INP-WealthPk

Shams ul Nisa

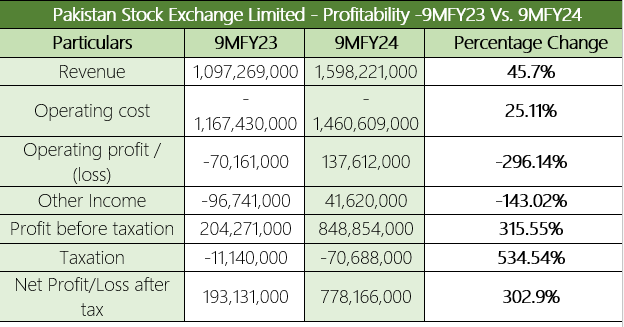

Pakistan Stock Exchange Limited's (PSX) net profit increased by 302.9% to Rs778.1 million in the nine months (9MFY24) of the Fiscal Year 2024, indicating favorable market conditions, efficient cost control, and improved operational efficiency, reports WealthPK.

According to the company's financial report, significant improvement was reported in financial parameters during the review period. The company posted a 45.7% rise in revenue to Rs1.59 billion in 9MFY24 compared to Rs1.09 billion in the same period last year. This increase was driven by increased daily trading value to Rs21 billion in 9MFY24 compared to Rs10.7 billion in 9MFY23. The company's operating cost climbed to Rs1.46 billion in 9MFY24, up by 25.11%. Thus, a notable turnaround of Rs137.6 million was observed in the operating profit compared to the operating loss of Rs70.16 million in 9MFY233 due to an increase in the operating cost by around 296.14%. Furthermore, the company observed a noteworthy shift in other income from a loss of Rs96.7 million in 9MFY23 to a gain of Rs41.6 million.

The expansion in revenue, operating profit, and other income pushed the profit before taxes from Rs204.27 million in 9MFY23 to Rs848.85 million in 9MFY24. The increase in markup income, data vending revenue, and improved performance of the associated companies added to the growth in profit before tax.

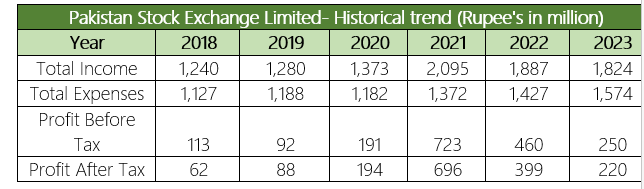

Historical trend

The historical analysis of PSX's financial performance from 2018 to 2023 indicates noteworthy trends in total revenue, expenses, and profit. From Rs1.240 billion in 2018 to a peak of Rs2.095 billion in 2021, the company's total income increased, indicating an enhanced market activity and favorable economic conditions. However, it declined in the following years, reaching Rs1.82 billion in 2023, mainly due to economic instability and a persistent rise in inflation. The PSX's total expenses grew to Rs1.57 billion in 2023 from Rs1.12 billion in 2018. This indicates that the persistent rise in inflation has put pressure on the surges in operational costs and other infrastructural investments over the years.

The profit before tax slid to Rs92.0 million in 2019 but climbed to the highest of Rs723.0 million in 2021. However, with the increase in market uncertainty and rising costs, the profit before tax slipped to Rs250.0 million in 2023, reflecting difficulties in maintaining high profitability. The net profit depicts a persistent growth from Rs62.0 million in 2018 to Rs696.0 million in 2021 but declined to Rs220.0 million in 2023. This can be due to the increased expenses and higher taxation during the period.

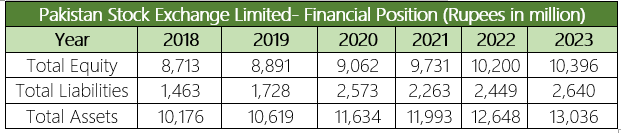

Financial position

The company's financial position has steadily improved from 2018 to 2023, with a significant rise in total assets, and equity. The total equity has followed a rising trend from Rs8.7 billion in 2018 to Rs10.3 billion in 2023. This reflects an increase in the shareholder value over the years and a rise in investment to expand its operations.

The total liabilities have grown from Rs1.4 billion in 2018 to Rs2.6 billion in 2023, showcasing increased borrowing by the PSX to finance its operations. Compared to the growth in liabilities, the total assets have also shown a steady improvement over the years. The company has reported a maximum of Rs13.0 billion total assets in 2023 and a minimum of Rs10.1 billion in 2018.

Future outlook

Pakistan Stock Exchange Limited continues to add value for investors and businesses looking to raise money. The PSX Board aims to improve governance and increase transparency.

Company profile

Pakistan Stock Exchange Limited was established on March 10, 1949, as a company limited by guarantee, but was reregistered as a public company limited by shares on August 27, 2012. The company's activities include buying, selling, and trading in shares, scripts, modaraba certificates, participation term certificates, stocks, bonds, debentures, government papers, loans, and any other similar instruments and securities, such as bearer national fund bonds, special national fund bonds, foreign exchange bearer certificates, and special national fund bonds issued by the Pakistani government or any other institution authorized by the Government of Pakistan.

Credit: INP-WealthPk