INP-WealthPk

Hifsa Raja

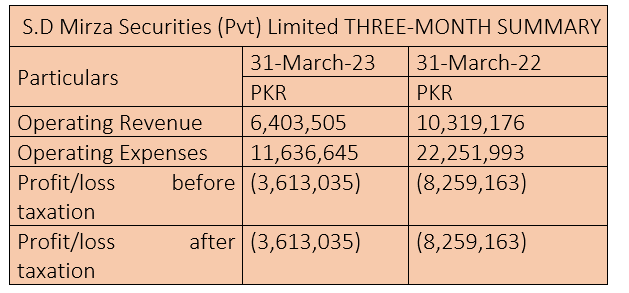

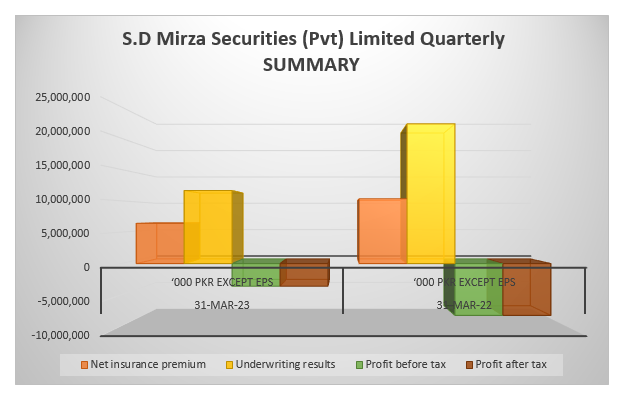

SD Mirza Securities (Pvt) Limited recently released its three-month summary for the period ending on March 31, 2023, demonstrating resilience and managing to reduce its losses by an impressive 56% compared to the same period last year despite facing significant headwinds. During the period, the company reported an operating revenue of Rs6.4 million compared to Rs10.3 million over the same period last year. However, the company reduced operating expenses to Rs11.6 million in 3QFY23 from Rs22.2 million in the same period last year, posting a 48% decline. This reduction in expenses played a vital role in strengthening the company's financial position. The company also managed to bring down its loss-before-taxation by a substantial 56% to Rs3.6 million compared to the same quarter of FY22.

Moreover, the company's loss-after-taxation also reduced by the same percentage points, signifying the steady progress in managing financial challenges. SD Mirza Securities' strategic approach and prudent financial management during this period allowed it to navigate through tough times while making significant strides toward recovery. The management's efforts to optimise operational efficiency and focus on core strengths have positively impacted the company's performance, setting a promising trajectory for future growth. As the company continues its journey in these challenging economic conditions, its ability to reduce losses and enhance financial stability positions it well for sustained progress in the coming quarters. With a steadfast commitment to innovation and adaptability, the company is poised to overcome obstacles and capitalise on emerging opportunities in the market.

Meanwhile, talking to WealthPK, Jahanzeb Mirza, the Chief Executive Officer of SD Mirza Securities (Pvt) Limited, said the current market situation was undoubtedly complex and challenging. "We've witnessed heightened volatility due to a combination of factors, including global economic uncertainties, geopolitical tensions, and regulatory changes. These variables have contributed to a sense of unease among investors, leading to fluctuations in various asset classes. These factors have a financial impact on the companies' performance."

He said addressing challenges, setting realistic expectations, and communicating strategic plans were vital to restore the investor confidence in the market. "Transparent leadership, consistent performance and adherence to ethical practices instills trust. Enhancing board engagement, aligning executive compensation with long-term goals, and delivering tangible results are also the key. By combining these strategies, companies can re-establish investor faith, illustrating a commitment to growth, resilience, and sustained value creation even in challenging times."

FY22 summary

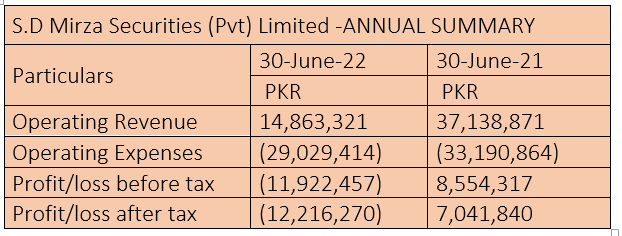

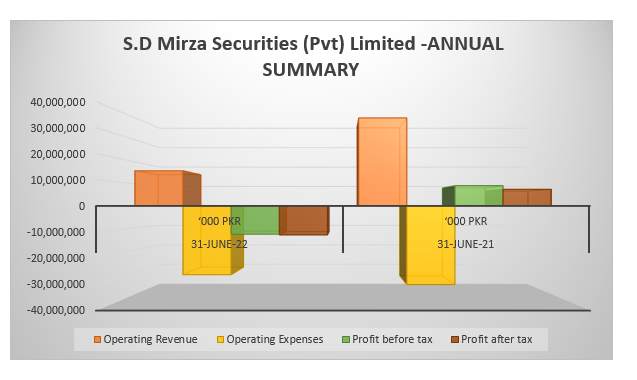

The company's financial performance in FY22 reflects a 28.85% decrease in operating revenue compared to the previous year. During FY22, SD Mirza Securities (Pvt) Limited achieved an operating revenue of Rs14.8 million. While the company faced headwinds, it managed to decrease its operating expenses to Rs29 million in FY22 from Rs33 million in FY21. The company demonstrated adaptability and prudence in its cost management despite a challenging environment.

Despite challenges impacting operating revenue and profits, the company's proactive approach to controlling expenses reflected its strategic resilience. This adaptability sets a promising foundation for future success. By navigating challenges head-on and maintaining a focus on efficient resource allocation, SD Mirza Securities is poised to emerge stronger. The company's commitment to growth and its capacity to navigate fluctuations position it well for improved financial performance and enhanced shareholder value in the times ahead.

About the company

SD Mirza Securities is a TRE Certificate (TREC) Holder at the Pakistan Stock Exchange. The company is licensed to deal as an equity brokerage house at the PSX. The management of the company strives to facilitate the clients in making timely and well-informed financial decisions. Mirza Sher Dill Sahib (late) laid the foundation of this organisation, as an individual member, in 1989. It is Mirza Sahib's discipline, commitment and dedication to his work, that the management strives to take forward in making the company a success.

SD Mirza Securities was incorporated as a private limited company on May 21, 2001. During this time period, the company has grown into a major brokerage house, engaged in shares brokerage, trading and customer services. The company has been able to develop a huge clientele and is known to serve its clients' short and long-term financial needs to the best of its ability and their satisfaction.

Credit: INP-WealthPk