INP-WealthPk

Muneeb ur Rehman

The value-added tax (VAT) system in the country has deeply embedded loopholes that continue to restrict the government's ability to meet the tax collection targets. It is, therefore, pertinent to deal with the loopholes with the necessary policy reforms, stresses Nadeem ul Haque, Vice-Chancellor of Pakistan Institute of Development Economics (PIDE). As per the latest Active Taxpayers List (ATL) issued by the Federal Board of Revenue, a cumulative 3,376,699 taxpayers had duly filed their income tax returns by August 2022. Talking to WealthPK, Haque said the most prominent loophole was that the businesses and corporate entities could easily exaggerate their input costs or make false claims to pay less taxes. The PIDE head also shed light on sectoral imbalances in the tax system in the following words.

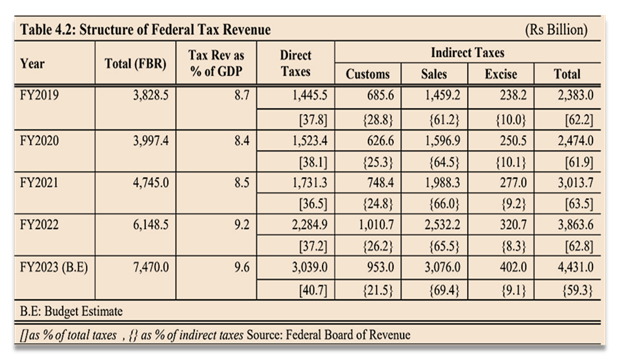

"Different sectors are facing different tax rates or exemptions, leading to potential distortions. For instance, the manufacturing sector makes the highest contribution, whereas the real estate and services sectors have the lowest contribution." "The presence of a significant informal economy, in addition, is contributing to tax leakages. Businesses operating in the informal sector are not registered for General Sales Tax (GST), leading to revenue loss for the government," he asserted. The table below shows the collection of federal tax revenues over the years.

Nadeem ul Haque highlighted the need for viable policy reforms to improve the taxation system of the country. "Simplify and clarify the tax laws to make them more accessible and understandable for businesses and taxpayers. Clear and straightforward regulations can reduce opportunities for misinterpretation and manipulation." He added that a flat tax system was often discussed, yet it was not considered seriously. "To promote fairness and encourage the business community's tax compliance, it is essential for the government to consider implementing a flat tax system, thereby mitigating perceptions of discrimination and fostering increased tax payment participation." Similarly, he suggested the government implement measures to combat tax evasion, such as improving cross-referencing of data, strengthening the tax audit process and utilising technology to detect anomalies in financial transactions. In conclusion, reforms in the taxation system have become indispensable for the government to meet rising expenditures.

Credit: INP-WealthPk