INP-WealthPk

Hifsa Raja

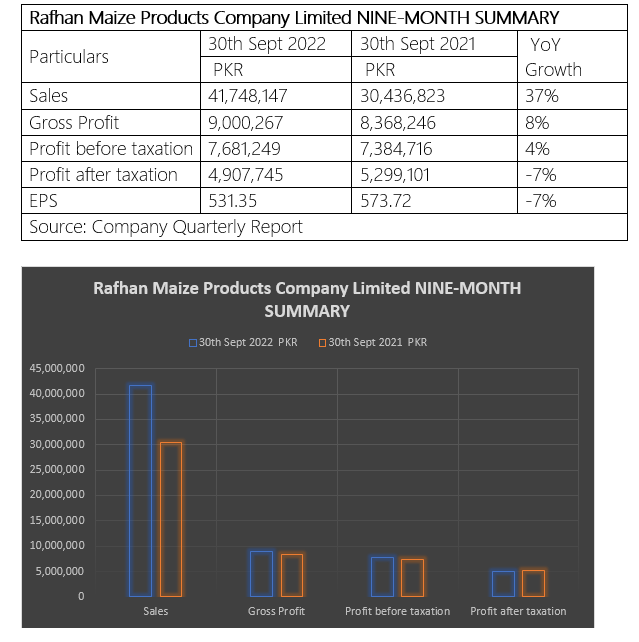

Rafhan Maize Products Company Limited’s sales increased by 37% to Rs41 million in the nine months ending September 30, 2022, compared with Rs30 million in the corresponding period of the previous year. The company’s Rs32 million in revenues was the cost of items sold which is subtracted from the sales, reports WealthPK. The gross profit increased by 8% to Rs9 million in CY22 from Rs8 million in CY21. The gross profit is the amount of money that’s left over after distribution expenses, administrative and operating expenses.

The profit before taxation during the nine months of CY22 was Rs7.6 million as against Rs7.3 million in the corresponding period of CY21. The profit after taxation shows a decrease in the profit by 7% from Rs4.9 million in the nine months of CY22 compared with Rs5.2 million profit over the corresponding period of CY21.

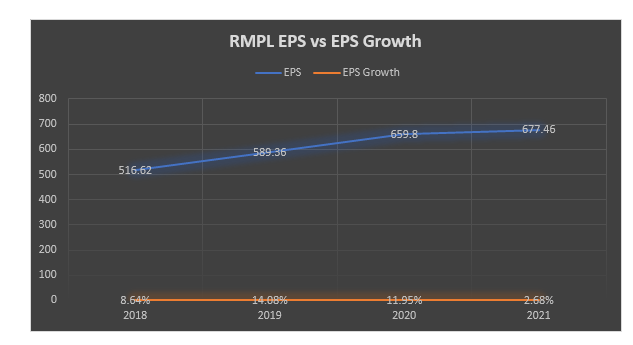

Earnings Growth Analysis:

The EPS has increased rapidly over the past four years, from 2018 to 2021. Growth-oriented investors can look for businesses with rapid growth rates. Even though the EPS growth must be greater than 20%, investing is still secure due to the continuous growth over time. There is consistency in the earnings per share of Rafhan Maize Products Company Limited, which is a good sign.

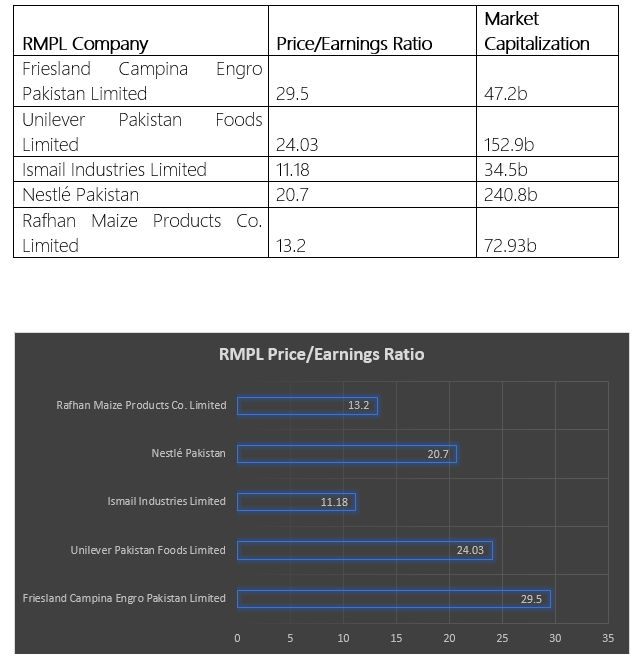

Industry Comparison:

Rafhan Maize Products Co. Limited’s competitors are Friesland Campina Engro Pakistan Limited, Unilever Pakistan Foods Limited, Ismail Industries Limited, and Nestlé Pakistan. Rafhan Maize Products Co. Limited’s PE ratio is 13.2, with a market capitalization of 72.93 billion. The company does not seem to be overvalued when compared with its competitors. The shares must be purchased by investors who want to make long-term investments.

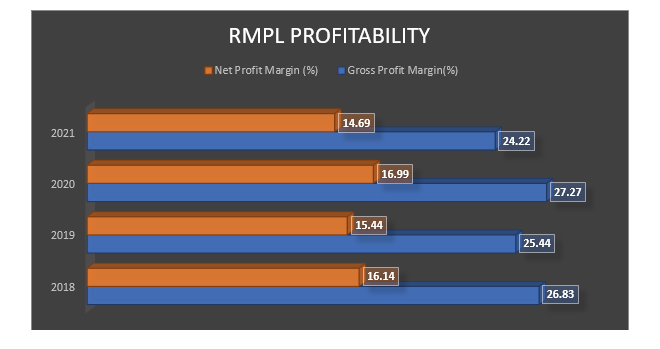

Profitability:

The company’s profitability is demonstrated by its net profit margin and gross profit margin. Profitability is comparatively low in 2021 compared with 2020. However, the values have been persistent over the past three years. Looking at the company’s past performance indicates that investing in the business would be a wise choice because of its consistency. Therefore, investing in such a company is a safe refuge for the investor. With a healthy market capitalization and producing a reasonable amount of profits, the company is neither overvalued nor undervalued.

Rafhan Maize Products Company Limited is a corn refiner company. Primary industrial starches, liquid glucose, dextrose, dextrin, and gluten meals are among the many industrial products that the company produces and sells using maize as the primary raw material. The company’s product line includes a variety of product categories that cater to different consumer groups in the textile, confectionery, processed food, dairy, ice cream, beverage, pharmaceutical, livestock, aquaculture, and many other industries.

Credit : Independent News Pakistan-WealthPk