INP-WealthPk

Jawad Ahmed

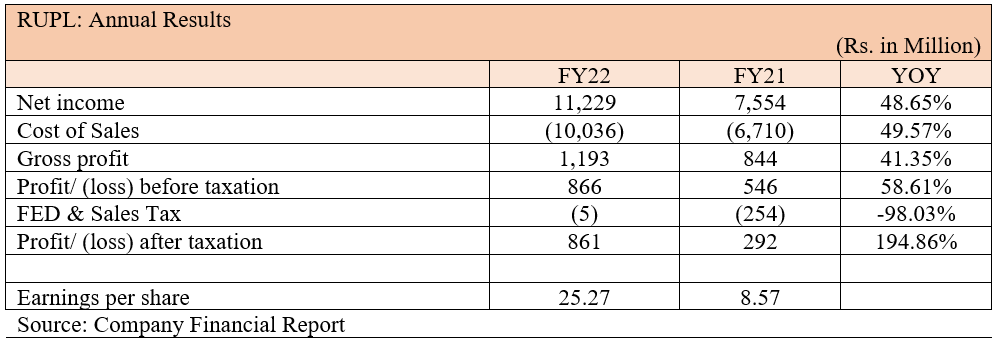

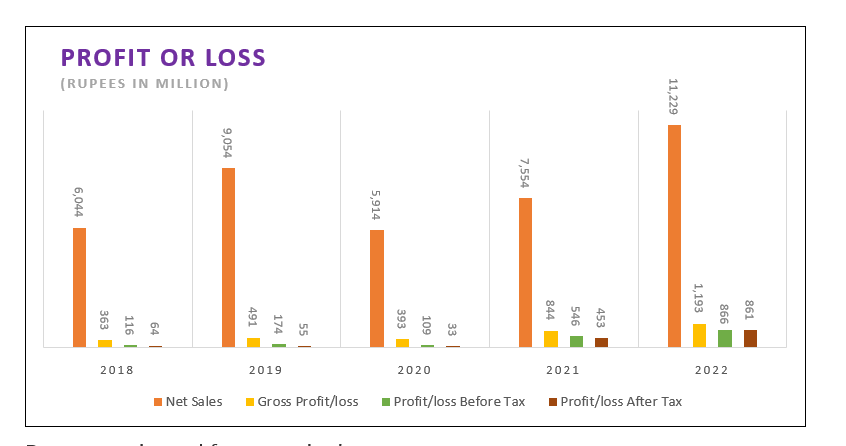

Rupali Polyester Limited’s net income increased 48.6% to PKR11.2 billion in the fiscal year 2021-22 compared with PKR7.55 billion in the fiscal year 2020-21. The sales revenue during the fiscal year 21-22 increased both quantitatively and monetarily, reports WealthPK quoting the company’s financial stats.

Rupali was incorporated as a publicly listed company in Pakistan on May 24, 1980, under the Companies Act, 1913. It is principally engaged in the manufacture and sale of polyester products.

The gross profit climbed 41.3% to RKR1.19 billion in 2021-22 from Rs844 million in the previous year as a result of an increase in revenue.

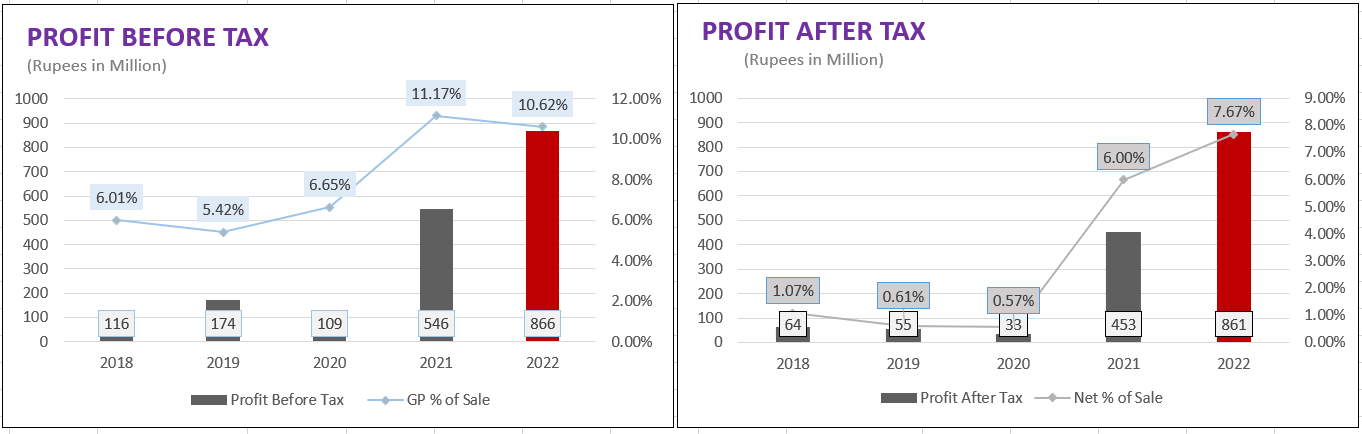

The profit before tax for the year was PKR866 million, up from PKR546 million in 2021.

The company's net profitability rose 194.8% from PKR292 million in FY21 to PKR861 million in FY22 as a result of significant topline growth. This increase caused the earnings per share (EPS) to soar to PKR25.27 from PKR8.57 in the previous year.

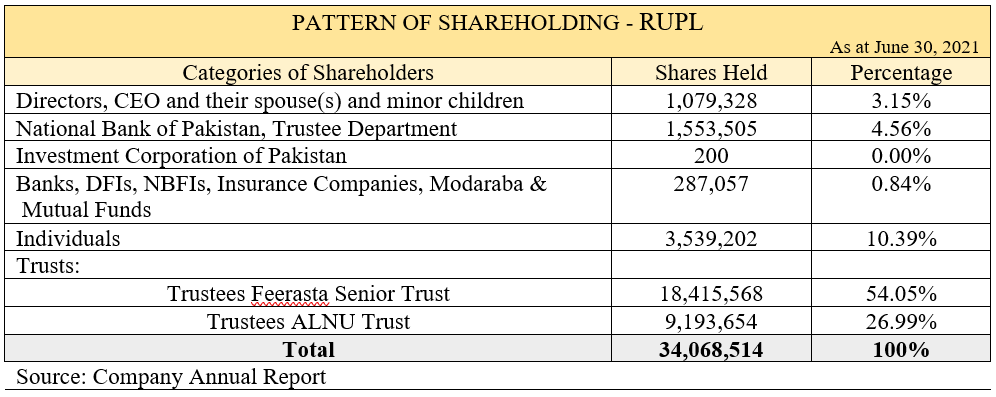

Shareholding pattern

As of June 30, 2021, the company's directors own 3.15% of the shares, National Bank of Pakistan, Trustee Department about 4.56%, individuals around 10.4%, banks, DFIs, NBFIs, insurance companies, modarabas and joint stock companies 0.84%, and Trustees Feerasta Senior Trust and Trustees ALNU Trust collectively almost 81% of the shares.

Historical financial performance

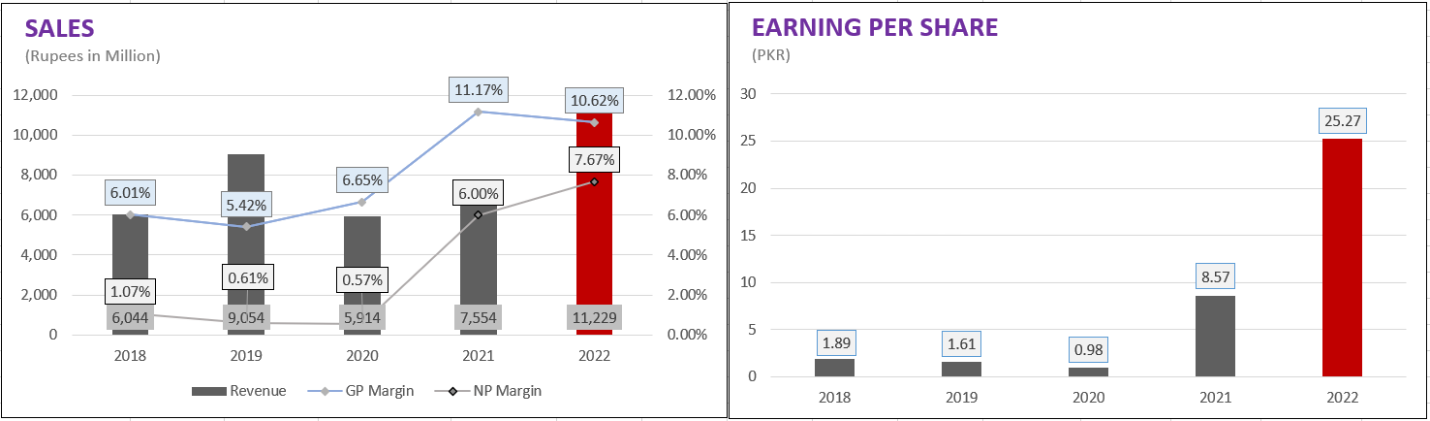

In 2019, the company's sales amounted to Rs9.05 billion, up 49.8% from Rs6.04 billion the previous year.

The company's total profit climbed from Rs363 million to Rs491 million in 2019; however, the profit after tax decreased by 14% to Rs55 million from Rs64 million in 2018.

The EPS decreased from Rs1.89 in 2018 to Rs1.61 in 2019 as a result of the company's profits.

In 2020, the COVID-19 pandemic and the difficult economic climate caused the company's sales to decline 34.7% to Rs5.91 billion from Rs9.05 billion the year before.

As a result, the business's gross profit decreased from Rs491 million to Rs393 million.

In 2020, the company reported a net profit of Rs33 million after tax deductions, down from Rs55 million in 2019. As a result, the EPS dropped from Rs1.61 in 2019 to Rs0.98 in 2020.

In 2021, due to both volumetric and monetary gains, the company's topline increased from Rs5.91 billion to Rs7.55 billion.

The gross profit increased to Rs844 million from Rs393 million in the previous year principally as a result of rising demand and the economy's rebound following the closure of COVID-19.

As a result, the earnings per share rose from Rs0.98 the previous year to Rs8.57 this year.

Revenue growth increased further, exceeding 48% in FY22. The top line's value increased to an all-time high of Rs11.23 billion. The increase in topline is due to growing demand and an economic rebound following COVID-19.

Even though the economy has improved after the COVID-19 variants, problems like escalating debt and inflation, depreciation of the Pakistani rupee, a bullish trend in commodity prices, record increase in sea freight, lack of a mechanism for recouping anti-dumping duties, and unstable geopolitical tensions will endure.

According to the financial report of the company, the business is continually aware of potential roadblocks and will keep taking proactive adaptation steps to ensure optimal performance and increased profitability for its shareholders.

Credit : Independent News Pakistan-WealthPk