INP-WealthPk

Ayesha Mudassar

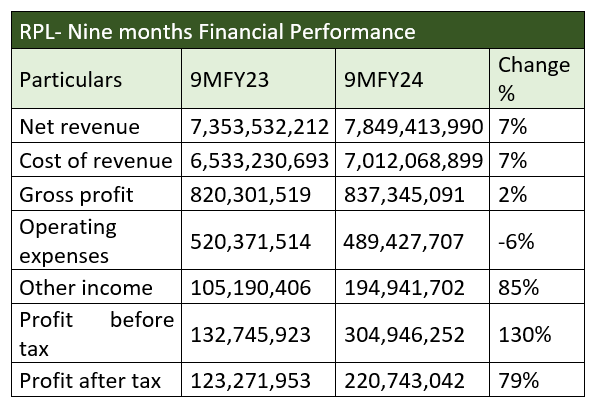

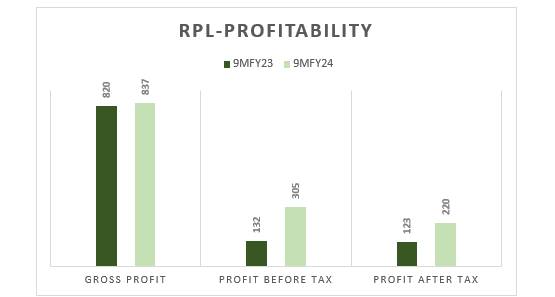

Roshan Packages Limited (RPL) experienced an increase of 130% and 79% in before-and-after-tax profits, respectively, in the first nine months of the ongoing fiscal year (9MFY24) compared with the same period last year, reports WealthPK As per the company's report, RPL posted a profit-before-tax of Rs304.9 million and profit-after-tax of Rs220.7 million in 9MFY24. Moreover, the gross profit stood at Rs837.3 million, demonstrating a rise of 2% over the previous year's nine-month period.

![]()

![]()

The RPL revenue increased to Rs7.8 billion, representing a growth of 7% from the preceding year's nine months. This growth can be attributed to the company's improved focus on customer satisfaction, meeting international quality standards and increased market share. Operating expenses, encompassing administrative, selling, and distribution expenditures, declined marginally from Rs520.3 million to Rs489.4 million during the period under review. Other incomes saw a notable rise, increasing from Rs105.1 million to Rs194.9 million in 9MFY24 thanks to diversified income sources and improved investment activities.

Performance in last four years (2020-23)

Financial highlights

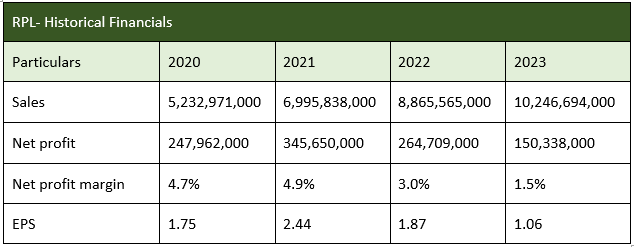

The net sales of RPL have been growing over the years from 2020 to 2023, but barring 2021 the net profit nosedived in subsequent years. In 2021, RPL's top line grew by 33.7% year-on-year (YoY) on the back of a volumetric growth of 7.9%. After the Covid-19 pandemic, people have become more aware of hygiene and the importance of proper packaging, which fortified the demand for RPL products. Owing to high demand and monetary easing, the net profit grew by 39% with a net profit (NP) margin of 4.9%. Moreover, the earnings per share (EPS) surged to Rs2.44 in 2021 from Rs1.75 in 2020.

The demand remained robust in 2022 with a 27% YoY growth in top line. However, a rise in the cost of imported raw materials coupled with rupee depreciation and higher utility charges pushed the cost of sales up by 30% in 2022. The rise in finance costs due to higher discount rates and increased borrowings translated into a 23% YoY drop in net profit, which clocked in at Rs264.7 million. EPS also plunged to Rs1.87 in the year. The RPL's top line posted a 16% YoY growth in 2023. However, rupee depreciation and high energy and finance costs diluted the impact of top line growth. The net profit plunged by 57% YoY in 2023 to clock in at Rs150.3 million. Moreover, EPS shrank to Rs1.06 from Rs1.87 in the previous year.

Financial ratios

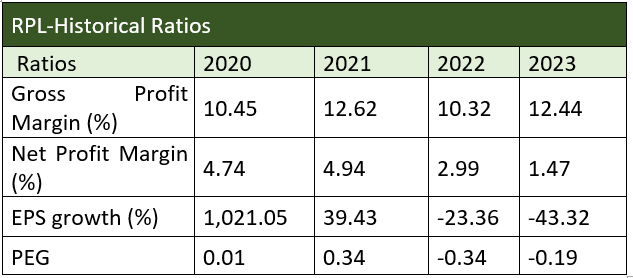

RPL’s historical ratios provide insight into the company’s profitability, efficiency and growth trends over the years. It witnessed fluctuations in its gross profit margin over the four years under review. In FY23, the gross profit margin was 12.44% compared to the previous year's margin of 10.32%. This rise in gross profit reflects the company's effective cost management and pricing strategies. The company posted the highest NP ratio of 4.94% in 2021. However, a declining trend has been observed in the subsequent years (2022, 2023). The decrease may be attributed to various factors, including an increased operating expense, changes in market conditions, or reduced profitability.

RPL experienced significant fluctuations in EPS growth over the period spanning 2020-23. In FY23, the EPS growth was negative at -43.32%, following a negative growth of 23.36% in the previous year. This was mainly due to challenges in maintaining profitability or unfavorable market conditions. The PEG ratio assesses the relationship between a company's price-to-earnings ratio and its EPS growth rate, providing insights into the company's valuation relative to its growth potential. In FY23, the PEG ratio was -0.19, indicating a potentially undervalued stock relative to its EPS growth.

About the company

Roshan Packages was incorporated in Pakistan as a private company limited by shares on August 13, 2002, under the Companies Act, 2017. It was converted into a public limited company on September 23, 2016, and was listed on the Pakistan Stock Exchange in February 2017. It is principally engaged in the manufacture and sale of corrugation and flexible packaging materials.

Future outlook

With the initiation of foreign inflows and ease of import restrictions, RPL is in a better position to stock up on its inventory and to significantly streamline its customer portfolio to include fast-moving consumer goods and essential commodities segment. In this way, it can guard its margins and bottom line from further decline.

Credit: INP-WealthPk