INP-WealthPk

Ayesha Mudassar

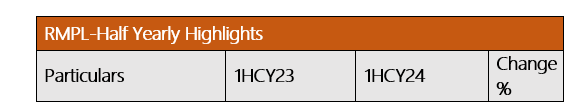

Rafhan Maize Products Company Limited (RMPL) experienced a 1% decline in net sales, 22% decrease in gross profit, and 12% reduction in net profit for the first half of the calendar year 2024 compared to the corresponding period of the last calendar, reports WealthPK. In the first half of CY24, the company reported net sales of Rs33.6 billion and a gross profit of Rs6.8 billion. The net profit stood at Rs3.7 billion compared to Rs4.2 billion in the corresponding period last year, resulting in the earnings per share (EPS) of Rs401.72 versus Rs456.47 in 1HCY23.

According to the unconsolidated results, the company's cost of sales increased by 7% year-on-year (YoY) to Rs26.7 billion, up from Rs25.07 billion in 1HCY23. On the expense front, the company observed a rise of 12% YoY in the distribution costs and a 13% YoY rise in the administrative expenses to Rs441.8 million and Rs748.3 million, respectively, during the review period. Additionally, the company experienced a significant rise in the finance cost, which increased by 183% YoY to Rs355.8 million compared to Rs125.6 million in 1HCY23.

Pattern of Shareholding

As of December 31, 2023, the company had a total of 9.2 million shares outstanding, held by 927 shareholders. Associated companies, undertakings, and related parties collectively owned 71% of the company's shares, followed by the local general public with a 19.7% stake. Directors, CEOs, their spouses, and minor children held approximately 6.4% of RMPL's shares, while the Insurance companies accounted for 1.4%. The remaining shares were distributed among the other categories of shareholders, each having less than 1%.

Historical Performance (2018-23)

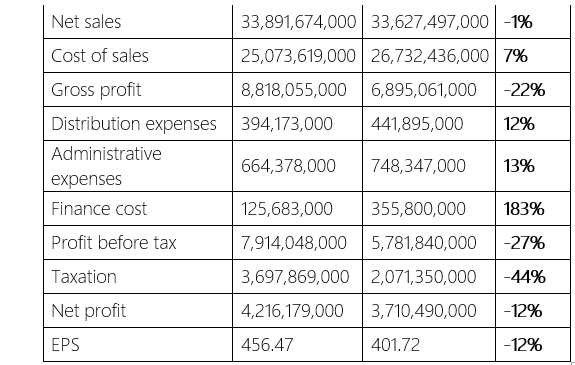

Rafhan Maize Products Company has demonstrated consistent growth in its topline since 2018. The bottom line also followed an upward trajectory except for a decline in 2022. Margins have been on a downward trend since 2018, but there was a notable increase in 2020, reaching their peak during that year. In 2019, the company recorded its highest revenue growth of 19%, driven by robust local and export sales. However, this revenue growth did not translate into improved margins due to the elevated production costs.

In 2020, RMPL faced a significant decline in volumetric sales due to Covid-19-related lockdowns and cancellation of export orders. However, lower sales volumes were somewhat mitigated by price increases, which only fetched a 2% YoY topline growth. Despite this, the bottom line grew by 12% YoY, with the NP margin rising to 17% compared to 15% in 2019. In 2021, the company's top line grew by 19% YoY, supported by higher prices and increased sales volume. However, high production costs continued to pressure the GP margin, which stood at 24% for the year. Consequently, the NP margin declined to 15%, down from 17% in 2020.

In 2022, RMPL achieved 38% YoY growth in sales, driven by an improved sales mix, enhanced operational leverage, and innovative customer solutions. Despite this growth, the company's GP margin fell to a five-year low of 20% due to elevated cost of sales. As a result, the bottom line decreased by 1% YoY, with the NP margin settling at 11% for the year. In 2023, the company's top line witnessed an 11% YoY rise, reaching Rs65.4 billion. This growth was mainly driven by both export and local sales. The gross profit exhibited a YoY growth of 17% during the year. Consequently, the company's net profit rose by 12% to Rs6.9 billion, resulting in the earnings per share of Rs748.43.

About the company

Rafhan Maize Products Company Limited started its operations in Pakistan as a corn refining industry in 1953. Since its inception, the company has expanded to become one of the largest agro-based industries in the country. RMPL specializes in producing a diverse range of food ingredients and industrial products, with maize as its primary raw material.

Credit: INP-WealthPk