INP-WealthPk

Shams ul Nisa

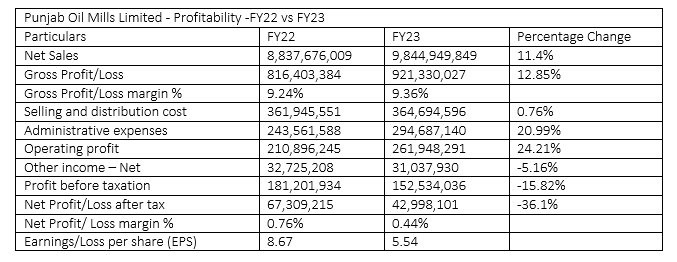

Punjab Oil Mills Limited announced its financial results for the fiscal year ending on June 30, 2023, posting an 11.4% increase in net sales to Rs9.84 billion compared to Rs8.83 billion recorded in the previous year. The company attributed this rise to the increase in the selling process induced by the higher costs of raw materials and currency devaluation. The company posted a gross profit of Rs921.33 million in FY23, rising by 12.85% compared to Rs816.4 million in FY22. Consequently, the gross margin increased marginally to 9.36% in FY23 from 9.24% in FY22.

The company also announced a 0.76% rise in selling and distributive expenses. Similarly, the administrative expenses spiked by 20.99% to Rs294.68 million in FY23 from Rs243.56 million in FY22. The increase in costs was because of rising energy costs.

According to the company’s results for FY23, it posted an operating profit of Rs261.94 million, which was 24.21% higher than Rs210.89 million in FY22. However, the other income dropped by 5.16% in FY23, reaching Rs31.03 million. The profit-before-tax decreased by 15.82% to Rs152.53 million in FY23 from Rs181.20 million in FY22. Punjab Oil Mills Limited registered a profit-after-tax of Rs42.99 million during FY23 as against a net profit of Rs67.3 million during FY22, posting a decline of 36.1%.

Hence, the net profit margin edged lower to 0.44% in FY23 from 0.76% in FY22. The company reported earnings per share of Rs5.54 in FY23 compared to Rs8.67 in FY22.

Profitability trend analysis

The sales of the company increased from Rs4.95 billion in 2018 to Rs9.84 billion in 2023, with only one dip in 2020 compared to the previous year. This shows that the company expanded its production over time.

![]()

The gross profit varied over the years ranging from Rs739.6 million in 2018 to Rs921.3 million in 2023. In 2023, the company registered the highest operating profit of Rs261.9 million and the lowest of Rs65.58 million in 2021. However, the net profit dropped from Rs69.15 million in 2018 to Rs42.99 million in 2023. The company registered the highest net profit of Rs107.37 million in 2019, and a net loss of Rs16.96 million in 2021.

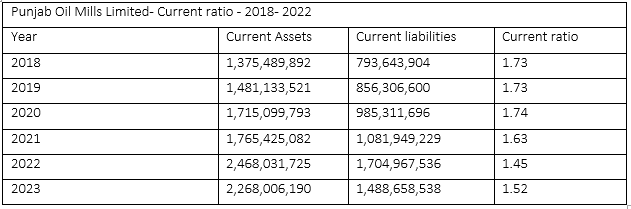

Current ratio analysis

The ability of a company to pay its short-term liabilities with its current assets is measured by the current ratio. Punjab Oil Mills maintained a stable liquidity position over time as its current ratio stayed above 1.2.

Credit: INP-WealthPk