INP-WealthPk

Qudsia Bano

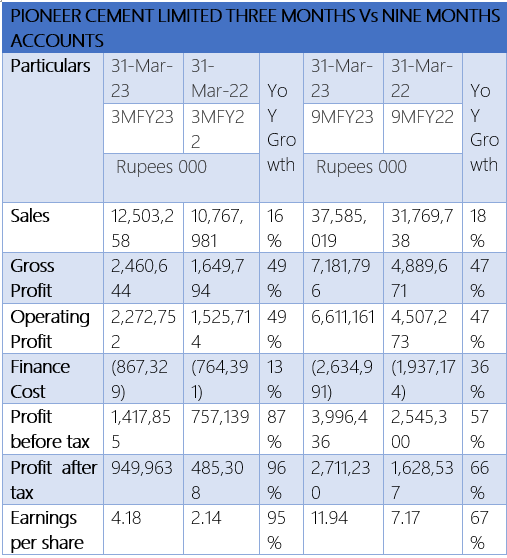

Pioneer Cement Limited has showcased a strong performance and an impressive year-on-year growth during the three-month period ending March 31, 2023, reports WealthPK. The company’s latest financial report showed that despite a decline in sales volume, it managed to improve its topline by 23.32% through a cost-push increase in the local sale price. During the three-month period ending March 31, the company reported sales of Rs12.5 billion compared to Rs10.8 billion in the same period last year, representing a growth of 16%. The company's gross profit increased significantly by 49% to reach Rs2.46 billion, up from Rs1.64 billion in the previous year. Similarly, the operating profit also experienced a notable growth of 49% to reach Rs2.3 billion, compared to Rs1.52 billion in the same period last year.

One of the significant factors impacting the cost structure was fuel and power cost rise. The cost of cement sold during the period rose to Rs9,861 per ton, a substantial increase from Rs6,880 per ton in the previous year. The increase in fuel and power costs can be attributed to rising coal prices and an increased national grid tariffs. Additionally, the company witnessed an increase in raw material costs due to the rise in diesel prices. Packing material costs also rose to Rs738 per ton, driven by the devaluation of the Pakistani Rupee.

Despite facing upward revisions in the policy rate, the company managed to maintain a strong financial footing. The finance cost for the period increased to Rs867.3 million, up from Rs764.4 million in the previous year, as a result of multiple revisions in the policy rate. After deducting tax charges, including the charge for super tax, the company achieved a profit after tax of Rs949.9 million in the third quarter of the fiscal year 2023, demonstrating an impressive growth of 66%. This translates into earnings per share of Rs4.18, compared to Rs2.14 in the same period last year.

The company reported impressive financial results in its nine-month accounts ending March 31, 2022. A substantial year-on-year growth was achieved across various key financial indicators, showcasing a strong performance and market position. During the nine-month period, the company recorded sales of Rs37.59 billion, representing an 18% increase compared to Rs31.77 billion in the same period of the previous year. This growth in sales demonstrates the company's ability to expand its market presence and capture a larger share of the cement industry.

The company's gross profit for the nine-month period reached Rs7.18 billion, a significant increase of 47% from Rs4.89 billion in the corresponding period of FY22. A similar growth rate of Rs6.61 billion was witnessed in the operating profit compared to Rs4.51 billion in the previous year. These figures highlight the company's strong operational efficiency and effective cost-management strategies. Finance costs, including interest expenses, amounted to Rs2.63 billion during the nine-month period, marking a 36% increase from Rs1.94 billion in the same period of FY22. This rise in the finance costs can be attributed to various factors, including the changes in interest rates and the company's borrowing activities.

Before-tax, the company achieved a profit of Rs3.99 billion, representing a substantial growth of 57% compared to Rs2.55 billion in the previous year. After accounting for taxes, the company's profit after tax stood at Rs2.71 billion, demonstrating a remarkable year-on-year growth of 66% from Rs1.63 billion in the same period of FY22, reflecting the company's ability to effectively manage its operations and capitalize on market opportunities.

The earnings per share (EPS) of Pioneer Cement Limited increased to Rs11.94 in the nine-month period of FY23, compared to Rs7.17 in the corresponding period of the previous year, indicating a remarkable growth of 67%. This increase in EPS shows the company's ability to generate higher profits on a per-share basis and create value for its shareholders.

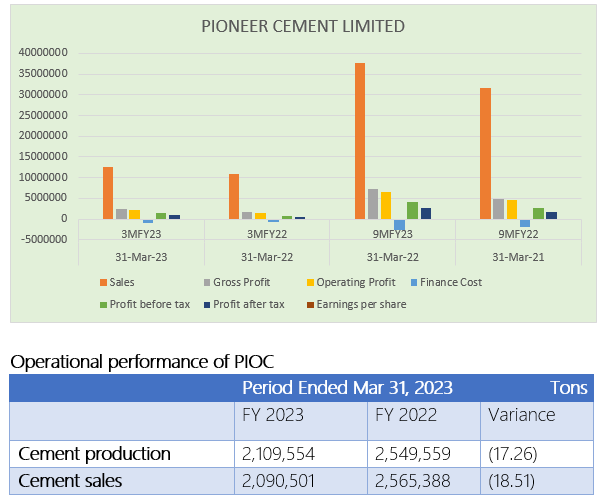

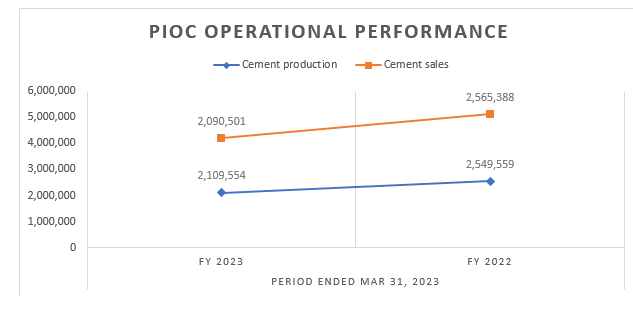

During the period under review, the company experienced a decline in sales volume, dispatching 2,090,501 tons of cement in the local market compared to 2,565,388 tons in the same period last year, representing a decline of 18.51%. However, the company managed to mitigate the impact of the decline through a cost-push increase in the local sale price.

Share Price Analysis

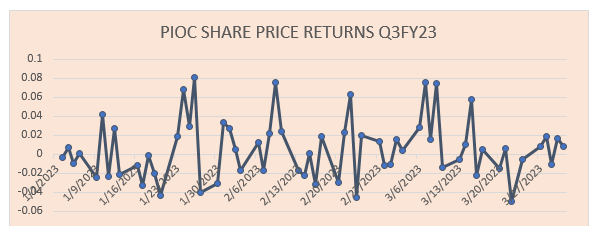

The share prices exhibited various trends and patterns during the third quarter of FY23. The share price opened at Rs50.25 this quarter and hovered near Rs50 for the initial days. From January 9, the share price experienced a downward trend, reaching its lowest point of Rs44.47 on January 20. This decline can be attributed to various factors, including market conditions and investor sentiment. However, from January 24th, the share price started to recover, steadily increasing over the next few days. By the end of January, the share price reached Rs51.75, showing a recovery from its earlier decline.

In February, the share price continued to exhibit a positive trend, gradually increasing and reaching a peak of Rs58.78 on February 10. This upward movement can be attributed to a positive market sentiment and potentially favorable company-specific factors. Following the peak in February, the share price experienced some fluctuations but generally remained within a relatively stable range.

In March, the share price showed another significant increase, reaching its highest point of Rs73.05 on March 15. This substantial surge can indicate a positive market sentiment, strong company performance, or potentially favorable industry conditions. Towards the end of March, the share price fluctuated but generally maintained a higher level compared to the start of the quarter.

About the company

Pioneer Cement Limited was incorporated in Pakistan as a public company limited by shares on February 9, 1986. The principal activity of the company is the manufacturing and sale of cement.

Credit: Independent News Pakistan-WealthPk