INP-WealthPk

Muneeb ur Rehman

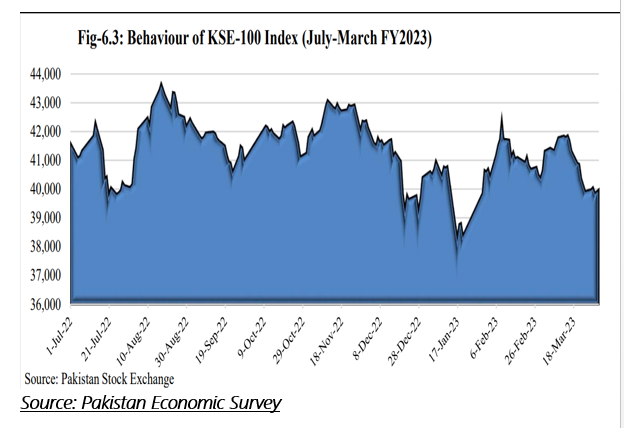

The equity market has been underperforming for quite some time due to a multitude of factors, warranting the implementation of a right set of policies to revitalize the equity market. The KSE-100 index experienced a drop in value from 41,540.8 points on June 30, 2022, to 40,000.8 points on March 31 this year. The index achieved its peak closing value of 43,676.6 on August 17, 2022, while its lowest point was recorded at 38,342.2 on January 17, 2023, says the Pakistan Economic Survey 2022-23. It merits mention that the KSE-100 serves as the benchmark index for the Pakistan Stock Exchange Limited (PSX).

Talking to the WealthPK, Javed Qureshi, a member of PSX Board of Directors, said the Securities and Exchange Commission of Pakistan (SECP) was actively working on regulatory reforms to enhance the governance and transparency of the equity market. In spite of these efforts, he said, there were policy options that escaped the government's focus. A potential area for government action is the expansion of company enlistment. "The government should offer incentives for privately-held companies to list on the stock exchange, thereby increasing the number of tradable stocks," he said. Besides the expansion of tradable stocks, collaboration with international exchanges and regulatory bodies can foster cross-border investment and trading, he added. The PSX exhibited a market capitalization of Rs6,956 billion during the FY2022-23, which subsequently decreased to Rs6,108 billion by the end of the fiscal year, indicating a reduction of 12.2%.

The average daily volume decreased to 204 million shares compared to 305 million shares during the same period last year (2021-22). Javed Qureshi attributed uncertainty on the political and economic fronts as the primary reason for the underperformance of the equity market. "Economic and political stability in the country where the equity market operates can significantly impact its soundness. Stable economic conditions, low inflation, and a favorable business environment in Pakistan can contribute to investor confidence." He suggested the government strengthen corporate governance standards for the listed companies and implement stricter rules on financial disclosure and audit standards. Coupled with the other steps, the government needs to invest in technology infrastructure in order to modernize trading systems and reduce downtime, he said.

Credit: INP-WealthPk