INP-WealthPk

Moaaz Manzoor

Pakistan’s economy has seen increased stability in the first quarter of Fiscal Year 2024-25 (Q1FY2025) due to robust revenue collection and gradual fiscal consolidation, reports WealthPK.

Notably, the fiscal deficit shrank to 0.7% of GDP

compared to 0.8% in the same period last year, reflecting the government’s efforts towards prudent fiscal management, shows the finance ministry’s monthly economic update and outlook for October 2024.

Source: https://www.finance.gov.pk/economic/economic_update_October_2024.pdf

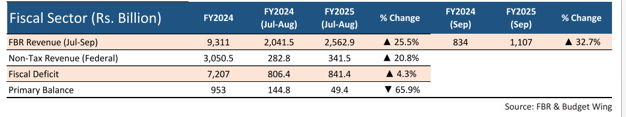

The federal revenues showed substantial growth, as the primary balance reported a surplus of 0.05% of GDP, reflecting positive fiscal adjustments. Tax collection by the Federal Board of Revenue (FBR) also performed exceptionally well; during July-September FY2025, net tax collection increased by 25.5%, reaching Rs2,562.9 billion compared to Rs2,041.5 billion in the same period last year. In September 2024 alone, tax collections surged by 32.7% to Rs1,107 billion from Rs834 billion in September 2023. The outlook for inflation is promising as well. The report anticipates a decline in inflation, predicting a range of 6-7% for October and a further decrease to 5.5-6.5% by November.

This improvement is attributed to the reduced global commodity prices and cumulative effects of fiscal consolidation. Dr. Nasir Iqbal, Acting Dean and Head of Macro Policy Lab at the Pakistan Institute of Development Economics (PIDE), noted that the shrinking fiscal deficit is indeed a positive signal. However, he cautioned that this fiscal improvement was partly due to Pakistan’s current slow economic growth rate, which stood at around 2%. Sluggish economic activities have contributed to lower deficit levels and a more balanced current account due to the restricted imports. Dr. Iqbal pointed out that Pakistan’s fiscal stability is heavily reliant on oil-based revenue sources, which, while beneficial in the short-term, could pose risks if the oil prices fluctuate.

The forthcoming months will be crucial for sustaining economic stability as Pakistan remains under the IMF program, which mandates careful management of expenditures and subsidies. Dr. Iqbal expected that rationalized fiscal measures, along with potential revenue from privatization efforts, would provide further stability. He also mentioned that Saudi Arabia, Qatar, and other Gulf countries have expressed investment interest — a development that can boost market optimism. Nevertheless, he underscored that the stability of Pakistan’s exchange rate remained pivotal. He stated that the currency’s future trajectory will significantly impact fiscal stability, especially if the exchange rate adjustments materialize as forecast. The October outlook portrays an optimistic, albeit cautious, view of Pakistan’s economic stability.

Fiscal adjustments and revenue growth, particularly in non-tax revenues from petroleum levies, have provided short-term relief, but reliance on volatile oil prices suggests that structural reforms are necessary for sustainable growth. Continued fiscal consolidation, foreign investment, and stabilization of the exchange rate will be vital in ensuring Pakistan’s economic resilience in the coming months. The government’s current measures indicate a potential path toward growth, yet the materialization of these efforts remains dependent on external factors, including global oil prices and ongoing IMF reforms.

Credit: INP-WealthPk