INP-WealthPk

Ayesha Mudassar

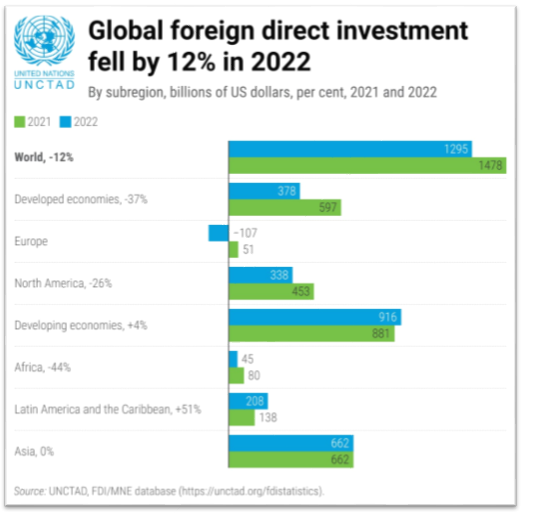

Foreign Direct Investment (FDI) witnessed a significant decline in response to a tighter financial environment, continued geopolitical challenges, and concerns about a looming recession.The United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2023 reveals that FDI declined by 12% in 2022 to $1.3 trillion.

Developed economies suffered the most, with a 37% decrease in FDI to $378 billion. Furthermore, flows to the least developed countries also declined. “The slowdown was primarily driven by numerous factors, including the Ukraine crisis, high energy and food prices, and tightening of national security regulations,” the report indicated. UNCTAD expects the global environment for international business and cross-border investment to remain challenging in 2023. Although the economic headwinds shaping investment trends in 2022 have somewhat abated, they have not disappeared. Geopolitical tensions are still high. Pakistan is a country with high political, economic, and financial volatility; hence, little can be expected on the foreign investment front.

The State Bank of Pakistan (SBP) shows that FDI has constricted by a staggering 25% in FY23 when compared with foreign investment of $1.93 billion in FY22. Speaking at an International Conference “Decade of China Pakistan Economic Corridor (CPEC) – Belt and Road Initiative (BRI): From Vision to Reality”, Asim Saeed, a member of the Planning Commission of Pakistan, attributed this decline primarily to the restrictions on the outbound repatriation of profits. The gigantic decline in profits and dividends has discouraged foreign investors, and it might take years to restore their confidence. The profits and dividends on foreign investments plummeted by approximately 80% during FY23, the SBP data showed.

Besides, persistent political unrest and economic mismanagement had discouraged foreign investors from investing, Asim pointed out. He emphasized that the government should prioritize foreign investors by clearing the way for profit repatriation to headquarters abroad. “This would boost investment confidence and encouraged investors to pour more capital into the country,” he added. Talking to WealthPK, Additional Secretary Board of Investment Ambreen Iftikhar said FDI is a key element of economic integration, as it creates stable and long-lasting links among the economies. Furthermore, it facilitates global trade and serves as an important conduit for the transfer of technology. Low FDI is hindering Pakistan from achieving inclusive and sustainable economic growth, as it has limited the government's ability to improve infrastructure and public services, leading to increased reliance on loans.

Addressing these challenges requires comprehensive reforms. Macroeconomic stability is a prerequisite for fostering an investment-friendly climate in the country. Ensuring external sector liquidity, improving sovereign credit rating, and incentivizing firms with high-growth potential are necessary to attract investment. Adding to the discussion, the BOI additional secretary believes that the Invest Pakistan Initiative, Investment Promotion Activity, Pakistan Investment Policy 2023, and Special Investment Facilitation Council are important steps toward boosting investors’ confidence. With a comprehensive set of measures and incentives, countries can strive to become a preferred investment destination and achieve their long-term economic development goals.

Credit: INP-WealthPk