INP-WealthPk

Hifsa Raja

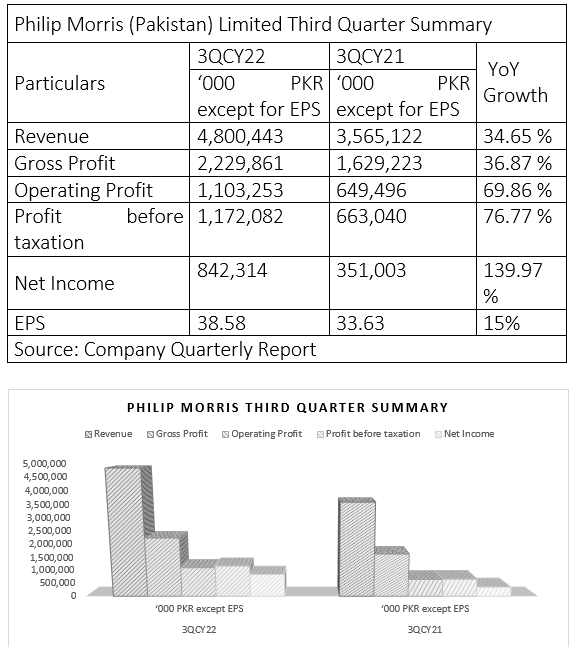

The revenue of Philip Morris (Pakistan) Limited (PMPK) – which manufactures and sells cigarettes and tobacco products – climbed 34.65% to Rs4.8 billion in the third quarter (July-September) of calendar year 2022 from Rs3.5 billion over the corresponding period of 2021. Similarly, the company’s gross profit grew 36.87% in 3QCY22 to Rs2.22 billion from Rs1.6 billion in 3QCY21. The company’s operational profit increased by 69.86% in 3QCY22 to Rs1.1 billion from Rs649 million in 3QCY21. Also, the net income leapt by a huge 139.97% to Rs842 million in 3QCY22 from Rs351 million in 3QCY21, reports WealthPK.

Performance in IHCY22

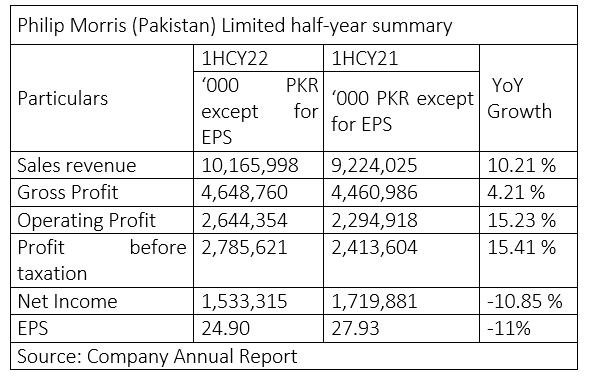

During the first six months of 2022, the company generated net sales worth Rs10.1 billion over Rs9.2 billion in the same period of 2021, registering an increase of 10% year-on-year. The company’s gross profit for 1HCY22 increased 4.21% to Rs4.6 billion from Rs4.4 billion in 1HCY21. The profit-before-tax for 1HCY22 stood at Rs2.7 billion, up 15.41%, from Rs2.4 billion in 1HCY21. However, the net income for 1HCY22 decreased 11% to Rs1.5 billion from Rs1.7 billion in 1HCY21.

Earnings per share and EPS growth

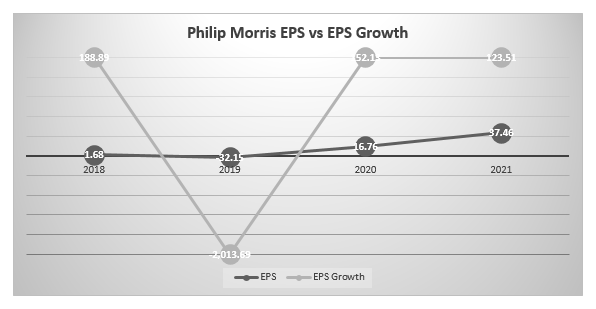

The company’s earnings per share (EPS) increased from a negative of Rs32.15 in 2019 to Rs37.46 in 2021. Likewise, the EPS growth was negative in 2019. However, in 2021, the EPS showed an exponential growth of 123.51, showing the company’s sound financial position.

Industry comparison

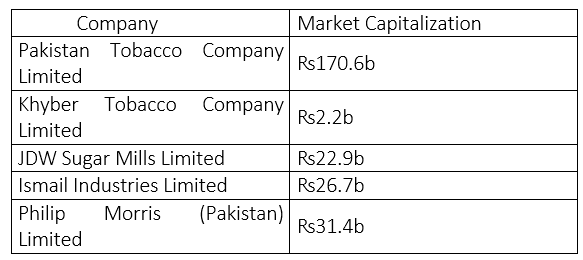

Philip Morris (Pakistan) Limited’s competitors include Pakistan Tobacco Company Limited, Khyber Tobacco Company Limited, JDW Sugar Mills Limited, and Ismail Industries Limited.

Ratio analysis

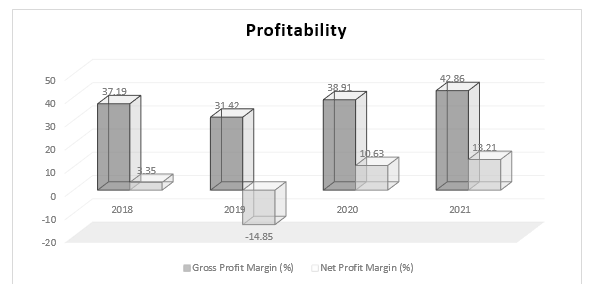

In 2018, the company’s gross profit margin stood at 37.19%, indicating it generated excellent revenues at the minimum possible cost. The net profit margin stood at 3.35% after accounting for all taxes.

In 2019, the company’s gross and net profit margins plunged with gross margin standing at 31.42% and net margin going into negative. In 2020, the company recovered as its gross profit margin increased to 38.91% and net margin to 10.63% from a negative of 14.85%. In 2021, the gross profit margin rose to 42.86%, and the net profit margin to 13.21%.

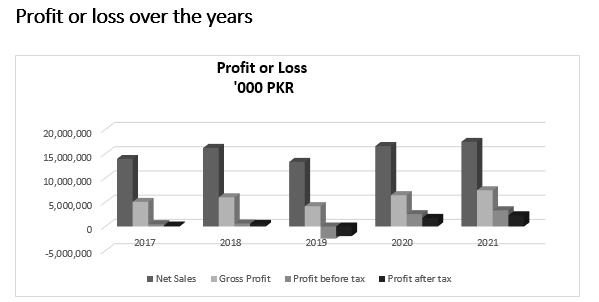

Profit or loss over the years

The net sales showed consistent growth in 2017 and 2018, but dropped in 2019. However, the sales kept on increasing in 2020 and 2021. In contrast, the company’s gross profit showed a mixed trend, which remained high in 2020 and 2021 after dipping in 2019.

Company profile

Philip Morris (Pakistan) is engaged in the manufacture, distribution and sale of cigarettes and other tobacco products. The company has a tobacco-leaf threshing plant and three cigarette manufacturing factories. Its manufacturing facilities are located in Kotri, Sahiwal and Mardan. The company's holding company is Philip Morris Investments BV, which is a subsidiary of Philip Morris International Inc. Philip Morris Pakistan’s subsidiary is Lakson Premier Tobacco Company (Private) Limited.

Credit: Independent News Pakistan-WealthPk