آئی این پی ویلتھ پی کے

Shams ul Nisa

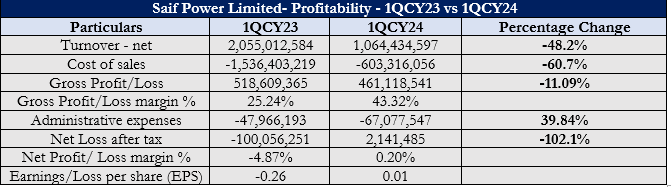

– Saif Power Limited's earned a net profit of Rs2.14 million compared to a net loss of Rs100.05 million in corresponding period of last fiscal year, indicating a drastic rise of around 102.1% for the first quarter of calendar year 2024 (1QCY24), reports WealthPk.

At the end of the quarter, the company showed a major decline in net turnover by 48.2% to Rs1.06 billion from Rs2.05 billion in 1QCY23. According to the director review report for the review period, the company's monthly capacity purchase price (CPP) has been subject to "Period Weighing Factors" (PWF) by the Central Power Purchasing Agency (CPPA-G). Thus, the company observed fluctuation in the profit and loss figures in different quarters. However, the cost of sales fell sharply by 60.7%, from Rs1.53 billion in 1QCY23 to Rs603.31 million in 1QCY24. This implies that the company significantly reduced its operating expenses by implementing cost-cutting strategies and reduced operations. Furthermore, the gross profit declined by 11.09% to Rs461.11 million in 1QCY24. However, the gross profit margin saw a major jump from 25.24% in 1QCY23 to 43.32% in 1QFY24, suggesting improved cost control compared to revenue generation.

On the expenses front, the administrative expenses stood at Rs67.07 million in 1QCY24, suggesting an increased by around 39.84%. This increase in administrative costs can be attributed to the higher overhead, higher salaries, and increased investments during the review period. The net profit margin and earnings per share stood at 0.20% and Rs0.01 in 1QCY24 compared to net loss margin and loss per share of 4.87% and Rs0.26 in the same period last year.

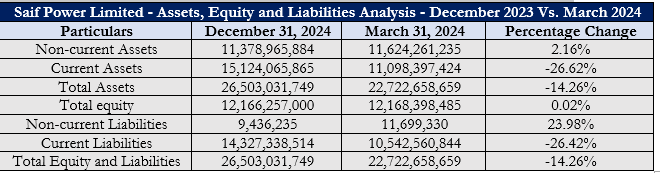

Assets, Equity and Liabilities Analysis

The company's total assets decreased by 14.26% between December 2023 to March 2024, primarily due to a major 26.62% decrease in current assets, indicating lower cash reserves, reduced inventories, and lower receivables. Whereas, the company’s non-current assets increased slightly by 2.16%, indicating ongoing investments in long-term assets like property, plant, and equipment. Total equity remained almost unchanged, rising marginally by 0.02% to Rs12.16 billion in March 2024, indicating the company did not issue new shares or repurchase significant amounts during the period.

Saif Power Limited's balance sheet shows a 23.98% increase in non-current liabilities, possibly due to increased long-term borrowings and increased deferred tax liabilities. However, the company's current liabilities decreased by 26.42% to Rs10.54 billion in March 2024, suggesting improved short-term debt management by the company. At the end of March 2024, total equity and liabilities stood at Rs22.72 billion, 14.26% lower than Rs26.5 billion in December 2023.

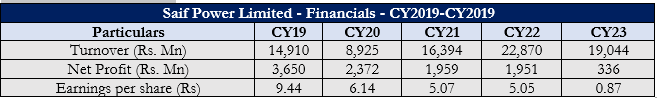

Historical Trend

Saif Power Limited's financial performance during the period 2019 to 2023 showed significant fluctuations in turnover, net profit, and earnings per share (EPS). The company’s turnover dropped significantly to Rs8.92 billion in CY20, attributing to market downturns and operational challenges. However, it rebounded in following years reaching Rs22.870 billion, suggesting sustained growth. In CY23, the company’s turnover declined to Rs19.04 billion. The net profit showed a declining trend over the years from Rs3.65 billion in CY19 to a low of Rs336.0 million in CY23, showcasing higher costs and reduced margins.

Similarly, earnings per share (EPS) steadily declined over five years, dropping from a high of Rs9.44 in CY19 to a low of Rs0.87 in CY22, highlighting the financial challenges in managing costs and maintaining profitability.

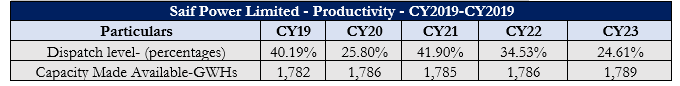

Productivity Trend

The analysis of Saif Power Limited's productivity from CY19 to CY23 reveals significant trends in its dispatch levels and capacity utilization. The dispatch level, which represents the percentage of generated electricity delivered to the grid, dropped significantly from 40.19% in CY19 to 25.80% in CY20. In CY21, it recovered to 41.90%, but then declined to 34.53% in CY22 and 24.61% in CY23, indicating decreased demand, operational inefficiencies, or external market factors.

The company's available capacity in GWh remained stable over the five years, increasing slightly from 1,782 GWh in 2019 to 1,789 GWh in 2023. It held steady at 1,786 GWh in both 2020 and 2022. This consistent capacity availability indicates efficient maintenance of operational infrastructure, ensuring reliable power generation.

Company’s profile

Saif Power Limited is an independent Power Producer (IIP) incorporated in 2004. The company is a subsidiary of Saif Holdings Limited. The Company's primary activities include owning, running, and maintaining a combined cycle power plant with a capacity of 225 MW (ISO), and selling the electricity to Central Power.

Credit: INP-WealthPk