INP-WealthPk

Amir Khan

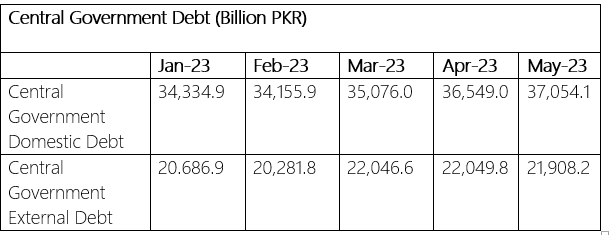

The central government accumulated a domestic debt of Rs 6 trillion during the first 11 months of FY23, with the total figure hitting a whooping Rs 37.054 trillion in May FY23, showing an increase of 19.2% compared to the corresponding month of the last year, reports WealthPK. According to a report by the State Bank of Pakistan, the central government’s external debt witnessed a 30.8% increase in the 11 months of FY23. The external debt rose by Rs5.161 trillion, reaching Rs21.908 trillion during this period.

SBP data report

Talking to WealthPK, Dr. Aliya Hashmi Khan, a member of the State Bank Monetary Policy Committee, expressed concern over this unprecedented growth in debt servicing, as it has created a significant imbalance for the FY24 budget. She further explained that the foreign debt servicing during the current fiscal year will exceed that of FY23. The budget document initially allocated Rs510.972 billion for FY23, but it was later revised upwards to Rs725.3 billion. As per the document, the country is expected to spend Rs872.219 billion on foreign debt servicing, indicating an increase from the original budgeted amount. Additionally, the central government’s overall debt has surged by Rs11.13 trillion or 23.3% to reach Rs58.962 trillion in the first 11 months of FY23.

“Moreover, the increasing debt burden on the government is straining its financial resources and impeding its ability to fulfil spending commitments. A significant portion of the government’s budget is now being allocated to servicing domestic debt, leaving limited funds for crucial expenditures such as education, healthcare, and infrastructure development,” she explained. She highlighted several factors that have contributed to the government’s increasing debt burden. One factor is the inefficient economic management, as the government has consistently run large fiscal deficits over the years, resulting in a rise in debt levels. Additionally, the government’s expenditure on non-developmental projects has been on the rise in recent years.

This includes factors such as the escalating cost of debt servicing, increased spending on defence, and higher subsidies. The mounting debt burden faced by the government poses a significant challenge that requires attention. If adequate measures are not taken to reduce the debt levels, a potential debt crisis could loom in future. She emphasized that a combination of measures must be implemented by the government to reduce the debt burden. However, it is crucial to recognize that there is no simple solution to this problem. The government will need to make difficult choices and take decisive actions to address the looming debt crisis.

Credit: INP-WealthPk