INP-WealthPk

Arooj Zulfiqar

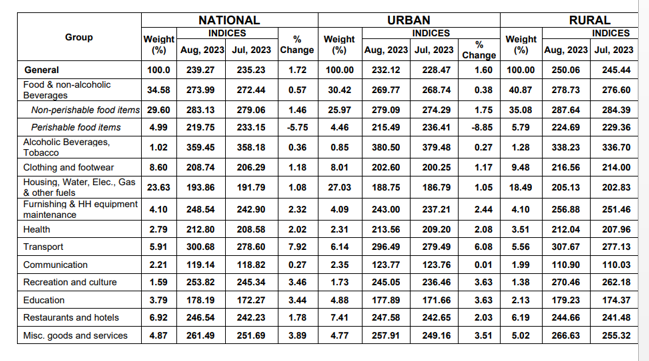

Pakistan has been facing a significant challenge due to the increasing inflation rate in recent months. The annual inflation rate has decreased for the third consecutive month to 27.4% in August 2023, which is the lowest since January, down from 28.3% in the previous month. However, despite this slowdown, the inflation rate remains high, posing significant challenges for both the government and citizens, reports WealthPk. The CPI National for the month of August 2023 increased by 1.72% over July 2023. The Urban CPI recorded an increase of 1.60%, while the Rural CPI recorded an increase of 1.88%.

(CPI) inflation for the month of August 2023

“The rising CPI inflation is a matter of grave concern that transcends economic statistics, deeply impacting the daily lives of the people. Several factors converge to contribute to the CPI ascent,” said Ali Kemal, Chief Economist at the SDG Support Unit, Ministry of Planning Development and Special Initiatives. “The soaring energy prices is one such reason. The surge in energy prices has a ripple effect, causing transportation costs to escalate and supply chains to falter, driving up prices across various sectors. This has significant consequences for businesses and consumers alike, impacting production costs and household budgets,” he said. “Another critical factor is the exchange rate dynamics.

The rupee depreciation has compounded the inflationary pressure. As the rupee weakens against major foreign currencies, the cost of imported goods rises, leading to higher prices for a wide array of products, from electronics to raw materials. “Furthermore, persistent budget deficits in Pakistan have led to increased borrowing. When such borrowing isn’t channeled into productive investments, it can amplify inflationary pressures by increasing the money supply,” said Ali Kemal. He stressed the importance of considering the socio-economic consequences of increase in the CPI inflation.

He said inflation, particularly when not accompanied by matching wage increases, erodes the purchasing power of households. This can lead to a lower standard of living and increased financial strain, he warned. “This situation calls for urgent measures to control inflation and provide relief to the common man bearing the brunt of these price hikes,” he said. However, he added, addressing the rising CPI inflation required a multi-pronged approach, encompassing prudent fiscal management, exchange rate stability, and measures to enhance productivity and alleviate the supply chain bottlenecks.

Credit: INP-WealthPk