INP-WealthPk

Ayesha Mudassar

Pakistan’s public debt has been multiplying at an unsustainable pace which can be gauged from the fact that Rs13.63 trillion has been added to the debt stock in just 12 months. In a discussion with WealthPK, Joint Executive Director at Sustainable Development Policy Institute (SDPI) Dr Vaqar Ahmed attributed the rise in public debt to uncontrolled expenditures, below potential revenue collection from various sectors, sinking rupee against the dollar, and changes in the government’s cash balance. “Besides these, the application of monetary and fiscal policies also impacted the sustainability of public debt,” Dr Vaqar said.

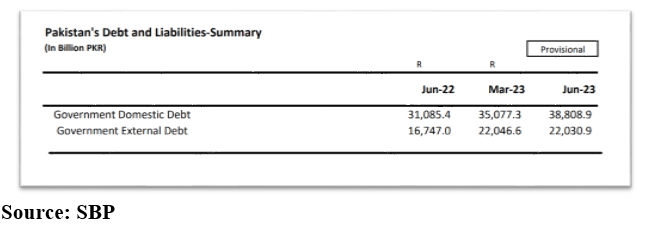

Fiscal Responsibility and Debt Limitation (FRDL) Act 2005 defines "total public debt" as debt owed by the government serviced out of consolidated funds and debts owed to International Monetary Fund (IMF). According to the Monthly Debt Bulletin of the State Bank of Pakistan (SBP), gross public debt jumped from Rs 49.24 trillion in June 2022 to Rs62.88 trillion by the end of the fiscal year 2022-23. Data shows that the government’s domestic debt increased to Rs38.8 trillion, an addition of Rs7.72 trillion (or 25%), during the year. The external debt of the government rose at an alarming pace of 32% to Rs22.03 trillion in a year. There was a net increase of Rs5.29 trillion in the external debt, largely due to currency depreciation.

At the end of June 2022, the external debt stood at Rs16.74 trillion, excluding the IMF liabilities. The share of external debt in the total debt is roughly 36%, and any movement in the exchange rate creates a major impact on the debt without even borrowing a single dollar. The rupee-dollar exchange rate fell by 43% in just 12 months, from Rs199.9 per dollar in June 2022 to Rs286.7 per dollar in June 2023. Moreover, Pakistan's total debt and liabilities have now increased to Rs77.1 trillion, or equal to 91.1% of the size of the national economy.

Concerning the measures to address the issue of mushrooming public debt, Vaqar said it is necessary to ensure that both the level and rate of growth in public debt are fundamentally sustainable while guaranteeing that the debt portfolio is efficiently structured in terms of currency composition, interest rates, and maturity profile. "Pakistan needs to implement a combination of fiscal discipline, economic reforms, and debt management strategies to address the problem of mounting public debt,” he added.

Credit: INP-WealthPk