INP-WealthPk

Fakiha Tariq

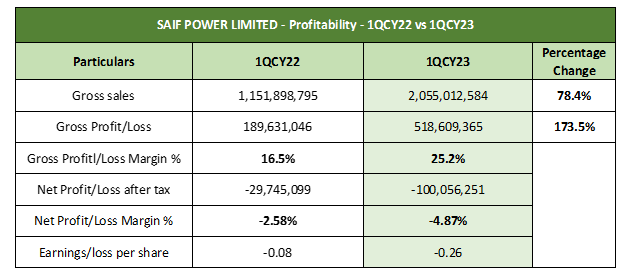

Saif Power Limited (SPWL) net loss increased to Rs100 million in the first quarter (January-March) of the ongoing calendar year 2023 compared to the net loss of Rs29 million over the same period of 2022, WealthPK reports. Though the power company showed high sales and gross profit growth, a 212% increase in the finance cost in 1QCY23 compared to 1QCY22 explained the decline in the net profitability.

The power firm bore the finance cost of Rs577 million in 1QCY23 compared to Rs185 billion in 1QCY22. SPWL ended the 1QCY23 with the gross sales of Rs2.05 billion. The company posted the gross profit of Rs518 million, thus posting the quarterly gross profit ratio of 25.2%. However, the company posted net loss of Rs100 million and net loss ratio 4.87% in 1QCY23. SPWL ended 1QCY23 with the loss per share of Rs0.26.

In comparison to corresponding period of 2022, SPWL increased its revenues by 78.4% from Rs1.15 billion to Rs2.05 billion in 1QCY23. Despite the net loss, the company excelled at its gross level profitability and posted hefty increase of 173.5% in its gross profit. SPWL’s loss per share also increased from Rs0.08 to Rs0.26 during the quarter under review. The firm is listed on the Pakistan Stock Exchange with the symbol “SPWL”. It is the sixth-largest firm registered in the power generation and distribution sector, with the market capitalisation of Rs7 billion.

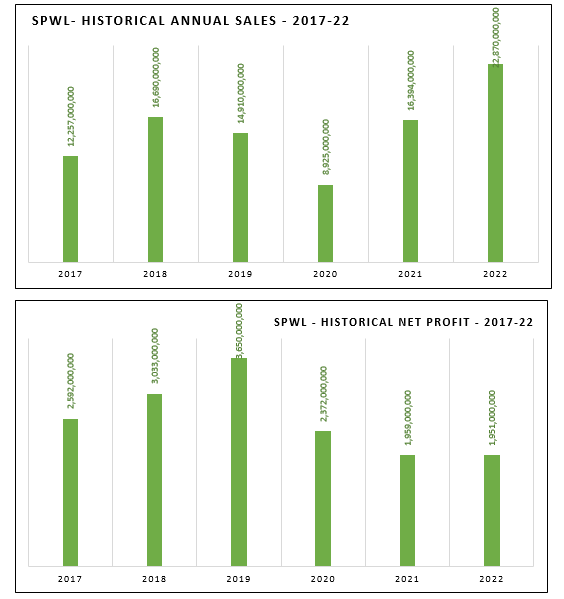

Financial analysis from CY17 to CY22

Historical annual analysis shows that SPWL’s net profit continued to decline over the last three years. During the last six years, SPWL posted the highest sales of Rs22.87 billion in 2022 and the lowest sales of Rs8 billion in 2020. From 2017 to 2022, the company declared the highest net profit of Rs3.6 billion in 2019 and the lowest Rs1.9 billion in 2022. The company managed to increase its sales from Rs12 billion in 2017 to Rs16 billion in 2018, followed by dips in 2019 and 2020. The company’s sales plunged in 2020 to Rs8.9 billion. From there, SPWL is continuously increasing its revenue collection.

The net profit increased from Rs2.5 billion in 2017 to Rs3.03 billion 2018 and Rs3.65 billion in 2019. However, profits began to dwindle afterwards with company posting profit of Rs2.3 billion in 2020 and Rs1.9 billion apiece in 2021 and 2022, respectively.

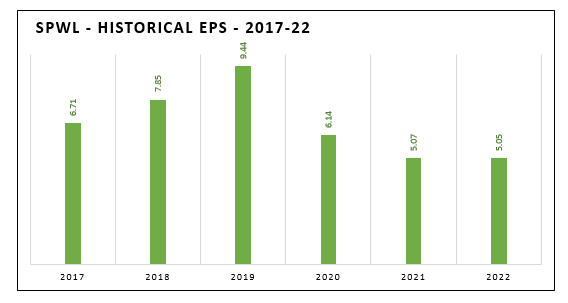

In the last six years, the company posted the highest earnings per share value of Rs9.44 in 2019. Then EPS value kept declining, with the company posting the lowest six-year EPS of Rs5.05 in 2022.

Credit: Independent News Pakistan-WealthPk