INP-WealthPk

Qudsia Bano

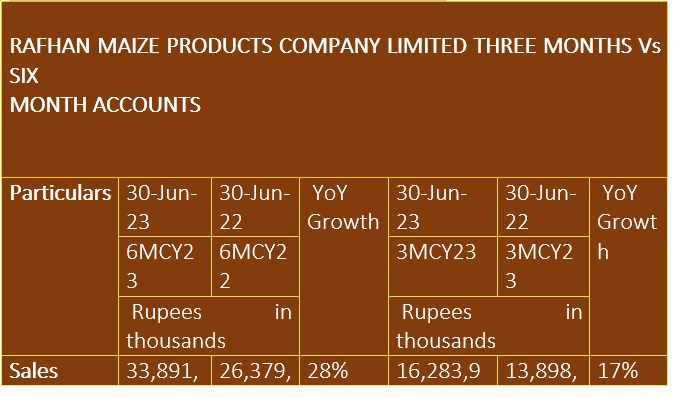

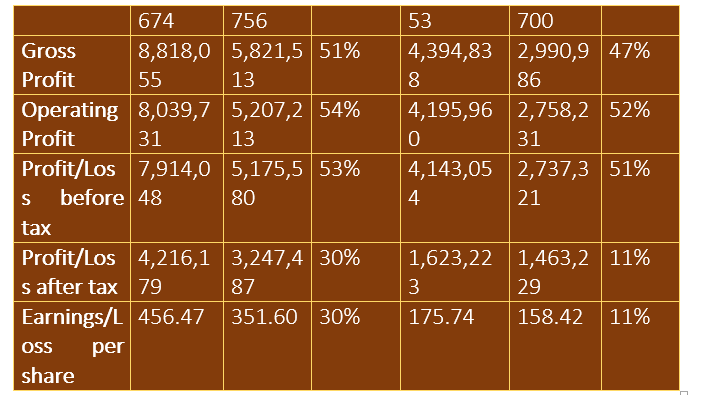

Rafhan Maize Products Company Limited, a significant player in the food processing industry, has released its financial results for the six-month and three-month periods ending on June 30, 2023. The company's performance during these periods underscores its consistent growth trajectory and ability to adapt to evolving market dynamics.

Six months analysis

In the first half of the year ending on June 30, 2023, Rafhan Maize Products Company demonstrated remarkable financial performance across various critical metrics, reaffirming its position as a resilient and growth-oriented entity. The sales revenue for the six months amounted to Rs33.89 billion, reflecting a substantial year-on-year growth of 28%. This growth underscores the company's continued market demand and its successful strategies to capture consumer preferences. The gross profit for the six months reached Rs8.82 billion, showcasing a commendable 51% increase compared to the same period last year. This growth highlights the company's efficient cost management and revenue generation capabilities. Rafhan Maize's operating profit for the first half of the year stood at Rs8.04 billion, marking a remarkable year-on-year growth of 54%.

This growth signifies the company's adeptness in managing operational efficiency and enhancing its profitability. The profit-before-tax for the six months amounted to Rs7.91 billion, reflecting a significant 53% increase from the same period last year. This growth underscores the company's ability to capitalise on market opportunities and effectively manage its financials. The profit-after-tax for the six months reached Rs4.22 billion, demonstrating a 30% year-on-year increase. This growth in profitability highlights the company's consistency in delivering positive financial results to its stakeholders. The earnings per share (EPS) for the six months stood at Rs456.47, reflecting a commendable 30% growth compared to the corresponding period last year. This growth indicates that the company's earnings available to shareholders have increased substantially on a per-share basis.

During the second quarter ending on June 30, 2023, Rafhan Maize's sales revenue surged to Rs16.28 billion, marking an impressive year-on-year growth of 17%. This growth is attributed to the company's effective market strategies and its offerings that continue to resonate with consumers. The gross profit for the quarter reached Rs4.39 billion, reflecting a robust 47% increase compared to the same period last year. This growth signifies the company's ability to effectively manage its production costs while generating healthy margins. Rafhan Maize's operating profit for the quarter amounted to Rs4.20 billion, showcasing a remarkable year-on-year growth of 52%.

This growth indicates the company's efficient management of its operational expenses and a focus on optimising its core business processes. The profit-before-tax for the three months stood at Rs4.14 billion, demonstrating a notable year-on-year increase of 51%. This surge underscores the company's effective financial management and its ability to capture market opportunities. The profit-after-tax for the quarter reached Rs1.62 billion, reflecting an 11% increase from the same period last year. While the growth rate is moderate, it still showcases the company's commitment to consistent profitability even in a competitive market environment. The EPS for the quarter stood at Rs175.74, marking an 11% increase compared to the corresponding period last year.

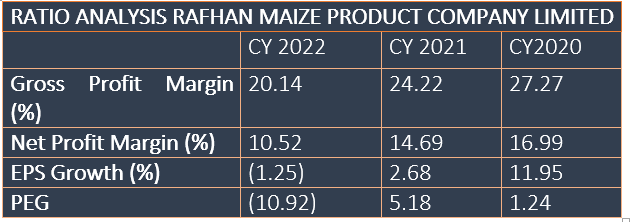

Rafhan Maize Products Company Limited's financial performance can be better understood through a comprehensive analysis of key financial ratios over the past three years.

Gross profit margin

The gross profit margin, which indicates the company's ability to generate profit from its core operations, has experienced a gradual decline over the past three years. In CY22, the gross profit margin was 20.14%, down from 24.22% in CY21 and 27.27% in CY20. This decline may suggest that the company faced challenges in managing its production costs relative to its revenue, leading to reduced profitability at the gross level.

Net profit margin

The net profit margin, a crucial indicator of a company's efficiency in converting revenue into profit, has also shown a downward trend. In CY22, the net profit margin was 10.52%, compared to 14.69% in CY21 and 16.99% in CY20. This decline could signify increased operational expenses, potentially due to factors such as rising input costs or less effective cost management strategies.

EPS growth

The growth in EPS reflects the company's ability to increase shareholder value through its profitability. In CY22, the EPS growth was negative at -1.25%. This follows the positive growth of 2.68% in CY21 and a substantial growth of 11.95% in CY20. The negative growth in CY22 indicates that the company's earnings available to shareholders decreased during that period, potentially due to various external or internal factors affecting its performance.

PEG ratio

The Price/Earnings to Growth (PEG) ratio is a measure of a company's valuation relative to its expected earnings growth. A PEG ratio below 1 is generally considered favourable. In this case, the PEG ratio has shown significant fluctuations. In CY22, the PEG ratio was -10.92, indicating that the company's stock price might have been relatively undervalued compared to its EPS growth rate. In contrast, the PEG ratio was 5.18 in CY21 and 1.24 in CY20, potentially suggesting that the stock might have been overvalued relative to the expected earnings growth in those years.

About the company

Ingredion Incorporated Chicago, US, holds the majority shares in Rafhan Maize Products Company Limited, which was incorporated in Pakistan. The company uses maize as the basic raw material to manufacture and sell a number of industrial products, the principal ones being industrial starches, liquid glucose, dextrose, dextrin, and gluten meals.

Credit: INP-WealthPk