INP-WealthPk

Irfan Ahmed

Pakistan's stock market (PSX) experienced a range-bound trading week due to political uncertainty that prevailed throughout the period. In addition, during the week, Pak Rupee depreciated against the greenback, dropping by PKR0.28, or 0.13%, on week-on-week (WoW) basis, settling at Rs223.94. Furthermore, the current account deficit declined by 68% on year-on-year (YoY) basis, primarily due to a decline in imports which went down by 23% on YoY basis.

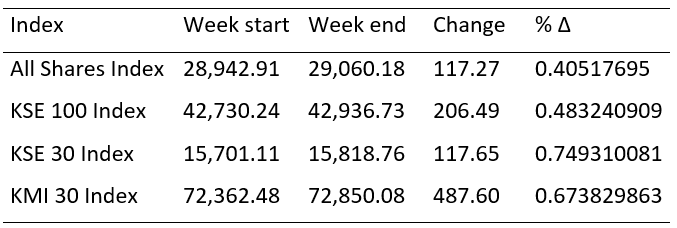

According to WealthPK analysis, the market gained 206.49 points throughout the week, closing at 42,936.73 points (up by 0.48%) on WoW basis. The All-Share Index also increased by 117.27 points or 0.41%, KSE-30 Index surged by 117.65 points or 0.74%, and the KMI-30 Index increased by 487.60 points or 0.67% on a weekly basis.

As per PSX data, foreigners buying was witnessed during last week, clocking in at $1.11 million compared to a net buying of $2.06 million last week. Major buying was witnessed in Technology and Communications ($0.78 million), all other sectors ($0.74 million), and E&P ($0.24 million).

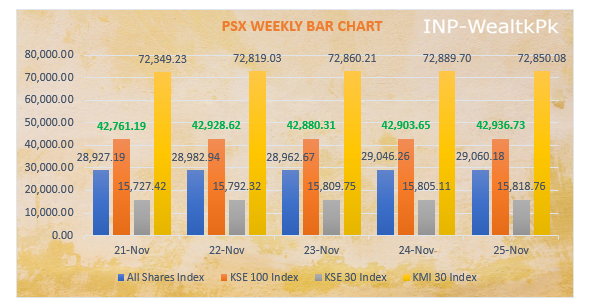

According to Shehryar Butt, a stock market analyst, the PSX last week started range bound on Monday, Nov 21, due to political instability and delays in IMF (International Monetary Fund) talks for the 9th review. The benchmark KSE-100 Index gained 30.95 points, depicting a slight positive change of 0.07%, closing at 42,761.19 points against 42,730.24 points on the previous working day.

The PSX on Tuesday, Nov 22, continued its bullish trend, as the MSCI (investment research firm) added four domestic companies to its frontier market index for Pakistan. The 100-Index gained 167.44 points, depicting a slight positive change of 0.39%, closing at 42,928.63 points.

The PSX ended the trading session in red on Wednesday, Nov 23, due to political instability rattling investors’ confidence. The KSE-100 Index posted losses by 48.32 points, falling to 42,880.31. The 100-Index gained 23.34 points on Thursday, Nov 24, depicting a nominal positive change of 0.05%, closing at 42,903.65 against 42,880.31 points the previous day.

The PSX witnessed a bullish trend on Friday, Nov 25, as PKR remained stable against the dollar in interbank. The KSE-100 gained 33.08 points and closed at 42,936.73 points.

Source: PSX/ WealthPK research

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $1.11 million. Mutual Funds made the most money this week, selling their shares for $2.82 million, followed by insurance companies with $1.42 million and companies with $1.02 million.

Individuals purchased up to $4.82 million in shares, followed by overseas Pakistanis, which purchased $1.21 million in stock. Other organisations purchased up to $0.50 million worth of stock.

According to Muhammad Irfan, a financial analyst with Arif Habib Limited, the market is expected to remain range-bound in the upcoming week as the participants will remain vigilant owing to the political situation in the country and the surprise hike in the policy rate to 16% (+100bps) by the State Bank of Pakistan (SBP).

Irfan said that dollar inflow from the Asian Infrastructure Investment Bank (AIIB) and the repayment of the SUKUK (fully-funded as per the SBP) next week are expected to support market momentum and increase investor confidence. In addition, the PM’s visit to Turkey to enhance bilateral cooperation is also expected to bring some positive momentum to the market, said Irfan.

Credit : Independent News Pakistan-WealthPk