INP-WealthPk

Shams ul Nisa

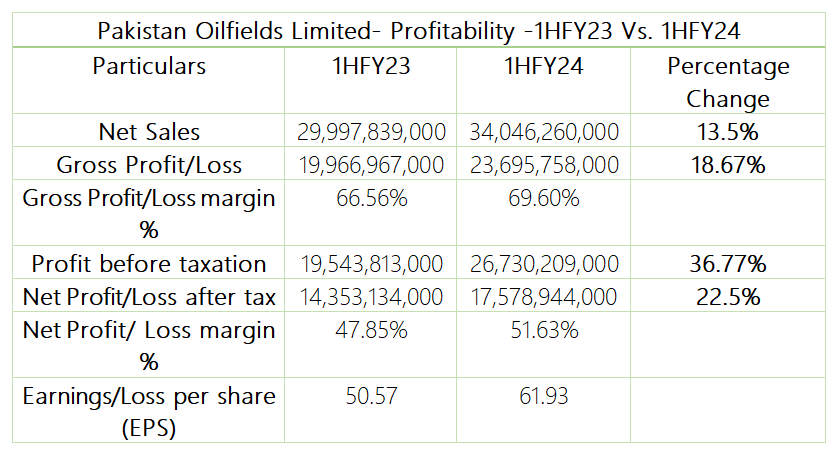

Pakistan Oilfields Limited's (POL) net sales rose by 13.5%, gross profit by 18.67%, and net profit by 22.5% in the first half of ongoing Fiscal Year 2024, reports WealthPK. During the period, the company recorded a net profit of Rs17.57 billion, driven by higher sales value, decreased exploration costs, and increased interest income due to the higher deposits and interest rates on bank deposits.

Thus, the company’s gross profit margins grew to 69.60% in 1HFY24 from 66.56% in 1HFY23. Furthermore, the company’s profit before tax increased 36.77% to Rs26.7 billion during the review period.The profit growth pushed the net profit margin to 51.63% in 1HFY24 from 47.85% in the corresponding period last year. At the end of the period, the company’s earnings per share (EPS) stood at Rs61.93 compared to Rs50.57 in 1HFY23.

Quarterly analysis

At the end of the second quarter, the company posted a jump of 23.8% in net sales to Rs17.3 billion. Likewise, a significant growth of 38.74% was observed in profit before tax and 32.2% in net profit. During 2QFY24, the company registered a profit before tax of Rs12.89 billion and a net profit of Rs7.87 billion. Thus, the EPS climbed to Rs27.73 in 2QFY24 from Rs20.98 in 2QFY23.

Analysis of profit or loss

The profit and loss statement over the six years portrays that the company’s net sales grew from 2018 to 2019. However, the sales dropped to Rs36.6 billion in 2020 and Rs36.04 billion in 2021. In the subsequent years, it gained momentum and climbed to Rs51.9 billion in 2022 and Rs60.9 billion in 2023.

The profit for the year followed a similar pattern, with a decline to Rs16.3 billion in 2020 and Rs13.38 billion in 2021. However, it rose to Rs25.9 billion in 2022 and Rs36.4 billion in 2023. The company’s dividend, which is the profit distributed to the shareholders, kept on rising over the years. In 2018, it stood at Rs10.05 billion, but remained the same at Rs14.19 billion in 2019, 2020, and 2021. The highest dividend of Rs22.7 billion was distributed to the shareholders in 2023.

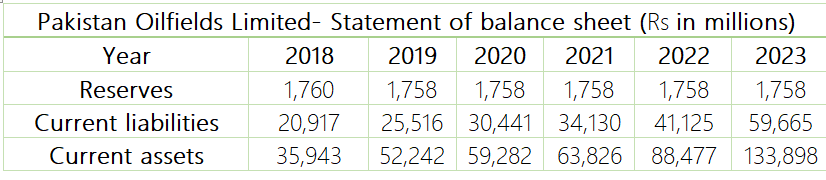

Statement of balance sheet

The balance sheet provides a detailed knowledge of the company’s resources and its sources of capital financing. The reserves remained stagnant at Rs1.758 billion from 2019 to 2023, but slightly lower than Rs1.76 billion in 2018. The company’s current liabilities showed an overall increasing trend over the years, reaching Rs59.66 billion in 2023. The current assets reported a notable growth during this period, reaching Rs133.89 billion in 2023 from Rs35.9 billion in 2018.

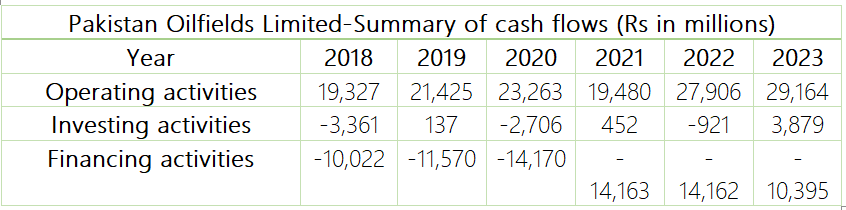

Summary of cash flows

The company’s cash flows give a thorough insight into the financial health and operating efficiency. The cash generated from operating activities overall expanded to Rs19.3 billion in 2018 to Rs29.16 billion in 2023 but with a single dip to Rs19.48 billion in 2021. The cash from investing activities remained volatile, as the company invested in 2018, 2020, and 2022 and managed to earn cash in 2019, 2021, and 2023. The company used cash for financing activities such as debt repayments throughout the review period, showcasing cash outflow.

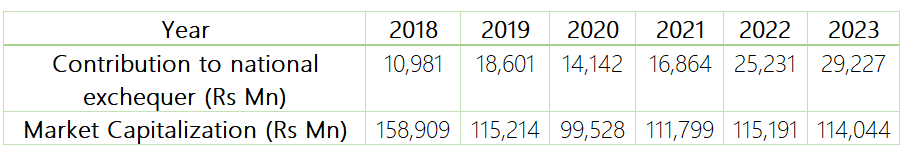

Market capitalization

Pakistan Oilfields Limited's contribution to the national exchequer grew overall, reaching Rs29.2 billion in 2023, with only one dip to Rs14.14 billion in 2020. However, its market capitalization fell from Rs158.9 billion in 2018 to Rs114.04 billion in 2023, representing a decline in the total market value of all the outstanding shares.

Company’s profile

Pakistan Oilfields Limited is a public limited company, mainly engaged in exploration, drilling, and production of crude oil and gas in Pakistan. Furthermore, its activities include marketing of liquefied petroleum gas under the brand name POLGAS and transmission of petroleum.