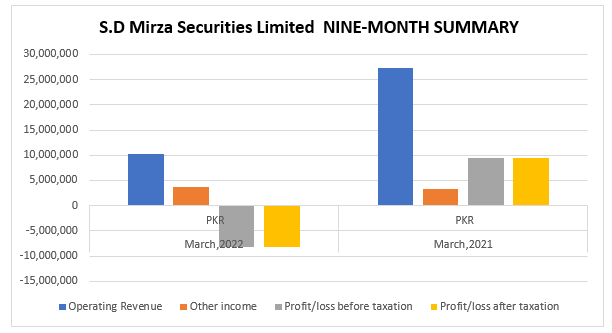

The operating revenue of S.D Mirza Securities declined 62% to Rs10.31 million in 9MFY22 compared to Rs27.24 million over the same period of FY21. However, the other incomes showed an increase of 14% and stood at Rs3.77 million in 9MFY22 compared to Rs3.31 million in 9MFY21.

The company suffered a loss-before-tax of Rs8.25 million in 9MFY22 compared to a profit-before-tax of Rs9.51 million in 9MFY21, showing a massive 187% decline in profit year-on-year. The company also suffered a loss-after-tax of Rs8.25 million in 9MFY22 compared to Rs9.51 million profit-after-tax over the same period in FY21, showing a decline of 187%, reports WealthPK.

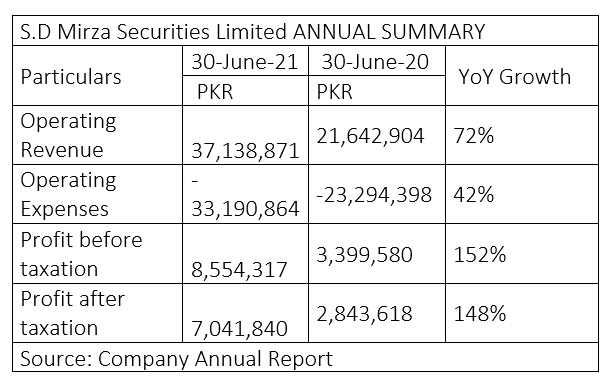

Financial Performance in FY21

During the fiscal year 2020-21, the company generated revenue of Rs37.13 million over Rs21.64 million in 2019-20, registering an increase of 72%. The operating expenses in FY21 increased to Rs33.19 million from Rs23.29 million in FY20, registering an increase in loss of 42%. The profit-before-tax in FY21 stood at Rs8.55 million compared to Rs3.39 million in FY20, showing an increase of 152%. Similarly, the profit-after-tax for FY21 stood at Rs7.04 million compared to Rs2.84 million in FY21, showing a growth of 148%.

Credit : Independent News Pakistan-WealthPk