INP-WealthPk

Hifsa Raja

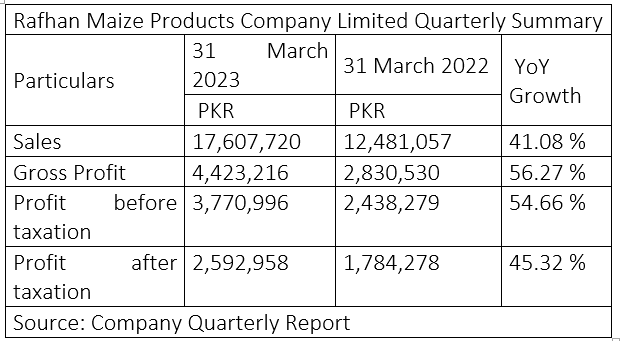

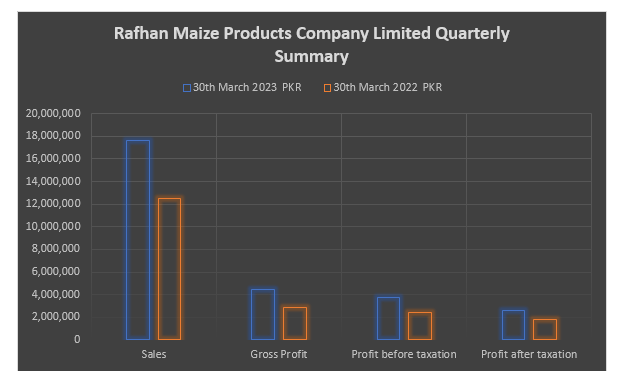

Rafhan Maize Products Company Limited’s sales increased by 41.08% to Rs17 billion in the three months ending March 31, 2023, from Rs12 billion over the corresponding period of the previous year. The gross profit increased by 56.27% to Rs4.4 billion in 1QCY23 from Rs2.8 billion in 1QCY22. The gross profit is the amount of money that's left over after accounting for distribution, administrative and operating expenses. The profit-before-taxation during the three-month period of CY23 jumped 54% to Rs3.7 billion from Rs2.4 billion over the corresponding period of CY22. The profit-after-taxation increased by 45.32% to Rs2.5 billion in three months of CY23 from Rs1.7 billion over the corresponding period of CY22, reports WealthPK.

These financial results not only highlight Rafhan Maize Products' exceptional performance in the quarter but also paint a promising picture for its future prospects. The company's ability to achieve robust growth in both revenue and profitability amidst a dynamic business landscape demonstrates its strategic agility and prudent management. As Rafhan continues to navigate the evolving market conditions, its consistent growth trajectory and ability to capitalise on market opportunities position it favourably for sustained success and shareholder value.

Performance in 2022

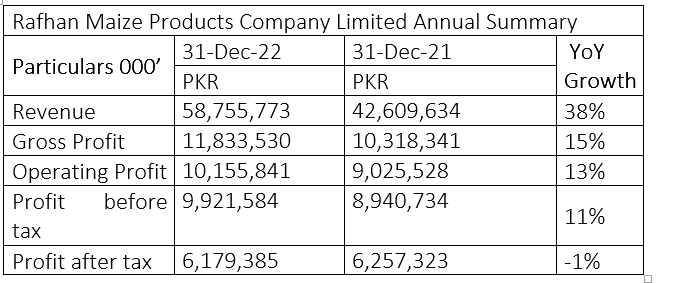

In the calendar year 2022, the company reported an increase in net sales revenue, reaching Rs58 billion compared to Rs42 billion in the previous year, indicating a growth of 38%. The gross profit increased 15% to Rs11 billion from previous year's Rs10 billion. The operating profit increased 13% to Rs10 billion from the previous year's Rs9 billion.

The company’s profit-before-tax increased 11% to Rs9.9 billion in CY22 from the previous year's Rs8.9 billion. However, the profit-after-tax inched lower to Rs6.1 billion in CY22 from Rs6.2 billion in CY21, posting negative growth of 1%. Rafhan Maize Products' annual summary showcases its ability to generate impressive revenue growth and maintain positive profitability indicators.

While the slight dip in net profit warrants attention, the company's strong revenue and gross profit performance, coupled with healthy operating and pre-tax profits, demonstrate its resilience and ability to navigate market challenges. As Rafhan continues to innovate and adapt, its ability to capitalise on market trends while addressing profitability concerns will be instrumental in sustaining its position in the competitive food industry.

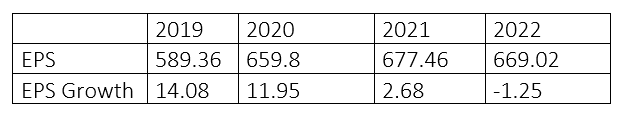

Earnings Growth Analysis

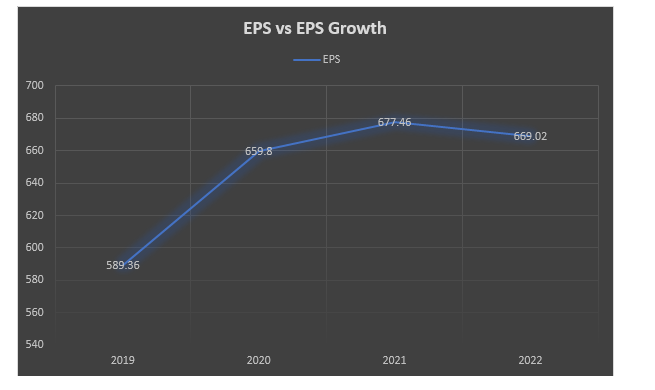

The EPS has been increasing rapidly over the past three years, from 2019 to 2021. Growth-oriented investors could look for businesses with rapid growth rates. In 2022, however, there was a slight decline, but there was consistency in the earnings per share of Rafhan Maize Products, which is a good sign.

Rafhan Maize Products’ ability to leverage its strengths and effectively mitigate challenges will determine its trajectory in the coming years. As the company continues to innovate and optimise its operations, investors and stakeholders will closely watch how its financial performance evolves and what steps are taken to sustain and improve EPS growth.

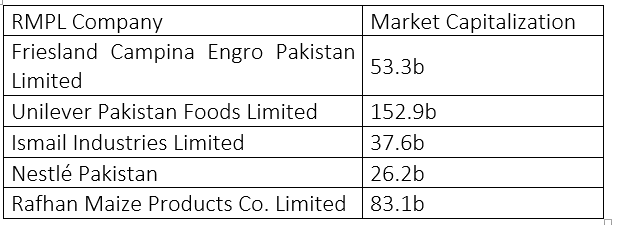

Industry Comparison

The companies that have been considered the competitors of Rafhan Maize Products are FrieslandCampina Engro Pakistan Limited, Unilever Pakistan Foods Limited, Ismail Industries Limited and Nestlé Pakistan. Rafhan Maize Products’ market capitalisation is Rs83.1 billion, which is the second largest after Unilever Pakistan Foods Limited’s Rs152.9 billion.

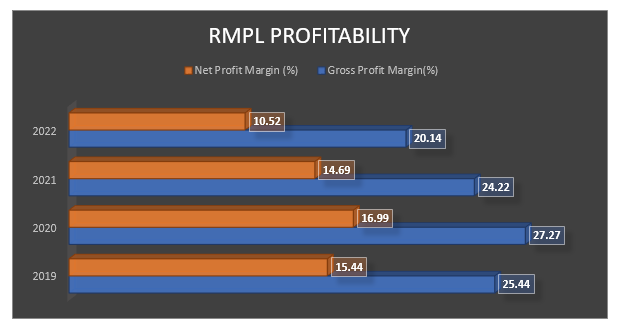

Profitability

Rafhan’s profitability is demonstrated by its net profit margin and gross profit margin. Profitability is comparatively low in 2021 as compared to 2020. However, the values have been persistent over the past four years. In 2019, the gross profit margin was recorded at 25.44%. This indicated that approximately 25.44% of the revenue was retained as gross profit after accounting for production costs.

In the same year, Rafhan reported a net profit margin of 15.44% In 2020, there was a noticeable improvement in the gross profit margin, reaching 27.27%. The net profit margin improved to 16.99% in 2020. However, in 2021, the gross profit margin decreased to 24.22%. The net profit margin also decreased to 14.69%. In 2022, the gross profit margin further decreased to 20.14% and net profit margin to 10.52%.

The fluctuating trends in both the gross profit margin and net profit margin indicate the dynamic nature of Rafhan Maize Products Company Limited's financial performance over the four years. While the company experienced periods of improved profitability, there were also challenges that impacted its margins.

The economic and business situation in the upcoming months remains uncertain and challenging, so the company will focus on increasing volumes, implementing strict cost controls, optimising processes, rationalising prices, and efficiently managing working capital. Despite the challenges, the company remains committed to achieving strategic expansion, improving shareholder value, and striving for excellence in all aspects.

Company Profile

Rafhan Maize Products Co. Limited produces and sells food ingredients and industrial products in Pakistan and internationally. The company primarily offers industrial starches, liquid glucose, dextrose, dextrin, and gluten meals. It serves various industries, including food and beverage, pharmaceuticals, paper, corrugated, textile, and brewing industries.

Its product line includes a variety of product categories that cater to different consumer groups in the textile, confectionery, processed food, dairy, ice cream, beverage, pharmaceutical, livestock, aquaculture, and many other industries. The company was founded in 1953 and is headquartered in Faisalabad. Rafhan Maize Products Co. Limited is a subsidiary of Ingredion Incorporated.

Credit: INP-WealthPk