INP-WealthPk

Ayesha Mudassar

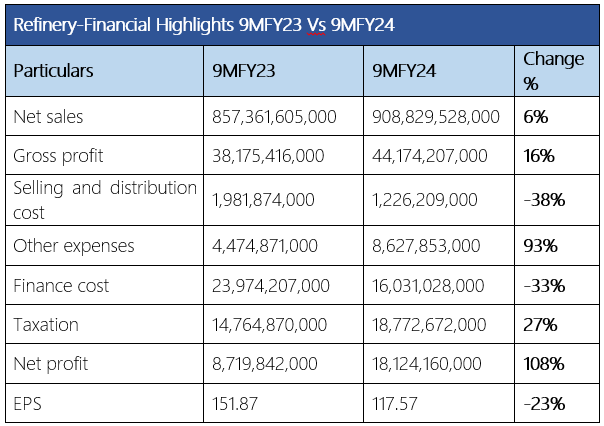

Pakistan's refinery sector recorded a notable 108% year-on-year (YoY) surge in the net profit during the nine months of the current fiscal year, clocking in at Rs18.1 billion compared to Rs8.7 billion in the same period last year, reports WealthPK. The profitability growth was largely led by Cnergyico PK Limited (CNERGY), which rebounded during the period with a net loss of Rs417.2 million compared to a loss of Rs10.4 billion during 9MFY23.

Meanwhile, Attock Refinery Limited (ATRL), the sector’s largest player, operated at a lower capacity mainly due to the implementation of an integrated refinery turnaround during February and March 2024. Accordingly, the ATRL's net profit fell 8% YoY in the nine months. Similarly, the escalating operating costs, particularly driven by higher utility tariffs and increased finance costs, forced the National Refinery Limited (NRL)’s earnings to remain negative in 9MFY24, with a loss that grew by 25% compared to 9MFY23. The Pakistan Refinery Limited (PRL) has seen significant growth in its bottom line with its earnings more than doubling for the nine months of FY24.

As per results compiled by WealthPK from the income statements of the four refinery companies, the sector saw a slight increase of 6% YoY in its sales, worth Rs908.8 billion as compared to Rs857.3 billion in 9MFY23. On the expense side, the sector observed a decrease in selling and distribution expenses by 38% YoY while other expenses rose by 93% YoY to clock in at Rs8.6 billion and Rs4.4 billion, respectively, during the review period. In addition, the industry’s finance cost dipped by 33% YoY and stood at Rs16.03 billion as compared to Rs23.9 billion in 9MFY23. On the tax front, the sector paid a significantly larger tax worth Rs18.7 billion against Rs14.7 billion paid in the corresponding period of last year, depicting a rise of 108% YoY.

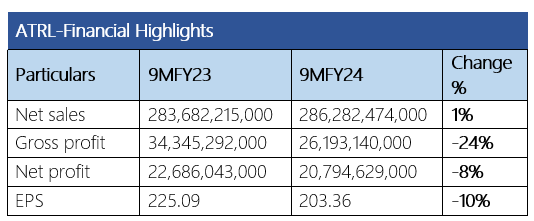

ATRL

The company unveiled its profit and loss statement for the nine months ending March 2024, wherein the net profit reduced to Rs20.7 billion compared to a profit of Rs22.6 billion in the same period last year. Going by the unconsolidated results, the company’s gross profit contracted by 24% YoY to Rs26.1 billion as compared to Rs34.3 billion in 9MFY23.

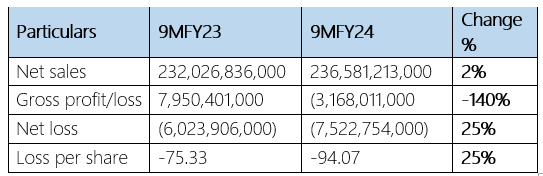

NRL

A gradual increase in product prices during the period resulted in a slight improvement in the company’s topline. However, the escalating operating costs particularly driven by higher utility tariffs and increased finance costs forced the company to record a loss after tax of Rs7.5 billion, resulting in a loss per share of Rs94.07 for the nine months ending March 31, 2024, as compared to a loss after tax of Rs6.02 billion, resulting in loss per share of Rs75.33 in the same period last year.

![]()

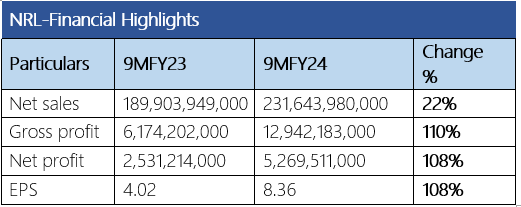

PRL

The company posted robust revenue and profit growth, as its net sales increased to Rs 231.6 billion in 9MFY24 compared to Rs189.9 billion in 9MFY23, thus posting a 22% growth. The rise in the company’s revenue was primarily due to the high petroleum product prices and record production of high-speed diesel and motor gasoline.

The company’s gross profit ballooned to Rs12.9 billion from Rs6.1 billion in 9MFY23. Furthermore, the net profit skyrocketed to Rs5.2 billion in 9MFY24 from Rs1.4 billion in 1HFY23, registering a whopping 108% growth.

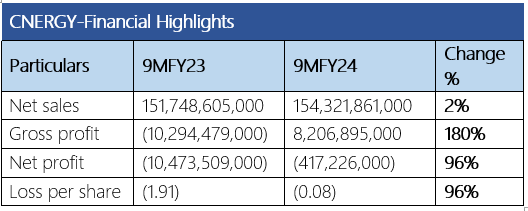

CNERGY

During the period under review, CNERGY was able to cut down its net loss by 96% to Rs417.2 million with a loss per share of Rs0.08. Moreover, the company recorded a gross profit of Rs8.2 billion in 9MFY24, against a gross loss of Rs10.2 billion during the same period last year as the company incurred huge inventory losses in 9MFY23 on account of severe flash flooding in the area surrounding the refinery.

Future outlook

The country’s economy and overall business climate are anticipated to remain challenging, characterized by the escalating costs of operations, high inflation, and unstable refining margins. However, these challenges can be overcome effectively through the implementation of appropriate policies and effective risk management.

Credit: INP-WealthPk