INP-WealthPk

Irfan Ahmed

Pakistan's stock market (PSX) experienced a negative trend last week after Moody's downgraded five commercial banks' ratings.

Moody’s decision, fluctuating rupee-dollar parity, and dwindling foreign exchange reserves played on investors' minds during the week. Resultantly, the KSE-100 index declined 137 points or 0.3% to end the week at 41,948.50 points (down by 0.32%). Average volumes clocked in at 267 million shares (down by 39% on week-on-week basis), while average value traded settled at $44 million (down by 7% WoW).

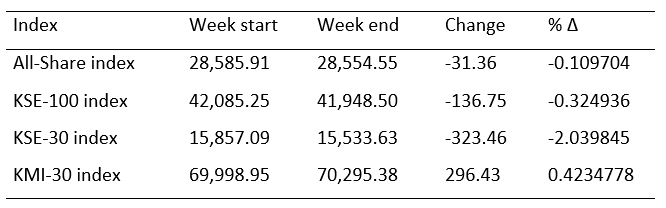

According to WealthPK analysis, the All-Share index also decreased by 31.36 points or 0.10%, the KSE-30 index slipped by 323.46 points or 2.03%, and the KMI-30 index increased by 296.43 points or 0.42% on weekly basis.

Source: PSX/WealthPK Research

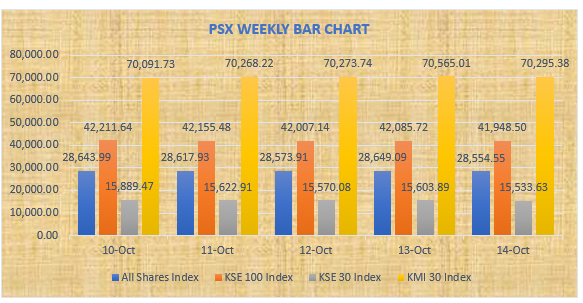

The Pakistan Stock Exchange (PSX) remained in the green zone on Monday, October 10, following Finance Minister Ishaq Dar's announcement that Pakistan will not seek debt restructuring from the Paris Club and will meet all multilateral, international, and bond payments. By the end of the day, the KSE-100 index gained 126.39 points, a positive change of 0.30%, closing at 42,211.64 points against 42,085.25 points on the previous working day.

The 100-index of the PSX lost 56.16 points on Tuesday, October 11, a negative change of 0.13%, closing at 42,155.48 points against 42,211.64 points on the previous working day. The PSX on Wednesday, October 12, shed 148 points after the investors opted for profit-taking. The benchmark KSE-100 index shed 148.34 points, or 0.35% to close at 42,007.14 points.

The PSX on Thursday, October 13, returned to a bullish trend, as the IT sector remained in the limelight. The benchmark KSE-100 index gained 78.58 points, a positive change of 0.19%, closing at 42,085.72 points.

The 100-index of the PSX witnessed a bearish trend on Friday, October 14, due to selling in various sectors. The KSE-100 index lost 137 points, a negative change of 0.33%, closing at 41,948. 50 points.

Source: PSX/WealthPK research

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $12.32 million. Broker Proprietary Trading made the most money this week, selling their shares for $4.81 million, followed by companies with $4.03 million and mutual funds with $2.70 million.

Foreign corporates purchased up to $13.17 million in shares, followed by individuals, who purchased $3.07 million in stock. The non-banking financial companies (NBFC) purchased up to $0.03 million worth of stock.

According to Muhammad Irfan Ahmed, a financial analyst with Arif Habib Limited, “The market is expected to remain positive this week, given the anticipation of FATF (Financial Action Task Force) decision over the expected exit of Pakistan from the grey list.”

Credit : Independent News Pakistan-WealthPk