INP-WealthPk

Ayesha Mudassar

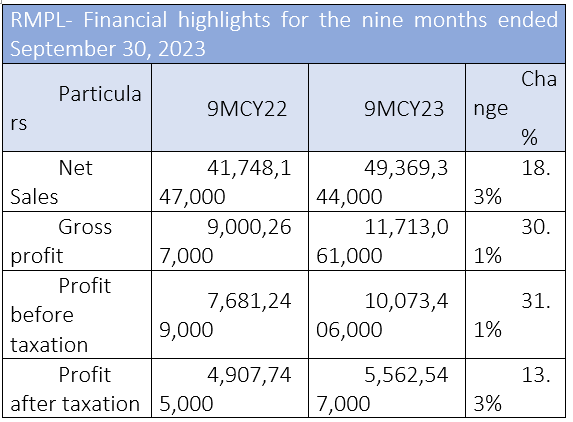

Rafhan Maize Products Company Limited (RMPL), a significant player in the food processing industry of Pakistan, has posted strong earnings in the first nine months of the ongoing calendar year 2023 (9MCY23). The company attributed its success to strategic initiatives, strong brand equity, and effective cost management practices. During the period, Rafhan Maize’s sales reached Rs49.3 billion, exhibiting a year-on-year (YoY) growth of 18.3% compared to the corresponding period of the earlier calendar year (CY22).

![]()

The company also reported a notable growth in gross profit, which amounted to Rs11.7 billion, indicating a 30.1% increase compared to the nine months of 2022. In addition to strong sales and gross profit growth, the company’s profit-before-tax for the period stood at Rs10.07 billion, representing a substantial year-on-year growth of 31.1% Moreover, the post-tax profit reached Rs5.5 billion, demonstrating a growth of 13.3% compared to the corresponding period of the previous calendar year. The rise in the post-tax profit underscores the company’s consistent profitability and effective tax management strategies. Consequently, the earnings per share (EPS) grew by 13.3% mainly on the back of gross profit improvement driven by a combination of pricing and cost efficiency measures.

Three-month summary

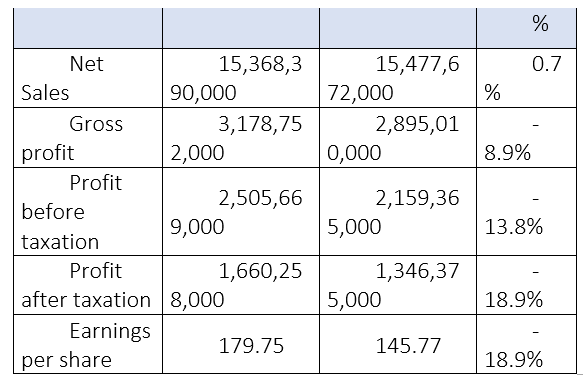

In the third quarter of 2023, Rafhan Maize’s revenue increased slightly by 0.7% year-on-year, reaching Rs15.4 billion. This was a marginal improvement from Rs15.3 billion in the same period of 2022.

However, the profit-before-tax and profit-after-tax declined during the period under review.

About the company

Ingredion Incorporated Chicago, US, holds the majority shares in Rafhan Maize Company Limited, which was incorporated in Pakistan. The company uses maize as the basic raw material to manufacture several industrial products, the principal ones being industrial starches, liquid glucose, dextrose, dextrin, and gluten meals.

Future outlook

Pakistan's economic and operating environment remains challenging. However, the management remains committed to creating long-term value for all stakeholders by leveraging global expertise, optimising operational efficiencies and meeting consumer demands with insights, innovations, and flexible pricing.

Credit: INP-WealthPk