INP-WealthPk

Irfan Ahmed

Pakistan's stock market commenced on a negative note last week (Oct 24) amid political noise. Furthermore, the Pakistani rupee remained under pressure against the US dollar, closing at Rs221.97 (down by 0.49% week-on-week (WoW). Also, the State Bank of Pakistan reserves fell 2% to $7.44 billion during the week from $7.76 billion the week earlier.

The International Monetary Fund, while asking Pakistan to raise taxes, electricity tariffs, and cut expenditures, has also reiterated that Islamabad should set up an anti-corruption task force. The global money lender has handed over a new list of demands and asked Pakistan to impose roughly Rs600 billion in additional taxes.

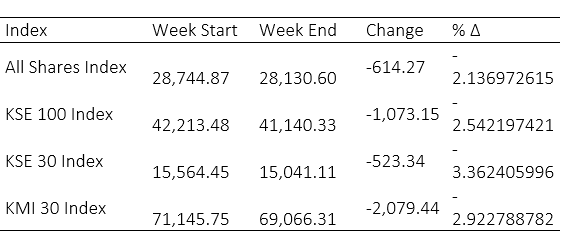

According to WealthPK analysis, the market lost 1,073.15 points throughout the week, closing at 41,140.33 points (down by 2.54%) WoW. The All-Share Index also decreased by 614.27 points or 2.13%, the KSE-30 Index slipped by 523.34 points or 3.36%, and the KMI-30 Index decreased by 2,079.44 points or 2.92% on a weekly basis.

Source: PSX/ WealthPK Research

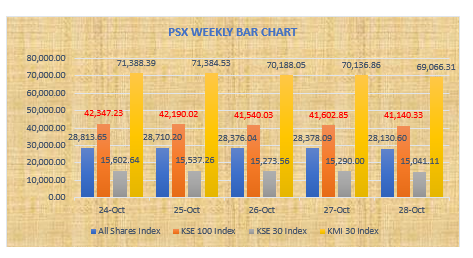

On Monday (Oct 24), the Pakistan Stock Exchange (PSX) reacted positively to Pakistan’s exclusion from the Financial Action Task Force’s (FATF) grey list as the KSE-100 Index gained 133.75 points, a positive change of 0.32%, closing at 42,347.23 against 42,213.48 points on the last working day.

The stock market slipped into the red zone on Tuesday (Oct 25) due to the rollover week, in which futures contracts are settled or rolled over to the next month. The KSE-100 Index lost 157.20 points, a negative change of 0.37%, closing at 42,190.03 points.

PSX continued with a bearish trend on Wednesday (Oct 26) amid political instability. The benchmark KSE-100 Index declined by 650.00 points to close at 41,540.03 points.

Despite the political unrest, the KSE-100 Index witnessed a slightly bullish trend on Thursday (Oct 27), gaining 76.44 points, a positive change of 0.18%, and closing at 42,213.48 points.

The PSX remained under pressure on Friday (Oct 28) as the KSE-100 Index slid 1.11% owing to political uncertainty. As a result, the index fell 462.53 points or 1.11% to close at 41,140.33. On a weekly basis, the benchmark KSE-100 Index lost 2.54%.

Source: PSX/ WealthPK Research

By selling its shares last week, the Foreign Investors Portfolio Investment made a profit of up to $0.97 million. Mutual Funds made the most money this week, selling their shares for $3.29 million, followed by individuals with $2.44 million and foreign corporates with $0.64 million.

Other organisations purchased up to $2.21 million shares, followed by companies, which purchased $1.35 million in stock. Overseas Pakistanis purchased up to $1.12 million worth of stock.

According to Muhammad Irfan Ahmed, a financial analyst with Arif Habib Limited, the market is expected to remain range-bound in the coming week due to political instability in the country.

Credit : Independent News Pakistan-WealthPk