INP-WealthPk

Hifsa Raja

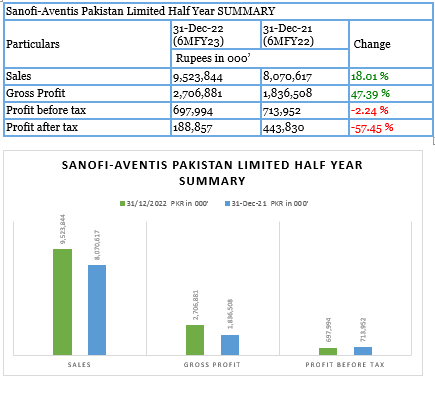

Pharma company Sanofi-Aventis Pakistan Limited’s sales revenue increased 18.01% year-on-year to Rs9.52 billion in the first six months of fiscal year 2022-23 (6MFY23). Similarly, the company’s gross profit increased by 47.39% to Rs2.70 billion in 6MFY23 from Rs1.83 billion in 6MFY22. However, the profit-before-taxation decreased 2.24% to Rs697 million in 6MFY23 from Rs713 million in 6MFY22. Likewise, the profit-after-taxation also declined 57.45% to Rs188 million in 6MFY23 from a post-tax profit of Rs443 million in 6MFY22. Overall, while the company has experienced growth in sales and gross profit, the decline in the post-tax profit is a red flag for the firm, and requires it to take steps to improve its financial performance and strategy.

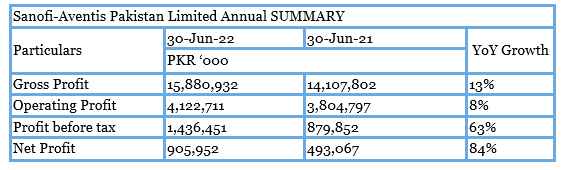

Performance in 2021-22

Sanofi-Aventis Pakistan Limited’s gross profit increased 13% to Rs15 billion in the fiscal year 2021-22 from Rs14 billion in the previous fiscal. This suggests the company has managed its costs and maintained profitability in the face of various challenges. Similarly, the company’s operating profit increased by 8% to Rs4.12 billion in FY22 from Rs3.80 billion in FY21. This indicates the company was able to generate more revenue from its operations while keeping expenses under control.

The profit-before-taxation jumped 63% to Rs1.43 billion in FY22 from a profit-before-tax of Rs879 million in FY21. The profit-after-taxation also surged 84% to Rs905 million in FY22 from a post-tax profit of Rs493 million in FY21. This suggests that the company was able to generate more income after accounting for all expenses, including taxes.

Industry comparison

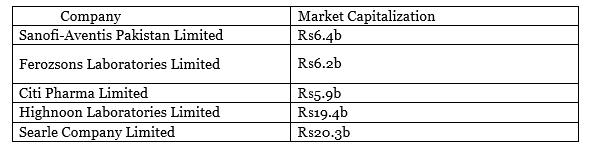

Sanofi-Aventis Pakistan Limited’s competitors include Ferozsons Laboratories Limited, Citi Pharma Limited, Highnoon Laboratories Limited and Searle Company Limited.

Sanofi-Aventis Pakistan Limited has a market capitalisation of ₨6.4 billion, which is the third-highest among its competitors. Ferozsons Laboratories Limited has a market capitalisation of ₨6.2 billion and Citi Pharma Limited ₨5.9 billion. Searle Company Limited and Highnoon Laboratories Limited have significantly higher market capitalisations at 20.3 billion and Rs19.4 billion, respectively.

About the company

The company was incorporated in Pakistan in 1967 as a public limited firm under the Companies Act, 1913 (now Companies Act, 2017). It is a subsidiary of Sanofi Foreign Participations BV registered in the Netherlands. The ultimate parent of the company is Sanofi SA, France. The company is engaged in the manufacturing, selling and trading of pharmaceutical and related products.

Credit: Independent News Pakistan-WealthPk