INP-WealthPk

Irfan Ahmed

Pakistan's stock market (PSX) commenced on a positive note last week as the country was hoping to get $13 billion financing -- $9 billion from China and $4 billion from Saudi Arabia.

On the other hand, the PKR was slightly down against the greenback, closing at Rs221.95 (down by 0.1% week-on-week). In addition to this, State Bank of Pakistan (SBP) reserves went down to $7.95 billion last week, down by $956 billion, compared to $8.91 billion on October 28, 2022.

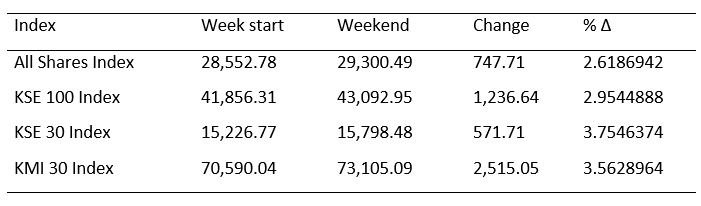

According to WealthPK analysis, the market gained 1,236.64 points throughout the week, closing at 43,092.95 points (up by 2.95%) on a WoW basis. All-Share Index also increased by 747.71 points or 2.62%, the Karachi Stock Exchange (KSE) 30 Index rushed by 571.71 points or 3.75%, and the KMI 30 Index increased by 2,515.05 points or 3.56% on a weekly basis.

According to PSX data, foreigners’ selling continued during this week, clocking in at $4.7 million compared to a net sell of $1.6 million last week.

Source: PSX/WealthPK research

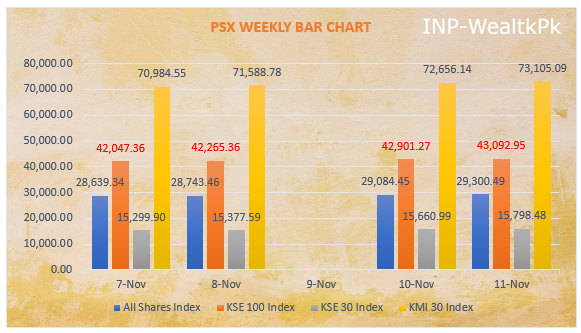

In response to the news of expected financial packages from KSA and China on Monday, November 7, the PSX opened the week with a boost. The KSE 100 Index gained 191.05 points, a positive change of 0.46%, closing at 42,047.36 points against 41,856.31 points on the previous working day. The bullish trend continued on Tuesday, November 8, gaining 218 points, a positive change of 0.52%, closing at 42,265.36 points.

The PSX on Thursday, November 10, witnessed positive sentiment from investors following the announcement of inflows from a multilateral institution, driving the benchmark KSE 100 Index upwards over 600 points. The 100 Index gained 635.91 points, a positive change of 1.50%, closing at 42,901.27 points.

The stock exchange extended its rally for the fourth consecutive session on Friday, November 11, as investor sentiment revived over expectations of foreign aid from friendly nations, and they made fresh investments. By the end of the session, the KSE-100 Index was up 191.68 points or 0.45% to close at 43,092.95 points.

Source: PSX/WealthPK research

By selling its shares last week, the foreign investor’s portfolio investment (FIPI) made a profit of up to $4.65 million. Foreign corporates made the most money last week, selling their shares for $7.57 million, followed by insurance companies with $5.97 million and overseas Pakistanis with $0.50 million. Mutual funds purchased up to $3.60 million in shares, followed by foreign individuals, who purchased $3.42 million in stock. Banks/DFIs purchased up to $3.06 million worth of stock.

According to Muhammad Irfan, a financial analyst with Arif Habib Limited, the market is expected to remain range bound this week as the participants will remain cautious due to the political noise in the country. He said any positive news coming from the foreign minister’s visit to UAE and IMF (International Monetary Fund) 9th review will benefit the market.

“Our preferred stocks are OGDC, PPL, MARI, MCB, FABL, MEBL, BAFL, LUCK, MLCF, FCCL, ENGRO, FFC, HUBC, PSO, HUMNL, and SNGP,” said Irfan.

Credit : Independent News Pakistan-WealthPk