INP-WealthPk

Fakiha Tariq

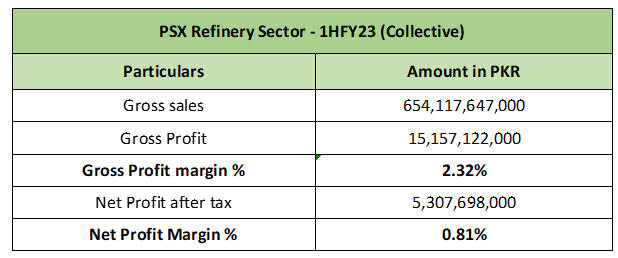

Pakistan’s refinery sector earned a gross profit of 2.32% and a net profit of 0.81% during the first half (July-December) of the current fiscal year (2022-23). Out of four listed refinery firms in Pakistan, two declared net loss during the first half of FY23, WealthPK reported. According to data from Pakistan Stock Exchange (PSX), refinery firms had to face inflated cost of production, which drastically caused gross profits to decline to its minimal level.

Collectively, the refinery sector grabbed a revenue of Rs654 billion. However, in terms of net production cost, its gross profit fell to Rs15 billion during 1HFY23. The refinery sector posted a net profit of Rs5.3 billion during the period under review.

The refinery sector on Pakistan Stock Exchange comprises four firms. With a market capitalisation of Rs18.6 billion, Cnergyico PK limited (CNERGY), previously known as BYCO Petroleum Pakistan Limited, is the largest firm in the refinery sector. Currently, Attock Refinery Limited (ATRL) is the second-largest firm which holds the market cap of Rs18.1 billion. However, National Refinery Limited (NRL) and Pakistan Refinery Limited (PRL), with market caps of Rs12.2 billion and Rs8.1 billion stand third and fourth in the refinery sector.

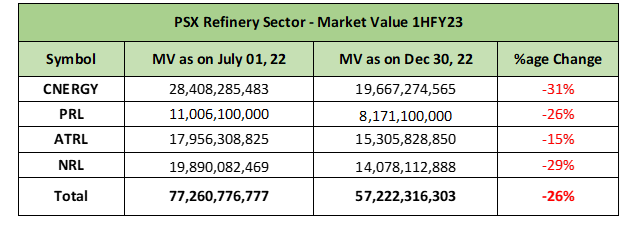

Refinery Sector – Market Value Review – 1HFY23

During the first half of the fiscal year 2022-23, the refinery sector lost 26% of its market value as a whole. The refinery sector overall plummeted from Rs77 billion to Rs57 billion during the period under review. CNERGY embraced the highest drop of 31% of its market value from Rs28 billion to Rs19 billion, followed by NRL, which showed an MV drop of 29%.

The PRL and ATRL dropped MVs by 26% and 15%, respectively, during the period under review.

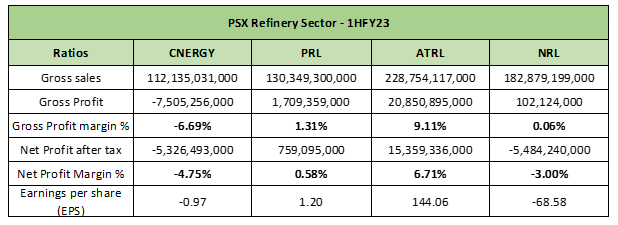

Refinery Sector – Profitability Review – 1HFY23

During the first half of FY23, ATRL overshowed its peer companies and posted the highest gross profit and net profit ratio of 9.11% and 6.71%, respectively.The ATRL posted the highest gross profit and net profit of Rs20 billion and Rs15 billion on its sales of Rs228 billion during 1HFY23. The earning per share (EPS) value posted by ATRL was Rs144.06 per share.

The PRL stood as the second profitable refinery firm during 1HFY23 by posting a gross profit ratio of 1.31% and a net profit ratio of 0.58%. The PRL posted semi-annual sales of Rs130 billion, and earned GP and NP of Rs1.7 billion and Rs759 million on it, respectively. The EPS value for PRL was reported to be Rs1.20 per share.

The NRL posted a gross profit ratio of 0.06% and a net loss ratio of 3% during 1HFY23. The NRL generated a gross profit of Rs102 million and faced a net loss of Rs5.4 billion on its sales of Rs182 billion during the period under review. The loss per share borne by the NRL shareholders was Rs68.58 per share. During the first half of FY23, CNERGY posted a gross loss and net loss of Rs7.5 billion and Rs5.3 billion, respectively, on its sales of Rs112 billion. CNERGY reported a loss per share of Rs0.97 during the period under review.

Credit: Independent News Pakistan-WealthPk