INP-WealthPk

Shams ul Nisa

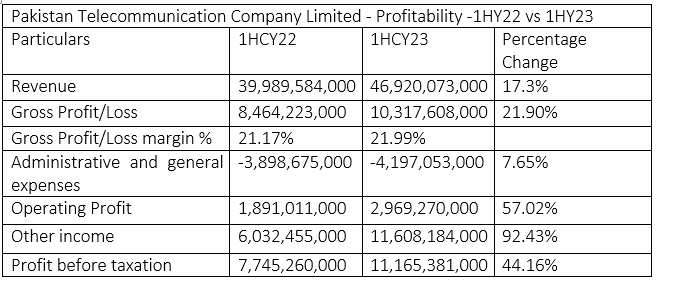

Pakistan Telecommunication Company Limited's (PTCL) revenue clocked in at Rs46.9 billion during the first half of the ongoing calendar year 2023, which is 17.3% up from Rs39.98 billion over the same period last year. The company attributed this hike in revenue to the expansion in carrier and wholesale, broadband businesses, mobile data, business solutions and banking services.

According to the company's financial results for the period ended June 30, 2023, it posted a gross profit of Rs10.3 billion compared to Rs8.46 billion over the same period last year, reporting a growth of 21.90%. PTCL's gross profit margin moved up marginally to 21.99% in 1HCY23 from 21.17% in 1HCY22.

The administrative and general expenses climbed up by 7.65%, clocking in at Rs4.19 billion during 1HCY23 compared to Rs3.89 billion in 1HCY22. This rise is because of the escalating energy and fuel prices, delay in opening letters of credit for import of necessary raw materials, devaluation of the currency, rise in interest rates and imposition of the super tax. Despite a hike in expenses, the company registered a considerable increase in operating profit, which jumped to Rs2.96 billion in 1HCY23, posting a 57.02% increase from Rs1.89 billion in 1HCY22. PTCL registered a profit-before-tax of Rs11.16 billion during the period under review compared to Rs7.74 billion in the same period last year, marking a notable growth of 44.16%.

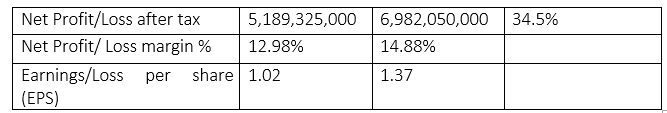

This was because the company's other income soared by a massive 92.43% to Rs11.6 billion in 1HCY23 from Rs6.03 billion in 1HCY22. The net profit climbed by 34.5% to Rs6.98 billion, and the net profit margin clocked in at 14.88% versus 12.98% in 1HCY22. This increase in net profit was attributed to the rise in non-operational income because of gains from both sales of obsolete assets and foreign currency-denominated receivables. Earnings per share also grew from Rs1.02 in 1HCY22 to Rs1.37 in 1HCY23.

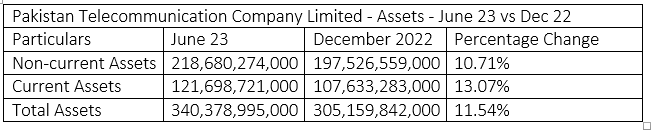

PTCL's non-current assets, such as property and equipment, long-term investments, long-term loans and advances, and intangible assets, climbed to Rs218.68 billion in June 2023, up 10.71% from Rs197.52 billion in December 2022. Similarly, the company's current assets, which include stores and spares, contract costs, trade debts and contract assets, loans and advances, and cash and bank balances, grew by 13.07% to Rs121.69 billion in June 2023 compared to Rs107.63 billion in December 2022. As a result, the company's total assets rose to Rs340 billion in June 2023 from Rs305 billion in December 2022, marking a growth of 11.54%.

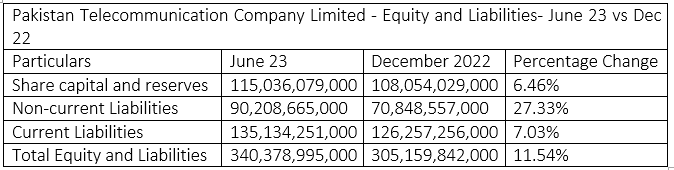

Equity and liabilities analysis

In June 2023, PTCL's share capital and reserves stood at Rs115.03 billion, 6.46% higher than Rs108.05 billion in December 2022. The yearly report of the company showed non-current liabilities standing at Rs90.2 billion in June 2023, up 27.33% from Rs70.8 billion in December 2022. The company booked a 7.03% increase in current liabilities, which rose to Rs135.13 billion in June 2023 from Rs126.25 billion in December 2022. Hence, the company recorded total equity and liabilities of Rs340.37 billion in June 2023, higher by 11.54% than Rs305.15 billion in December 2022.

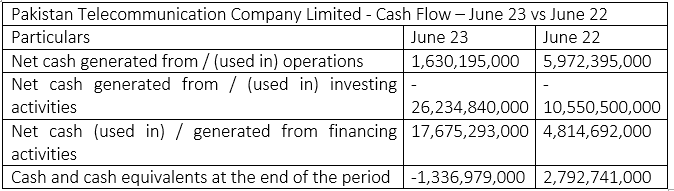

Cash flow analysis

PTCL generated net cash of Rs1.63 billion from operations in June 2023, less than Rs5.97 billion generated in June 2022. In June 2023 and June 2022, the company used cash of Rs26.23 billion and Rs10.55 billion, respectively, in investing activities. This means that the company invested in purchasing property, plant and equipment. From financing activities, the company generated Rs17.67 billion in June 2023, which was much greater than Rs4.8 billion generated in June 2022. Whereas, the company saw a massive decline in cash and cash equivalent at the end of the period from Rs2.79 billion in June 2022 to a negative value of Rs1.33 billion in June 2023.

Credit: INP-WealthPk