INP-WealthPk

Shams ul Nisa

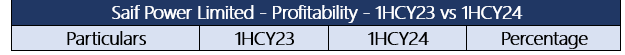

Saif Power Limited experienced a significant decline in turnover by 64.2%, but the net profit witnessed a substantial surge of around 169.9% during the first half of the calendar year 2024, reports WealthPK.

During the review period, the company reported a net profit of Rs518.7 million compared to a net loss of Rs742.4 million in 1HCY24. However, the cost of sales of the company decreased by 77.2% to Rs2.2 billion, suggesting effective cost management. Thus, the gross profit increased by 154.5%, indicating better pricing strategies or operational efficiencies. Furthermore, other income surged by 1369.4%, suggesting diversification of income streams or capitalizing on opportunities outside core operations. Similarly, the company’s administrative expenses increased by 39.3% during the review period.

The net profit margin showed an impressive improvement from a net loss margin of 7.27% in 1HCY23 to a net profit margin of 14.20% in 1HCY24, indicating a recovery in profitability relative to sales. Likewise, the earnings per share (EPS) shifted from a loss per share of Rs1.92 to an earnings per share of Rs1.34 in 1HCY24.

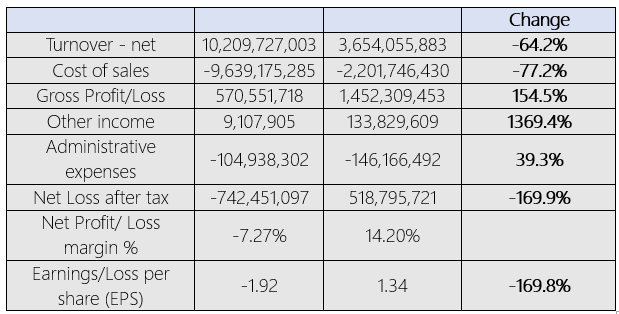

Power Generation & Distribution Sector

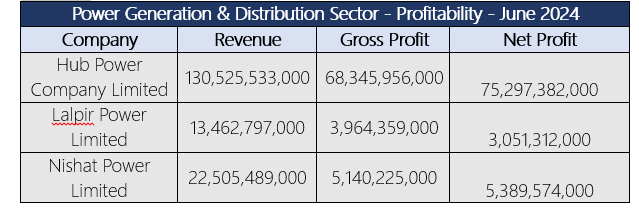

The power generation and distribution sector saw a total revenue of Rs186.75 billion, with a gross profit of Rs82.53 billion and a net profit of Rs87.47 billion. This growth reflects robust demand for power generation services and effective cost management across the sector. The sector comprises Hub Power Company Limited, Lalpir Power Limited, Nishat Power Limited, Saif Power Limited, Kohinoor Energy Limited, and Engro Powergen Qadirpur Limited.

Hub Power Company Limited reported the highest revenue of Rs130.53 billion in the sector during the period ending June 2024, demonstrating a significant operational efficiency and a favorable pricing environment. Likewise, the company is the top performer in the sector in terms of gross profit and net profit. Nishat Power Limited earned the second-highest revenue of Rs22.51 billion in the sector, demonstrating strong operational capabilities and effective cost-control measures. The company posted a gross profit of 3.9 and a net profit of 3.05 in June 2024. Lalpir Power Limited reported a revenue of Rs13.46 billion, generating a gross profit of Rs3.96 billion and a net profit of Rs3.05 billion, followed by Kohinoor Energy Limited with a revenue of Rs10.01 billion, a gross profit of Rs2.30 billion, and a net profit of Rs1.60 billion. Additionally, Engro Powergen Qadirpur Limited’s revenue stood at Rs6.59 billion, gross profit at Rs1.33 billion, and net profit at Rs1.61 billion. Saif Power Limited reported a revenue of Rs3.65 billion, a gross profit of Rs1.45 billion, and a net profit of Rs518.80 million.

Historical Trend

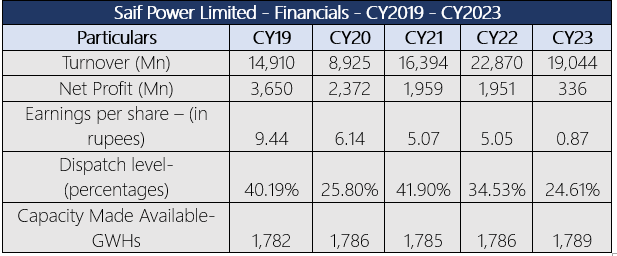

Over the past five years, Saif Power Limited's turnover has fluctuated, with a significant drop in CY20 to Rs8.9 billion due to the operational challenges and reduced demand. However, in CY21, the turnover rebounded to Rs16.39 billion, and peaked to Rs22.87 billion in CY22. However, in CY2023, the turnover fell again to Rs19.04 billion, indicating potential issues in sustaining sales growth and increased competition impacting revenue generation. The net profit has declined over the period, dropping from Rs3.65 billion in CY19 to Rs336 million in CY23. This decline is attributed to the increasing operational costs and lower efficiency, or reduced margins, affecting profitability. Similarly, the earnings per share shows a downward trajectory to Rs0.87 in CY23, indicating diminishing returns for the shareholders.

Dispatch levels reveal the percentage of capacity utilized by Saif Power Limited peaked at 40.19% in CY19 and declined sharply to 25.80% in CY20. However, the capacity made available remained relatively stable, ranging from 1,782GWhs in CY19 to 1,789GWhs in CY23.

Company’s profile

Saif Power Limited is an independent power producer (IIP) incorporated in 2004. As a subsidiary of Saif Holdings Limited, its primary activities include owning, running, and maintaining a combined cycle power plant with a capacity of 225MW (ISO) and selling electricity to the Central Power.

Credit: INP-WealthPk