INP-WealthPk

Fakiha Tariq

Sazgar Engineering Works Limited (SAZEW) posted an 11% revenue growth and a 10% profit rise in the first half (Jul to Dec) of Fiscal Year 23 compared to the corresponding period of the previous fiscal 22, WealthPK reports. Sazgar Engineering Works Limited is listed in the automobile assembler sector under the symbol of “SAZEW” on the Pakistan Stock Exchange. It is a medium cap firm with a market capitalisation of Rs3.3 billion.

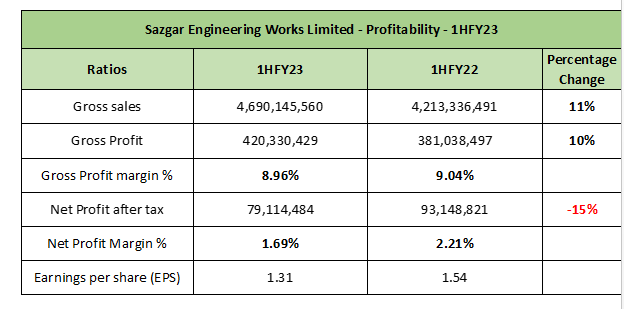

SAZEW is the ninth largest company as per market cap in the automobile assembler sector. Established in 1991, Sazgar autos is the largest manufacturer of 3-wheelers in Pakistan with recognition in both domestic and international markets. In the first six months of Fiscal Year 23, SAZEW posted a gross profit of Rs420 million on its sale of Rs4.6 billion. The net profit declared by the company was Rs79 million. The gross profit ratio and net profit ratio came out to be 8.96% and 1.69% respectively in 1HFY23. The company posted EPS value of Rs1.31 in 1HFY23.

Though sales and gross profit increased, SAZEW net profit declined in first half of the ongoing fiscal 23 compared to the first half of previous fiscal 22. In 1HFY22, the company posted gross profit and net profit of Rs381 million and Rs93 million on its sales of Rs4.2 billion. Thus, the gross profit ratio and net profit ratio stood at 9.04% and 2.21% in 1HFY22. The EPS value was 1.54 per share in 1HFY22.

Quarterly Review – 1HFY23

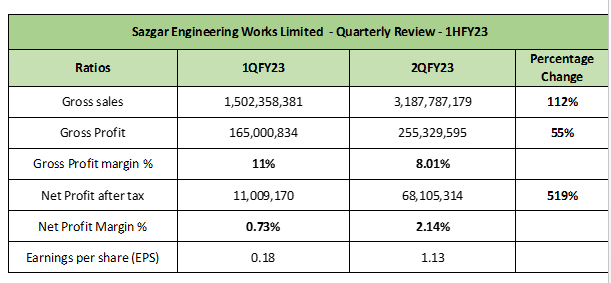

The quarterly review of profitability reveals that the company performed outclass in the second quarter (Oct to Dec) compared to the first quarter (Jul to Sept) of the ongoing fiscal 23.

In the first quarter of FY23, the company posted a gross profit of Rs165 million and a net profit of Rs11 million on its quarterly sales of Rs1.5 billion. Thus, the gross profit ratio and net profit ratio came out to be 11% and 0.73% in 1QFY23. The company declared the EPS value of Rs0.18 per share in 1QFY23.

However, in the second quarter of fiscal 23, the company posted a gross profit of Rs255 million and a net profit of Rs68 million on sales of Rs3.1 billion, which were more than 55% and 519% than the same financials obtained in 1QFY23. The gross profit ratio and net profit ratio stood at 8.01% and 2.14% in 2QFY23. The company also posted incremented EPS value of Rs1.13 per share in 2QFY23.

Market Value Review – 1HFY23

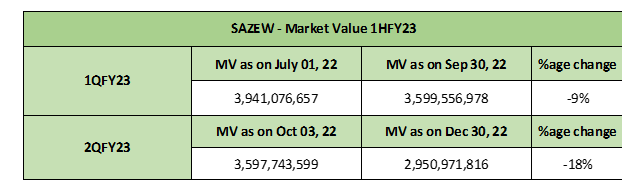

Overall, in 1HFY23, the company bore a 25% loss in its market value on the stock exchange.

The company suffered a market value loss of 9% in the first quarter of fiscal 23 and 18% in the second quarter, resulting in the closing MV of Rs2.9 billion on the last trading day of 1HFY23.

Credit: Independent News Pakistan-WealthPk