INP-WealthPk

Irfan Ahmed

The Pakistan Stock Exchange (PSX) turned bullish last week as the rupee started gaining strength again the dollar, WealthPK reports.

The week commenced on a positive note as the market was up 531.1 points on Monday following the release of the Sensitive Price Index (SPI) number on the last working day, which was 8.8% down on week-on-week basis.

The market reacted positively to the change in the Finance Ministry at the highest level. The Pakistani rupee started gaining strength against the greenback, closing at 228.45.

The Asian Development Bank (ADB) also promised to provide $2 billion to Pakistan. However, the market sentiment became negative towards the end of the week as the State Bank of Pakistan (SBP) reserves declined by 4% on week-on-week basis, clocking-in at $8 billion.

Yields on the government’s international bonds, maturing in 2022 and 2024, increased during the week by 20 to 24 frames per second (pps) on week-on-week basis. The market sentiments were further dented as Habib Bank Limited came under international scrutiny for allegedly providing support to terrorists. Albeit, the market closed at 41,128.67 points, gaining 508.46 points.

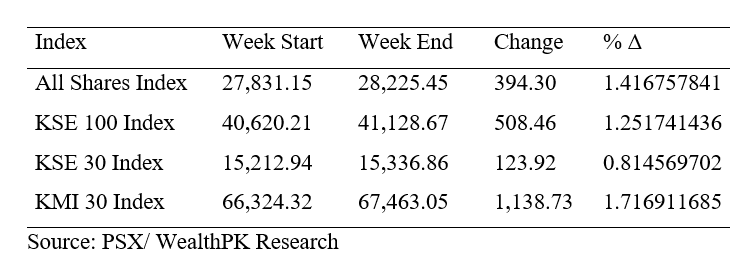

According to WealthPK analysis, the market gained 508.46 points throughout the week, closing at 41,128.67 points. The All-Share index also increased by 394.30 points, the KSE-30 index surged by 123.92 points and the KMI-30 index increased by 1,138.73 points.

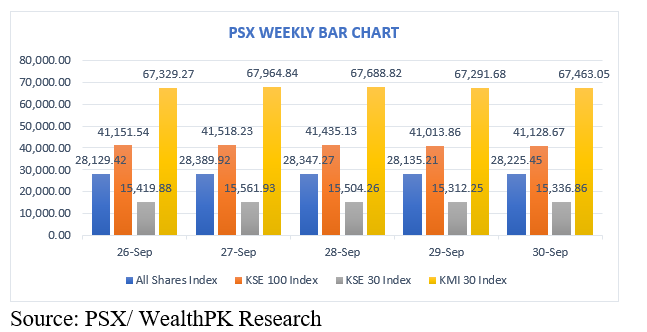

In response to further clarity on political grounds, the Pakistan Stock Exchange (PSX) remained in the green and maintained its upward trend from its previous close. The benchmark KSE-100 index recovered 531 points on September 26, closing at 41,151.54 points against 40,620.21 points of the previous day.

As a result of the rupee’s appreciation against the US dollar, the 100-index of the Pakistan Stock Exchange (PSX) continued with a bullish trend on September 27. KSE-100 index gained 366.69 points, a positive change of 0.89% by closing at 41,518.23 points.

On Wednesday, PSX opened in the positive zone, but investors decided to take profits as political noise built over the last hour of the session. As a result, the KSE-100 finished the day with a decrease of 83.1 points to close at 41,435.13 points.

The KSE-100 index decreased by 1.02% on Thursday as weakening economic cues dented sentiment and investors chose to remain on the sideline. The imposition of secondary liabilities on HBL in a terror financing case also added to downside pressure on the market. As a result, the KSE-100 index finished the day with a decrease of 421.27 points and closed at 41,013.86 points.

The 100-index of the Pakistan Stock Exchange witnessed a bullish trend as the rupee continued to recover for the sixth consecutive session on September 30, gaining Rs1.18 against the dollar in the interbank market.

As a result, the KSE-100 index finished the day with a gain of 114.81 points, a positive change of 0.28 percent, and closed at 41,128.67 points.

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $0.15 million. Mutual Funds made the most money this week by selling their shares for $7.58 million, followed by foreign individuals with $ 6.51 million and insurance companies with $3.93 million.

Individuals purchased up to $5.47 million in shares, followed by foreign corporates, which purchased $4.91 million in stock. Other organisations purchased up to $2.90 million worth of stock.

Muhammad Irfan, a financial analyst with Arif Habib Limited, said that with the results season almost over, the market was expected to remain range-bound next week.

“Our preferred stocks are OGDC, PPL, MARI, MCB, FABL, MEBL, BAFL, LUCK, MLCF, FCCL, ENGRO, FFC, HUBC, PSO, HUMNL and SNGP,” he told WealthPK.

Credit : Independent News Pakistan-WealthPk