INP-WealthPk

Arooj Zulfiqar

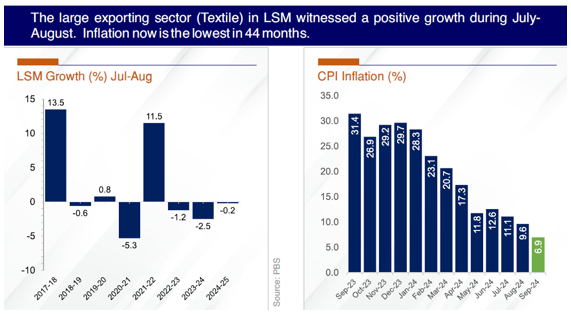

Pakistan’s economy has shown a robust recovery trajectory during the first quarter of FY2025, with improvements across fiscal, external, and industrial sectors. The country has successfully maintained macroeconomic stability, bolstered by a US$1.03 billion IMF EFF disbursement and boosted confidence following the Shanghai Cooperation Organization (SCO) summit in Pakistan.According to the data released by the Ministry of Finance in a monthly outlook for October, large-scale manufacturing (LSM) recorded substantial growth on a month-on-month (MoM) basis, rising by 4.7% in August 2024, signalling economic revival. While the overall LSM dipped slightly by 0.2% in the first two months of FY2025, it fared better compared to a 2.5% contraction

in the same period last year. Key sectors driving growth included textiles, food and beverages, apparel, petroleum products, chemicals, automobiles, and paper. As per the report, the automobile industry also reported a notable growth, with vehicle production and sales increasing by 18.1% and 17%, respectively. Cement dispatches, a critical economic indicator, reached 10.3 million tonnes during the quarter, marking a 22.2% increase in exports. Inflation has seen a consistent decline, with the Consumer Price Index (CPI) inflation recorded at a 44-month low of 6.9% year-on-year (YoY) in September 2024, a marked decrease from 31.4% in September 2023. On a MoM basis, the CPI fell by 0.5% in September, compared to a 2% increase in the same month last year. Key inflation drivers included food, housing, healthcare, clothing, and education costs.

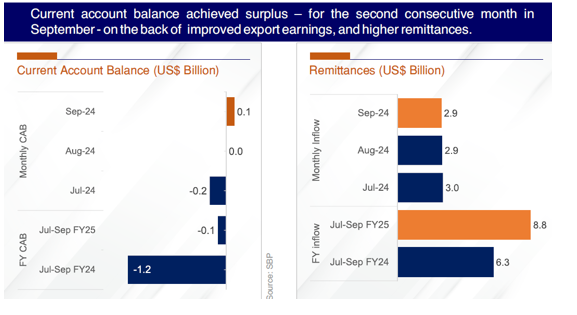

According to the data, the fiscal sector demonstrated resilience, with net federal revenue increasing by 20.8% to Rs986.7 billion during Jul-Aug FY2025, compared to Rs816.6 billion in the previous year. The expenditures rose by 3.1%, while a slight reduction in policy rates led to a 6.3% decrease in markup expenditures, bringing the fiscal deficit to 0.7% of GDP. The Federal Board of Revenue’s (FBR) tax collection grew by 25.5% in the first quarter, reaching Rs2,562.9 billion. The external account balance has shown signs of improvement, driven by higher exports and record-high remittances. Goods exports rose by 7.8% to $7.5 billion, although imports increased by 15.7% to $14.2 billion, resulting in a trade deficit of $6.7 billion. However, the current account recorded a surplus for the second consecutive month in September.

Notably, Pakistan’s export growth was seen in rice (77.6%), fruits and vegetables (17.4%), knitwear (14.1%), and garments (23.2%), while petroleum, machinery, fertilizers, and cotton dominated imports. Service exports increased by 5.9%, while IT exports grew by 33.5% to $0.9 billion. Foreign Direct Investment (FDI) rose by 48.2% to $771 million, with significant inflows from China and the UK. Workers’ remittances reached a record high of $8.8 billion, a 39% YoY increase, with the largest share from Saudi Arabia (24.5%). Pakistan’s liquid foreign exchange reserves totaled $16.0 billion as of October 18, 2024, supported by the State Bank of Pakistan’s $11.0 billion reserves. As fiscal and external stability gains momentum, the economy is poised for sustainable growth in the coming months, supported by key financial inflows, industrial recovery, and a favorable macroeconomic outlook.

Credit: INP-WealthPk