INP-WealthPk

Fakiha Tariq

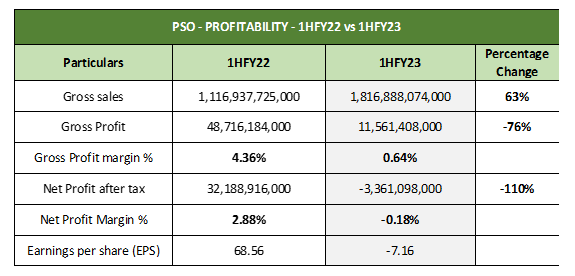

The Pakistan State Oil Company Limited (PSO) posted a decline of 76% in gross profit and 110% in net profit in the first six months (Jul to Dec) of the Fiscal Year 23 compared to the corresponding period of the Fiscal Year 22, reports WealthPK. In the first half of FY23, the company posted gross revenue of Rs1.8 trillion. The company earned a gross profit of Rs11 billion and a net loss of Rs3.3 billion on its sales in 1HFY23. The oil marketing giant reported a loss per share value of Rs7.16 in the just-ended six-month period of FY23.

The gross sales increased by 63% to Rs1.81 trillion in the first half of FY23 from Rs1.11 trillion posted in the corresponding period of the last year.

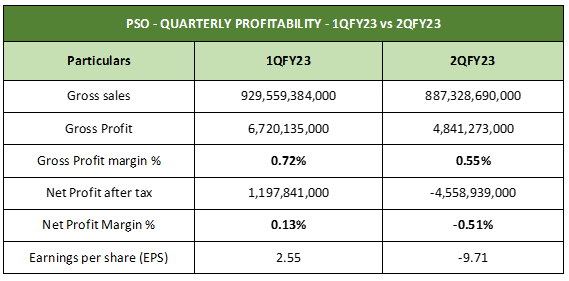

Quarterly review - 1HFY23

In the first quarter (Jul to Sept) of the Fiscal Year 23, the PSO posted gross sales of Rs929 billion. The gross profit and net profit were reported to be Rs6.7 billion and Rs1.1 billion, respectively. Thus, the gross profit ratio and net profit ratio turned out to be 0.72% and 0.13% in 1QFY23. The company posted an EPS value of Rs2.55 per share in 1QFY23.

However, in the second quarter (Oct to Dec) of FY23, the PSO posted gross profit and net loss of Rs4.8 billion and Rs4.5 billion on its sales of Rs887 billion. The company reported a gross profit ratio of 0.55% and a net loss ratio of 0.51%, respectively in the 2QFY23. The PSO reported a loss per share value of Rs9.71 per share in 2QFY23.

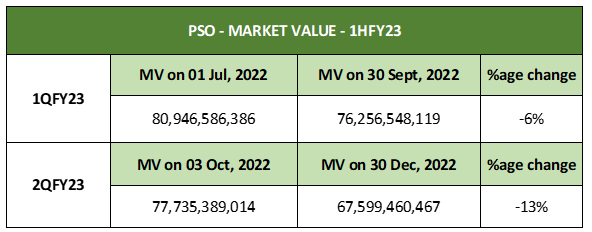

Market Value Review - 1HFY23

The company lost the market value by 16% from Rs80 billion to Rs67 billion in the first half of the Fiscal Year 23. In the first quarter of FY23, the company posted a market value decline of 6% from Rs80 billion to Rs76 billion by the end of the quarter.

In the second quarter of Fiscal Year 23, the market value decreased by 13% from Rs77 billion to Rs67 billion.

Credit: Independent News Pakistan-WealthPk