INP-WealthPk

Fakiha Tariq

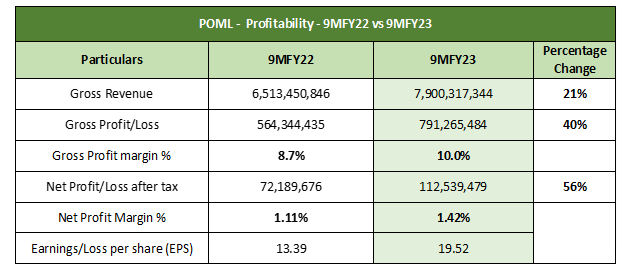

Punjab Oil Mills Limited (POML) saw its gross profit surge by a stunning 40% and net profit by a whopping 56% in the first nine months (July-March) of the ongoing fiscal year 2022-23 compared to the corresponding period of the last fiscal year, reports WealthPK. POML made gross sales of Rs7.90 billion, and earned a gross profit of Rs791 million, thus coming up with the gross profit ratio of 10.0% in 9MFY23. The company posted a nine-monthly net profit and a net profit ratio of Rs112 million and 1.42%, respectively. POML posted earnings per share of Rs19.52 during the period under review.

In comparison to the nine-month financials of FY22, the leading oil mill of Pakistan raised revenues by 21% from Rs6.51 billion to Rs7.90 billion in 9MFY23. Likewise, the gross profit increased by 40% in 9MFY23 from Rs564 million in 9MFY22. POML’s net profit of Rs72 million in 9MFY22 surged by 56% in 9MFY23. Listed on Pakistan Stock Exchange (PSX) with the symbol ‘POML’, the company is the biggest firm in the vanaspati and allied industries sector with the market capitalisation of Rs768.7 million.

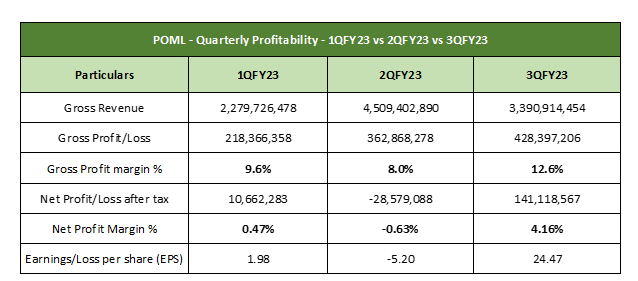

POML – Quarterly Review – 9MFY23

Review of quarter-based profitability reveals that POML enjoyed gross profits in the first three quarters of FY23, consecutively. However, the company bore a net loss in the second quarter of FY23. In the first quarter (July-September) of FY23, POML posted gross revenues of Rs2.2 billion and a gross profit of Rs218 million. The company posted a net profit of Rs10 million. Therefore, the gross and net profit ratios turned out to be 9.6% and 0.47%, respectively. In 1QFY23, the company reported the earnings per share of Rs1.98.

In the second quarter (October-December), the vanaspati oil firm posted a gross revenue of Rs4.5 billion – the highest of the ongoing fiscal – and a gross profit of Rs362 million. However, the company posted a net loss of Rs28 million. Therefore, the gross profit and net loss ratios were recorded at 8.0% and 0.63%, respectively. In 2QFY23, the company reported a loss per share of Rs5.20.

In the most recent quarter (January-March) of FY23, the company posted gross revenues of Rs3.3 billion and a gross profit of Rs428 million. The company posted a net profit of Rs141 million. Therefore, the gross and net profit margins were calculated at 12.6% and 4.16%, respectively. In 3QFY23, the company posted the earnings per share of Rs24.47.

Credit: Independent News Pakistan-WealthPk