INP-WealthPk

Naveed Ahmed

The fiscal year 2021-22 saw Pakistan’s economy adversely affected by rising global commodity prices and the ramifications of the Russia-Ukraine conflict. However, the measures taken by the State Bank of Pakistan to insulate the economy from external and internal shocks paid off to some extent.

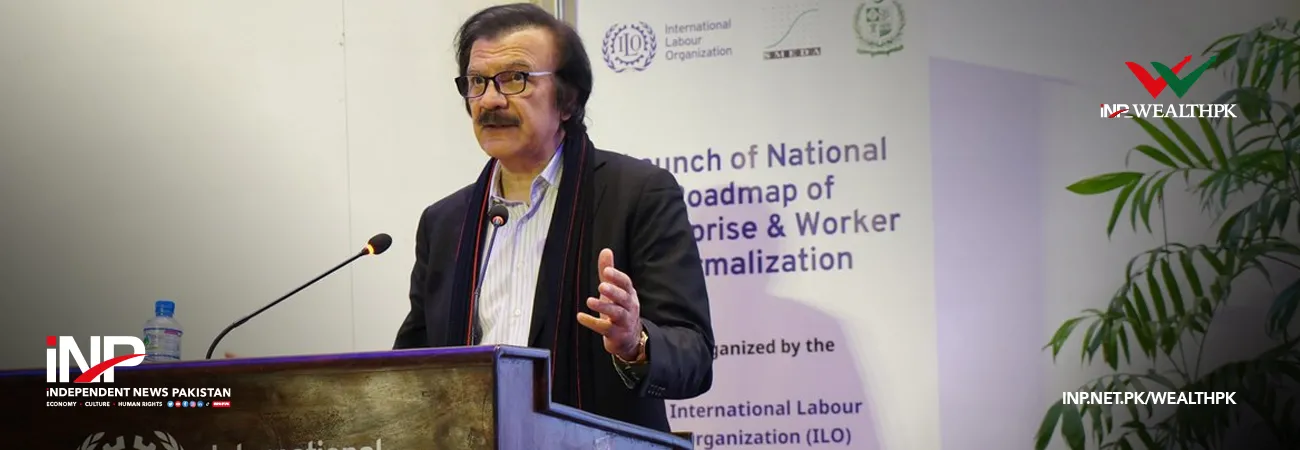

Dr Usman Mustafa, a professor of economics at the Pakistan Institute of Development Economics, told WealthPK that Pakistan experienced higher than anticipated inflation and a widening current account deficit (CAD) in FY22 due to various internal and external variables. “These factors include an unanticipated expansionary fiscal policy, internal political instability, the Russia-Ukraine conflict, a higher policy rate by the US Federal Reserve, and high inflation expectations domestically, all of which impacted the Pakistani rupee.”

He said the Russia-Ukraine conflict was a major supply shock to the global economy. “The outlook for inflation and foreign account in Pakistan also worsened as the conflict’s impact expanded, resulting in supply chain disruptions and a new jump in commodity prices.” He said in March 2022, the US Federal Reserve announced its first rate increase since 2018 and made clear its intention to continue tightening rates further during the year. “This policy resulted in contractionary monetary measures adopted by major central banks of the world, ultimately affecting financial markets worldwide.”

Third, Usman Mustafa said Pakistan’s macroeconomic outlook deteriorated due to domestic political instability and policy uncertainty. He said inflation assessed by Consumer Price Index (CPI) was 12.5% in FY22, exceeding both the government’s inflation target and the SBP’s revised forecast range of 9% to 11%. “Moreover, Pakistan’s CAD rose from $2.8 billion in FY21 to $17.3 billion, reflecting the impact of rising commodity prices and domestic demand.”

He argued that this situation required addressing the increased risks to the inflation outlook and minimising external account deficit to decrease financial market volatility and impact on economic growth. He explained that after maintaining an expansionary monetary policy during FY21, the SBP considerably boosted the policy rate in FY22 from 7% to 13.75%.

“However, a larger-than-anticipated increase in global commodity prices, an increase in energy tariffs, and an adverse exchange rate movement resulted in fiscal slippages and high inflation rates.” He said the continuing increase in global commodity prices and pressures from local demand posed challenges to inflation and CAD-tackling measures. However, he said the tight monetary and fiscal policies have stabilised macroeconomic indicators to some extent, and heralded economic recovery.

He highlighted that at the close of FY22, Pakistan’s macroeconomic indicators had begun to approach sustainable levels, though a combination of unfavourable global and local developments posed dangers to the country’s macroeconomic stability. He said throughout the year, the central bank’s Monetary Policy Committee had to balance out between safeguarding the economic recovery and effectively addressing inflationary pressures.

Credit: Independent News Pakistan-WealthPk