INP-WealthPk

Shams ul Nisa

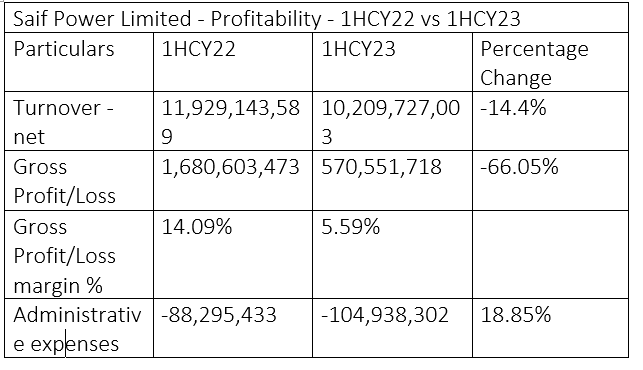

Saif Power Limited’s net turnover decreased by 14.4% in the first half (January- June) of the ongoing calendar year 2023 to Rs10.21 billion from Rs11.93 billion over the same period last year, WealthPK reports. Additionally, the power company reported a 66.05% decline in gross profit, which plunged to Rs570.55 million in 1HCY23 from Rs1.68 billion in 1HCY22. Thus, the gross profit ratio also plunged to 5.59% in 1HCY23 from 14.09% in 1HCY22, reflecting a decline in profitability on sale of each unit. This significant decline in net turnover and gross profit can be attributed to the economic uncertainties, high production costs and price pressures during this period.

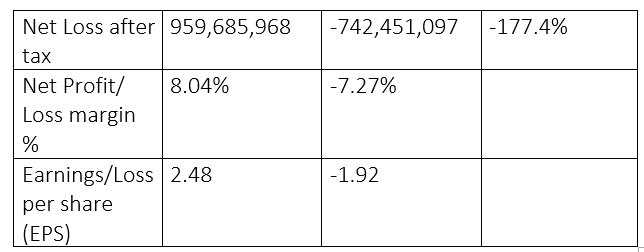

The power company’s administrative cost surged to Rs104.94 million in 1HCY23 from Rs88.29 million in 1HCY22, posting a growth of 18.85%. The company faced a staggering net loss of Rs742.4 million in the first half of CY23, a sharp contrast to the net profit of Rs959.69 million it earned in the same period last year. This amounted to a 177.4% decline in its bottom line.

As a result, the company sustained a net loss margin of 7.27% in 1HCY23 compared to net profit ratio of 8.04% in 1HCY22, reflecting the worsening financial performance during the period. The net losses consequently affected the earnings per share of the company, thus making its stock less attractive for investors. During 1HCY23, the power company observed a loss per share of Rs1.92 over EPS of Rs2.48 in 1HCY22.

Assets analysis

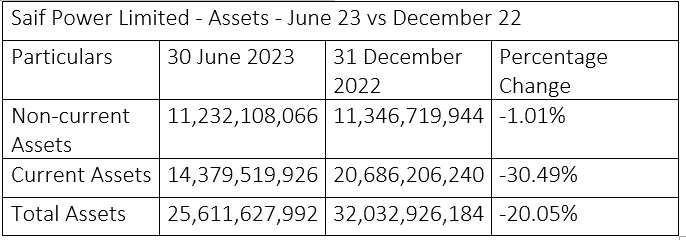

As of December 31, 2022, the company’s non-current assets totalled Rs11.34 billion, which marginally decreased to Rs11.23 billion on June 30, 2023, a posting a negative growth of 1.01%. This slight reduction is due to currency depreciation and the changes the company made in its long-term investments such as property, plants and equipment.

The power company experienced a significant decline of 30.49% in current assets, which plunged to Rs14.37 billion on June 30, 2023 from Rs20.68 billion on December 31, 2022. This shows that the firm experienced a reduction in short-term assets and decreased sales during this period. This decrease in current and non-current assets constituted a downfall of 20.05% in total assets, which dropped to Rs25.61 billion on June 30, 2023 from Rs32.03 billion on December 31, 2022.

Equity and liabilities analysis

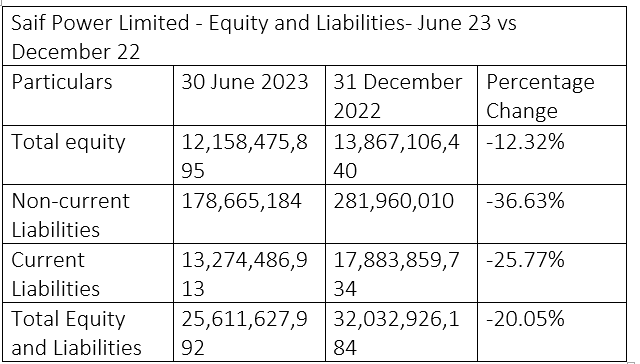

The company’s total equity stood at Rs12.15 billion on June 30, 2023 compared to Rs13.86 billion on December 31, 2022, constituting a decline of 12.32%. This decline shows the reduction in the company’s shareholder equity and is attributed to the company’s net losses during this period.

The current and non-current liabilities showed a notable reduction of 25.77% and 36.63%, respectively, which indicates that the company paid off its long and short-term obligations, thus lowering the liquidity and financial risk. The total equity and liabilities dropped by 20.05% to Rs25.6 billion on June 30, 2023, from Rs32.03 billion on December 30, 2022.

Historical analysis

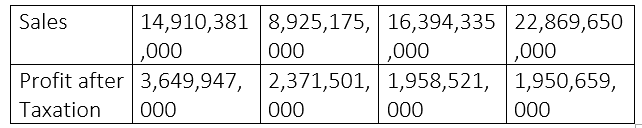

Saif Power’s sales in CY19 stood at Rs14.91 billion, but fell to Rs8.92 billion in CY20. But in the subsequent years of CY21 and CY22, sales kept increasing to Rs16.39 billion and Rs22.86 billion.

![]()

The profit-after-taxation showed a gradual decreasing trend over the period from CY19 to CY22. The after-tax profit stood at Rs3.64 billion in CY19, Rs2.37 billion in CY20, Rs1.958 billion in CY21 and Rs1.950 billion in CY22, respectively. This shows that over the years the company was unable to increase its profitability.

Company’s profile

Saif Power Limited is an independent power producer (IIP) incorporated in Pakistan in 2004. The company is a subsidiary of Saif Holdings Limited. The company operates and maintains a power plant that produces 225 megawatts of electricity using a combined cycle process. It sells the electricity to the Central Power Purchasing Company, which distributes it to the consumers.

Credit: INP-WealthPk