INP-WealthPk

Moaaz Manzoor

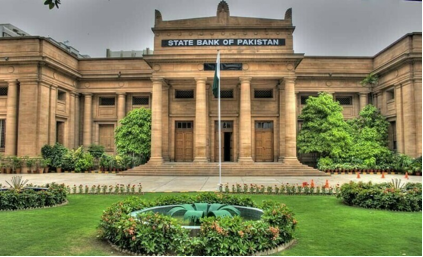

The State Bank of Pakistan’s (SBP) cautious policy rate cut aims to stimulate economic activity while managing inflation, but experts highlight risks such as potential price hikes, capital hoarding, and reduced foreign investment, necessitating a stable and long-term monetary approach, reports WealthPK.

The central bank has opted for a measured approach in extending monetary relief, reflecting the challenges of managing the inflationary pressures while supporting economic growth. The recent policy rate cut from 13% to 12% underscores this cautious stance. Speaking with WealthPK, Hissan ur Rehman, a renowned economic reform advocate and instructor at the Pakistan Stock Exchange (PSX), argued that Pakistan’s inflation is cost-push in nature and has no direct correlation with the interest rates.

According to him, the prevailing high real interest rates disproportionately benefit the banks while burdening both the government and the general public. With PKR9 trillion out of the PKR13 trillion tax target allocated to debt servicing, he suggests the high policy rates exacerbate fiscal constraints rather than providing relief. Rehman stressed that Pakistan requires at least a 6% GDP growth rate to match its demographic trends, yet an entrenched banking lobby has effectively taken control of economic decision-making, from the Monetary Policy Committee (MPC) to the research arms of the leading businesses.

He calls for an urgent intervention akin to the Independent Power Producers (IPPs) model, urging policymakers to lower the rates in line with inflation while managing imports to maintain economic stability. In his view, relying solely on the International Monetary Fund (IMF) as a justification for maintaining high rates is unsustainable. Muhammad Armughan, Senior Researcher at the Federation of Pakistan Chambers of Commerce & Industry (FPCCI), explained that reducing the policy rate stimulates borrowing, which fuels economic activity through increased business investments and consumer spending.

Lower rates make credit more accessible, driving demand for goods such as homes and automobiles. However, he noted that an uptick in borrowing can lead to the rising prices, potentially compelling the central bank to reverse the course and increase the interest rates again. Armughan also highlighted the strategic risks of frequent rate adjustments. The MPC’s decision to lower the rate from 15% to 13% earlier had already set market expectations. A further reduction to 12% might lead investors to anticipate additional cuts, prompting capital hoarding instead of immediate investment.

He suggested that setting interest rates requires a long-term vision to avoid unsettling market sentiment. While the cut may provide short-term benefits —boosting the stock market and real estate sector — it also carries the risk of excessive lending and an uptick in non-performing loans. Additionally, lower rates could deter foreign investment in government securities as investors seek higher returns in other markets. The SBP’s strategy underscores the balance between fostering economic expansion and ensuring financial stability.

While lower rates could encourage investment and spending, the risks associated with inflationary pressures, capital flight, and financial sector vulnerabilities remain. Going forward, a nuanced policy approach that considers structural economic constraints and market dynamics will be crucial in sustaining growth without compromising stability.

Credit: INP-WealthPk