INP-WealthPk

Ayesha Mudassar

The ongoing industrial regression in Pakistan has been due to numerous reasons including the global economic slowdown, political instability, non-availability of raw material, and rupee devaluation. This was stated by business leaders and industrialists while briefing the Senate Standing Committee on Finance and Revenue, which met under the chairmanship of Senator Saleem Mandviwalla. The current situation highlights the need for comprehensive measures to address the challenges faced by the sector. These measures include all cutting-edge strategies that reduce costs, enhance productivity, and boost competitiveness.

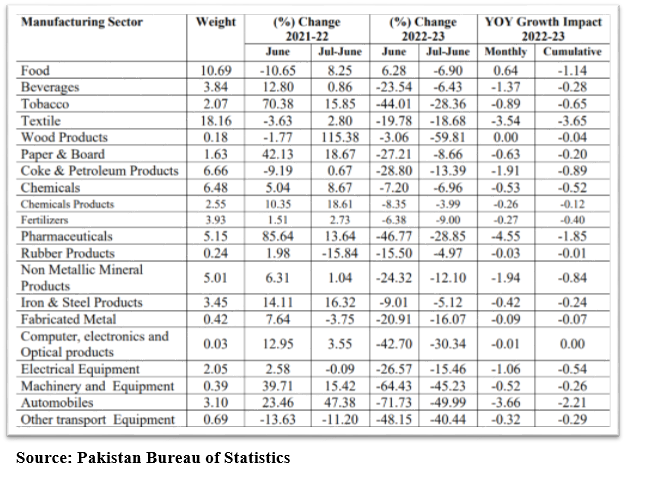

By leveraging the strengths and resolving the issues, Pakistan can advance towards a more robust and thriving manufacturing sector, the Seante committee was told. Recent data for the large-scale manufacturing index (LSMI) in June 2023 reveals a worrying 14.96% year-on-year (YoY) decrease. In addition, the 12-month period of FY2023 also shows an overall YoY decline of 10.26%. The main sectors contributing to this decline are textiles, automobiles, pharmaceuticals, food, petroleum products, cement, and chemicals.

The textile sector witnessed a dip of 18.68% during FY23 compared to 2.80% growth during the corresponding period last year. Economic challenges, technological limitations, and fluctuations in raw material prices have contributed to this decline. The automobile sector plunged by 49.99% during the period under review against 47.38% growth during the previous year. Talking to WealthPK, Secretary of Auto Industry Development Committee (AIDC) Asim Ayaz attributed this decline to exponential depreciation of the local currency, tighter monetary measures, and rising inflation.

“The decision to continue import restrictions on completely knocked-down (CKD) kits has proven damaging for the industry,” he said. The pharmaceutical sector witnessed a dip of 28.85% during FY23 against 13.64% growth last year. Elaborating the reasons, Chairman of the Pharmaceutical Manufacturers Association Syed Farooq Bukhari said the drying-up of foreign reserves and massive rupee devaluation had significantly reduced the country's ability to import essential medicines or active pharmaceutical ingredients utilised in domestic production. Coke and petroleum production went down by 13.39% during FY23 against a growth of 0.67% during the previous year.

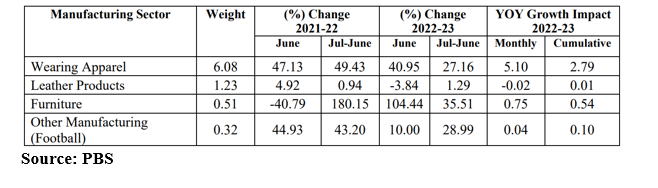

Massive currency depreciation and high energy prices depressed the overall growth momentum. The food sector witnessed a decline of 6.90% during the period under review against a growth of 8.25% during the previous year. The chemical sector showed a contraction of 3.99% against 18.61% growth seen previously, while fertiliser production dived down by 9%. However, there have been some positive contributions from the wearing apparel and furniture sectors. The production of leather products and other manufacturing (footballs) has also increased.

During FY23, the production of furniture and leather products grew by 35.51% and 1.29%, respectively. Other manufacturing, particularly football production, increased by 28.99% during the period under review. The country’s development is deeply linked with the growth of industrial sectors. Given the present circumstances, the government should commit to achieving a strong industrial growth rate for the revival of the economy through the implementation of short-term and long-term plans.

Credit: INP-WealthPk