INP-WealthPk

Irfan Ahmed

Pakistan Stock Exchange (PSX) experienced a negative trend during September 2022 due to floods, currency weakness, and political uncertainty.

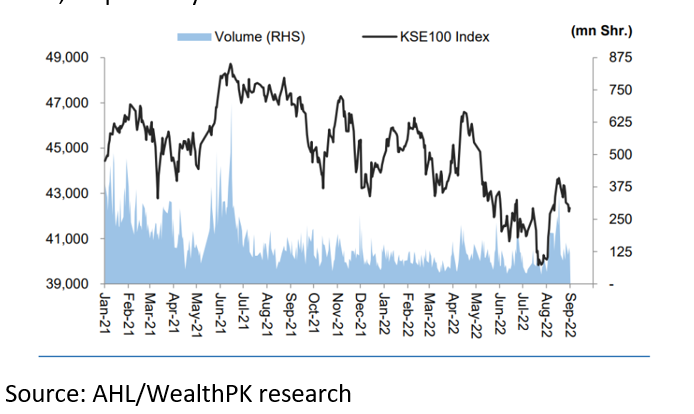

The KSE-100 index returns turned negative during September, with the bourse closing at 41,129 points (-1,222 points/2.9% WoW), reported WealthPK.

Investors continue to take account of destruction from floods, while the sentiment at the index also remained frail initially due to continued weakness in the Pak rupee which almost touched its all-time low level of 239/USD by mid-month.

Albeit, the rupee displayed a recovery to 228.45/USD with the new finance minister taking oath in the last week of September, and expectations of flows of $1.5 billion, $0.5 billion and $0.2 billion from the Asian Development Bank (ADB), Asian Infrastructure Investment Bank (AIDB), and the Japanese government, respectively.

Moreover, the World Bank is also expected to offer flood-related support of $1.7 billion. However, improvement in the market trajectory remained short-lived as Habib Bank Ltd (HBL) once again came under international scrutiny.

As per the PSX data, the KSE-100 index posted a negative return of -1% during the three quarters of 2022 (3QCY22) against -7.5% in the prior quarter, whereby political uncertainty and delay in the International Monetary Fund (IMF) program hammered the market returns. Average traded volume and value during September 2022 went down by 46% (175mn shares) and 33% ($28 million) on month-over-month (MoM) basis, respectively.

Positive contributors to the stock market on September 22 were technology (329pts) as buying was observed in TRG, power (64pts), followed by tobacco (23pts), leather (12pts) and cement (7pts). Negative index contribution was led by banks (709pts) given international scrutiny on HBL, exploration and production (349pts), and fertilizer (202pts).

Major gainers and losers’ scrip-wise performance chart during the month was led by TRG, CHCC, JVDC, PAKT and SRVI companies, posting positive returns of 43%, 13%, 10%, 8%, and 8%, respectively. On the flip-side, BNWM, ANL, NATF, EPCL and HGFA posted negative returns of 14%, 13%, 13%, 12% and 12%, respectively.

In terms of sectors, the major gains were made by the technology sector, posting a return of 32% followed by tobacco (8%), leather (8%), leasing (8%), and power (3%). Negative returns were led by woolen (14%), mutual funds (12%), textile weaving (9%), modarabas (9%), and banks (8%).

According to a financial analyst from Arif Habib Private Limited (AHL), market returns will largely be dependent on a stable currency outlook coupled with smooth foreign inflows and aid, particularly to offset the devastation from floods and to meet debt obligations. In particular, effective negotiations with the IMF to postpone debt settlement or to roll over debt repayments temporarily will allow the government some much-needed fiscal space.

The analyst said that inflation in Pakistan has peaked and as the base effect kicks in, some relief will be witnessed on that front. Although the government is yet to increase domestic gas prices, a decision regarding the same is expected to be taken prior to IMF’s next meeting.

“Given the international scrutiny on HBL, the sentiment of the index-heavy sector may remain dampened as compliance issues across the board appear substantial,” he said.

“Essentially, we expect 3Q results to be strong due to the impact of asset repricing and lower tax charges. As a result of the floods and the weaker rupee, margins of cement, steel, and automobile sectors will be squeezed during 3QCY22,” the analyst said.

Credit : Independent News Pakistan-WealthPk