INP-WealthPk

Ayesha Mudassar

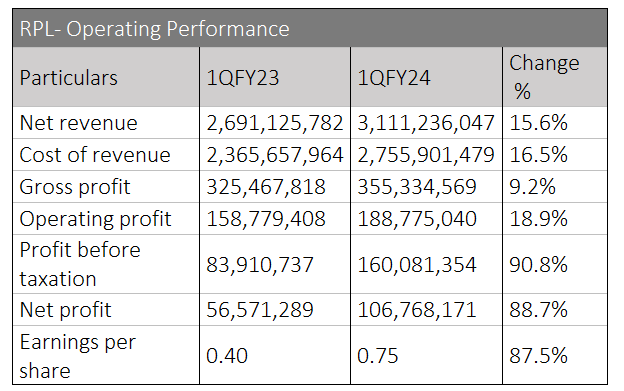

Roshan Packages Limited (RPL) witnessed an increase of 90.8% and 88.7% in before-and-after-tax profits, respectively, in the first quarter of the current fiscal year (1QFY24) compared with the same period last year, according to WealthPK. As per the company's quarterly report, RPL posted a profit-before-tax of Rs160 million and profit-after-tax of Rs106 million in 1QFY24. Moreover, the gross profit stood at Rs355 million, demonstrating a growth of 9.2% over the previous year’s three-month period. This rise demonstrates the company’s continuous efforts on cost efficiencies and better capacity utilisation. Furthermore, the company experienced a considerable rise of 18.9% in operating profit.

RPL’s revenue increased notably to Rs3.11 billion, representing a 15.6% increment from the preceding year’s first quarter. This growth can be attributed to the company's improved focus on customer satisfaction, quality products and market share.

Financial position highlights

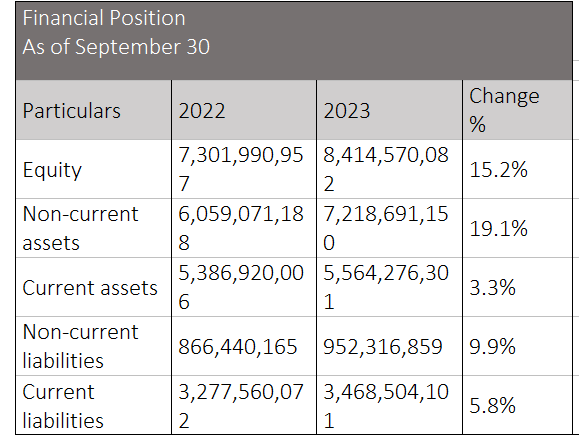

The analysis of the company’s financial position shows a growth of 19.1% in its non-current assets during the quarter ended September 30, 2023, compared to 1QFY23. This rise indicates the company’s investment in modernisation of production facilities. Moreover, the company’s current assets rose from Rs5.3 billion in 1QFY23 to Rs5.5 billion in 1QFY24, indicating an increase in stores, spares and other consumables, aligning with the company’s regular business expansion requirements. RPL’s equity (share capital and reserves) increased by 15.2% from Rs7.30 billion (IQFY23) to Rs8.41 billion (FY24).

During the quarter under review, the long-term borrowing grew 9.9% compared to 1QFY23. This growth shows that the company took additional long-term liabilities or debt for the expansion and modernisation of production facilities. Besides, the rise in short-term borrowing in the current quarter is in line with the growing business operations and high working capital demands of the company.

Historical ratios analysis

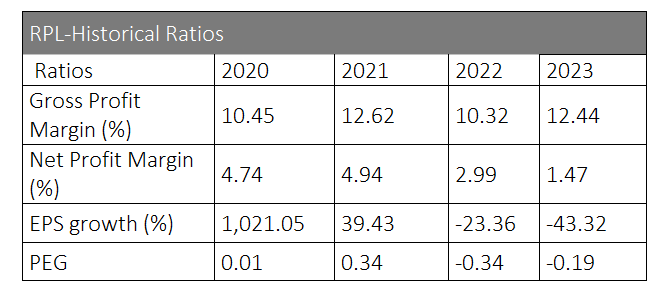

RPL’s historical ratios provide insights into the company’s profitability, efficiency and growth trends over the years. Roshan Packages witnessed fluctuations in its gross profit margin over the four years. In FY23, the gross profit margin was 12.44% compared to the previous year's 10.32%. This rise in gross profit reflects the company's effective cost management and pricing strategies. Concerning the net profit ratio, the company posted the highest ratio of 4.94% in 2021. However, a declining trend has been observed in the subsequent years (2022, 2023). The decrease may be attributed to various factors, including an increased operating expense, changes in market conditions, or reduced profitability.

Roshan Packages experienced significant fluctuations in EPS growth over the period 2020-2023. In FY23, the EPS growth was negative 43.32%, following a negative growth of 23.36% in the previous year. This was mainly due to challenges in maintaining profitability or unfavourable market conditions. The PEG ratio assesses the relationship between a company's price-to-earnings ratio and its EPS growth rate, providing insights into the company's valuation relative to its growth potential. In FY23, the PEG ratio was -0.19, indicating a potentially undervalued stock relative to its EPS growth.

Company profile and future outlook

Roshan Packages was incorporated in Pakistan as a private company limited by shares on August 13, 2002, under the Companies Act, 2017. The company was converted into a public limited company on September 23, 2016, and was listed on the Pakistan Stock Exchange on February 28, 2017. It is principally engaged in the manufacture and sale of corrugated and flexible packaging materials. Roshan Packages is determined to deliver sustainable, customer-centric packaging solutions that empower businesses and contribute to Pakistan's economic growth.

Credit: INP-WealthPk